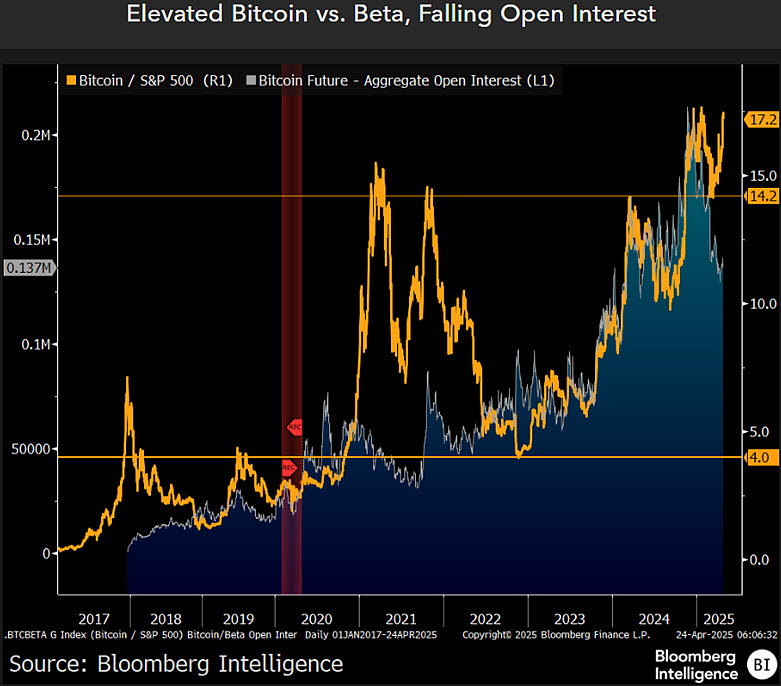

In accordance with Bloomberg’s senior commodity strategist Mike McGlone, Bitcoin (BTC) has outshined the S&P 500 to date in 2025.

As of April 23, BTC had returned to breakeven for the 12 months, whereas the S&P 500 lagged with a virtually 10% loss. McGlone referred to as this efficiency “an accomplishment,” particularly given the broader downturn in conventional fairness markets.

Recession May Derail Crypto Momentum

McGlone warned that Bitcoin’s lead could not maintain if the U.S. economic system dips into recession. Citing Bloomberg Economics projections, he outlined a possible 30% inventory market decline beneath such situations. Drawing parallels to main market collapses—1929 within the U.S., 1989 in Japan, and the 2000 dot-com crash—he argued that crypto markets may face related deflationary dangers as a consequence of extreme hypothesis and token oversupply.

Bitcoin and Gold Rise Collectively—however For How Lengthy?

Over the previous 12 months, each Bitcoin and gold have climbed roughly 42%, far outpacing equities. McGlone sees Bitcoin as a powerful contender within the ongoing “secure haven” narrative.

Whereas gold stays a conventional hedge, he famous that BTC’s attraction may rise if financial instability and debates over Fed independence intensify.

McGlone concluded that Bitcoin stays a high-risk, high-reward asset—however in unsure instances, it could proceed to draw traders searching for alternate options to fiat-based methods.