- China denied Trump’s claims of ongoing tariff negotiations, saying no talks are occurring in any respect.

- Blended alerts from Trump and U.S. officers rattled markets, as fears of extended commerce stress grew.

- Consultants consider China is betting Trump can’t deal with the financial fallout from his personal tariff insurance policies.

Only a day after President Donald Trump stated the U.S. and China have been in “lively” talks to chill down their tariff battle, Beijing got here out swinging—denying any such factor. In line with China’s International Ministry, there are not any negotiations occurring proper now. None. Zip.

“China and the U.S. haven’t engaged in any consultations or negotiations concerning tariffs, not to mention reached an settlement,” stated ministry spokesperson Guo Jiakun at a Thursday presser in Beijing. He didn’t mince phrases both, including, “If it’s a struggle, we’ll struggle to the tip.”

That’s… not precisely the type of discuss that hints at peace breaking out.

A Tariff Tussle with No Exit Plan?

Trump has been cranking tariffs as much as 145% on Chinese language items, the steepest charges slapped on any nation up to now. China fired again with its personal heavy-duty 125% tariffs on U.S. imports. At this level, it’s beginning to look extra like a full-blown embargo than only a spat over commerce insurance policies.

And whereas markets briefly perked up after Trump hinted on Wednesday that tariffs is perhaps coming down, issues turned muddy actual fast. Treasury Secretary Scott Bessent muddled the message additional by saying “each side are ready to talk to the opposite.” So… possibly talks? Possibly not?

Trump, for his half, was busy scouting a spot on the White Home garden for a 100-foot flagpole when he declared, “Everyone needs to be part of what we’re doing,” insisting that the U.S. and China are speaking “each day.” Besides, apparently, they’re not.

Actuality Bites… Exhausting

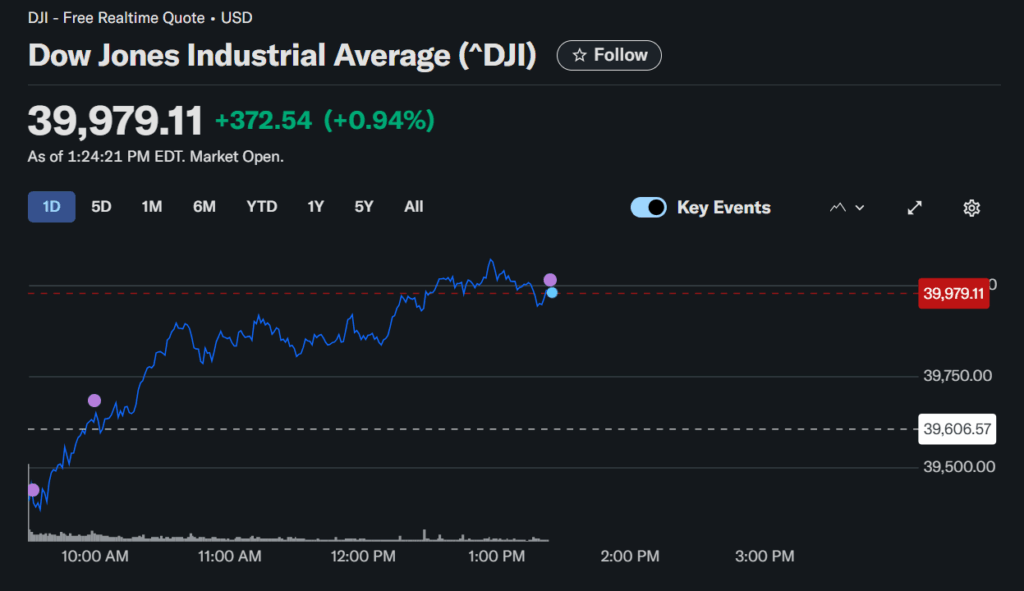

In the meantime, U.S. shares took successful because the blended messaging unsettled traders. The Dow dipped, and the S&P 500 and Nasdaq adopted go well with. Asian markets ended the day on shaky legs, whereas Europe opened within the crimson.

Consultants weren’t precisely shopping for Trump’s newest pivot both. Economist Lee Branstetter from Carnegie Mellon put it bluntly: “Speaking about tariff reductions earlier than profitable any concessions from China seems to be like a climbdown.” He added, “They’ve now turn out to be way more evident to him”—“they” being the implications of this entire tariff gambit.

And it’s not simply the economists who’re spooked.

Transport large Hapag-Lloyd stated a whopping 30% of orders from China to the U.S. have been canceled this week. The IMF additionally minimize world development forecasts, flagging the commerce battle as a high concern. It’s not nearly taxes anymore—it’s beginning to hit real-world provide chains and vacation season orders.

China Isn’t Budging… But

Don’t anticipate Beijing to come back crawling to the negotiating desk, although. Wu Xinbo, a professor and authorities adviser in China’s International Ministry, stated Trump’s public feedback are principally aimed toward reassuring U.S. markets—not a mirrored image of precise talks.

“Trump simply needs to ship some reassuring alerts to the home market, suggesting that ‘The Chinese language are speaking to us, don’t fear.’ However that’s not the case,” Wu stated flatly.

That stated, China’s not precisely cruising both. With exports slowing and the center class feeling the pinch, they may want to speak… ultimately. However they’re not in any rush. Xi Jinping doesn’t must face reelection, in any case.

And Branstetter summed it up with a mic-drop: “The Chinese language have taken the measure of Donald Trump… they usually’ve decided that he can’t afford the price of dragging this out for much longer.”