XRP is gaining momentum as soon as once more, climbing practically 6% up to now week and pushing its market cap again above $130 billion for the primary time since March 27.

The altcoin’s RSI has entered overbought territory for the primary time in over a month, its Ichimoku Cloud setup stays bullish, and its EMA strains have shaped consecutive golden crosses. With merchants eyeing each breakout targets and key help zones, XRP enters a pivotal second that might outline its subsequent main transfer.

XRP Enters Overbought Zone for First Time Since March

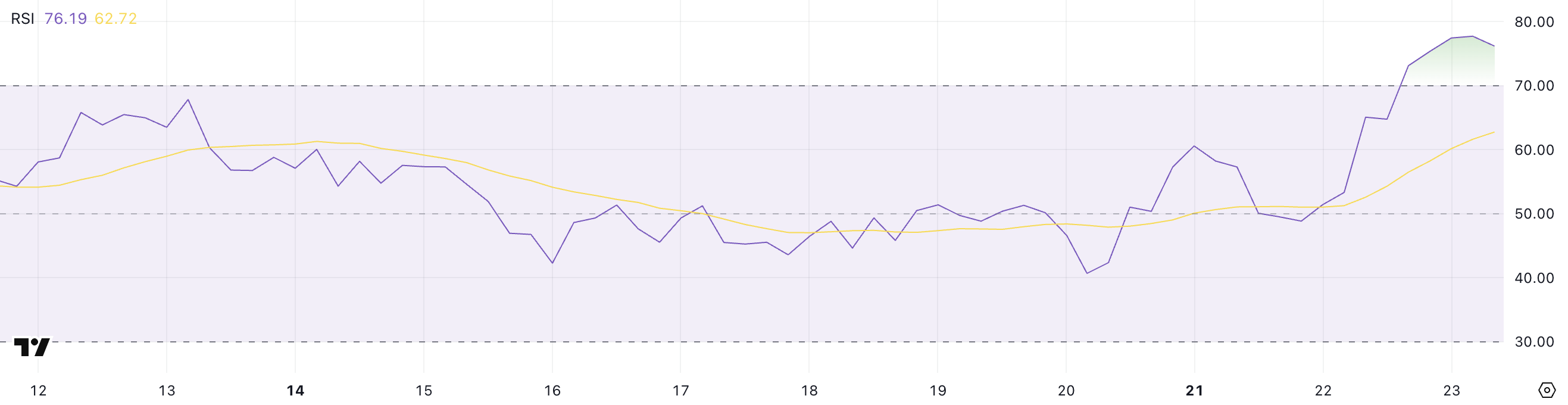

XRP’s Relative Power Index (RSI) has surged to 76.19, climbing above the 70 threshold for the primary time since March 19 — over a month in the past.

Simply yesterday, its RSI was at 51.4, signaling a pointy enhance in shopping for momentum inside a brief interval.

This leap means that XRP is coming into an overbought zone, a stage the place worth motion typically begins to gradual or reverse, relying on broader market sentiment.

RSI is a momentum indicator that ranges from 0 to 100 and helps merchants assess whether or not an asset is overbought or oversold. A studying above 70 usually indicators overbought situations, suggesting that the asset could also be due for a pullback.

A studying beneath 30, however, indicators oversold situations and potential for a bounce. With XRP now at 76.19, merchants could start to observe for indicators of weakening momentum or consolidation. Regardless of that, some analysts declare XRP market cap may quickly surpass Ethereum’s.

Nevertheless, robust upward RSI strikes also can sign the beginning of a breakout if supported by quantity and broader bullish sentiment.

Ichimoku Alerts Align for XRP as Cloud Turns Bullish

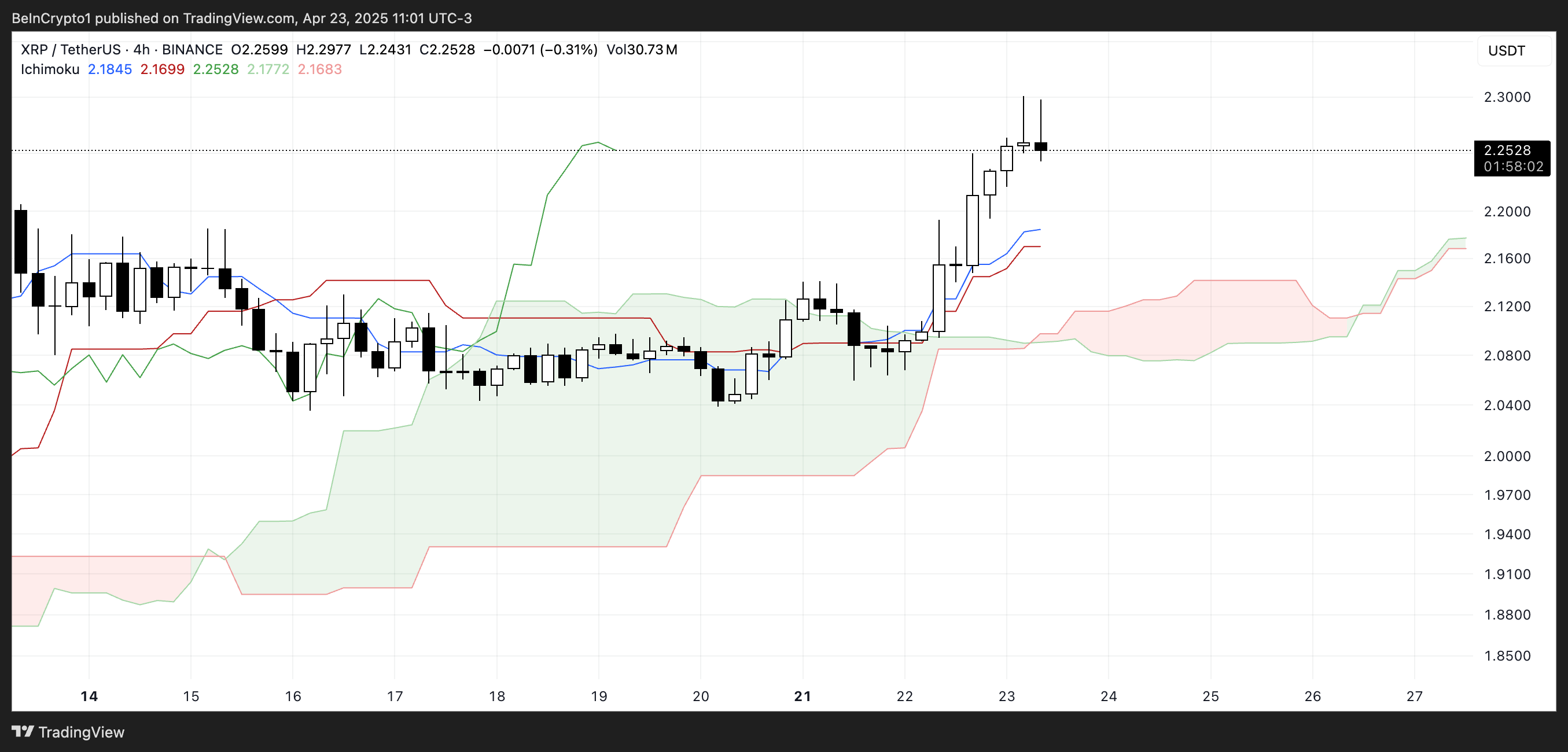

XRP’s Ichimoku Cloud stays in a bullish configuration, with the worth clearly positioned above the Kumo (cloud), shaped by the Senkou Span A (inexperienced line) and Senkou Span B (pink line).

This means a continuation of upward momentum, although the inexperienced cloud forward is narrower than earlier than, suggesting that bullish conviction is probably not as robust as in earlier phases of the development.

Nonetheless, being above the cloud usually favors consumers within the quick time period.

The Tenkan-sen (blue line) is above the Kijun-sen (pink line), signaling short-term bullish momentum via a optimistic crossover.

In the meantime, the Chikou Span (inexperienced lagging line) is properly above the cloud, confirming that present momentum is supported by previous worth power.

Nevertheless, the thinner cloud forward requires some warning — whereas the development stays bullish, a weaker cloud can recommend lowered help if the worth turns.

For now, XRP has a optimistic technical construction, however merchants will monitor for any indicators of weak spot.

XRP Builds Momentum on Golden Crosses—Reversal or Rally?

XRP’s exponential transferring common (EMA) strains have shaped consecutive golden crosses since yesterday, a robust bullish sign that signifies rising upward momentum.

This sample means that short-term averages are crossing above longer-term ones, typically seen as an indication of a development reversal or the start of a brand new uptrend.

If this momentum continues, XRP worth may climb to check $2.50, with additional resistance ranges at $2.64, $2.74, and $2.83.

Ought to the broader bullish sentiment return, XRP could even try and reclaim the $2.99 stage — and presumably break above $3 for the primary time in months.

Nevertheless, if the momentum fades and the development reverses, XRP may pull again to check help at $2.18. A lack of that stage would open the door for a deeper correction towards $2.03.

Continued draw back stress may push XRP beneath the $2 mark, with the subsequent main help ranges at $1.90 and $1.61.

Disclaimer

In step with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.