Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin is altering palms at costs virtually 40% beneath its modeled “power worth,” but an uncommon confluence of technical, elementary and coverage alerts suggests the market could also be turning, in accordance with Charles Edwards, founding father of the quantitative crypto hedge fund Capriole Investments. In his newest e-newsletter, Edwards argues {that a} newly-formed “Triple Put”—simultaneous backstops from the White Home, the Federal Reserve and the US Treasury—has altered the danger profile for all threat property simply as on-chain and macro indicators for Bitcoin flip decisively larger.

Bitcoin Flips Bullish

Edwards begins with sentiment, describing it as “within the pits.” The American Affiliation of Particular person Buyers’ bull–bear unfold, he notes, is “as bearish as 2009 and the 2022 lows, and considerably worse than the 2020 Covid crash,” despite the fact that each Bitcoin and the S&P 500 have fallen lower than fifteen p.c from their current peaks.

The CNN Concern & Greed Index has registered its bleakest studying “in years,” whereas Capriole’s personal Energetic Supervisor Sentiment gauge exhibits fairness managers at near-record under-exposure. “Merely put, traders are panicking as we speak,” he writes, warning that such excessive readings “sometimes coincide on the mid-late stage of a serious worth backside.” The mix leaves what Edwards calls “blood (and concern) on the road,” echoing the Rothschild maxim he cites in full: “the time to purchase is ‘when there’s blood on the streets, even when the blood is your personal.’”

Associated Studying

Technically, Bitcoin staged a pointy reversal simply days in the past. A breakout candle to $94,000 reclaimed your complete $91,000–$100,000 vary that had capped the market since February. Edwards classifies the transfer as a “important vary reclaim,” including that “for Bitcoin, such bullish vary reclaims hardly ever see worth look again.”

Until the market delivers “a every day shut underneath $91K,” he writes, “it’s laborious to get a technical chart extra bullish than this.” The breakout coincides along with his agency’s machine-learning fundamentals mannequin, the Bitcoin Macro Index, turning optimistic after months in impartial territory. The index blends greater than seventy on-chain, macro-economic and equity-market variables; worth is intentionally excluded to keep away from suggestions results. Final week the mannequin “reset to ‘truthful worth’ after which resumed a bullish development,” a shift Edwards calls “a really promising elementary information studying.”

The ‘Triple Put’

Coverage developments present the third leg of the story. On April 2—the so-called “Liberation Day”—the USA imposed sweeping international tariffs, solely to halve them and add a 90-day pause as soon as equities bought off by roughly fifteen p.c, the VIX jumped above 30, and credit score spreads widened.

Edwards describes the speedy reversal because the inaugural “Trump Put,” proof that “if markets decline an excessive amount of, Trump will step in, enact coverage and backstop them.” At some point earlier, on April 1, the Federal Reserve started slashing the tempo of quantitative tightening by 95% (the “Fed Put”), successfully ending a four-year balance-sheet contraction; derivatives merchants on the CME FedWatch software now assign the base-case to a few fee cuts earlier than year-end.

Associated Studying

In the meantime, Treasury Secretary Scott Bessent advised reporters that the swoon in Treasuries was pushed by deleveraging moderately than overseas promoting and that the division “had instruments to mitigate the state of affairs, together with scaling up buybacks if mandatory” (“Treasury Put”).

Edwards concludes that “we now have three main monetary market places in place, all able to backstop monetary markets. Collectively the US President, Federal Reserve and US Treasury symbolize the Triple Put,” a volatility backstop unprecedented in its breadth.

Is BTC Undervalued?

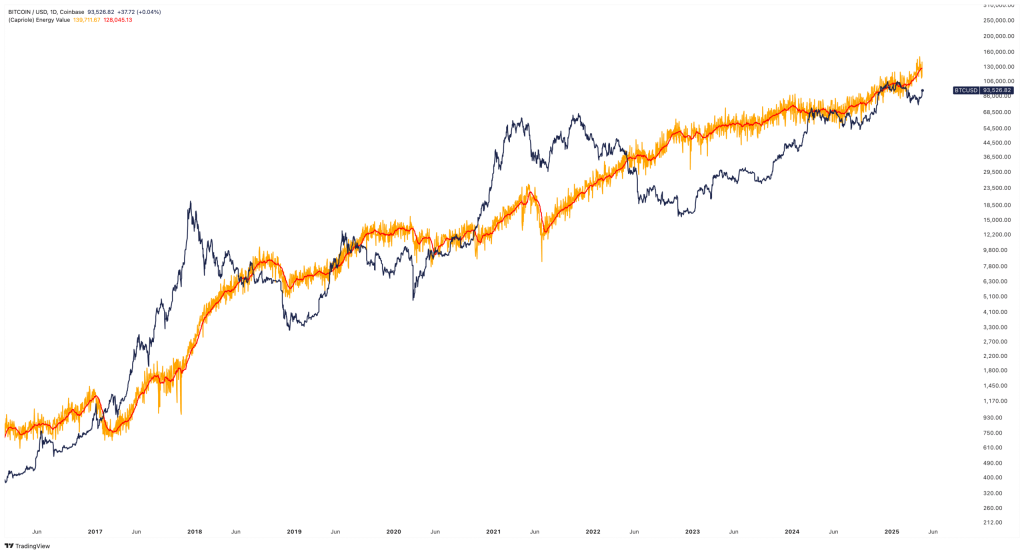

Capriole’s personal “Chart of the Week” underscores the valuation argument. The Bitcoin Vitality Worth—an in-house metric that costs the community utilizing mixture miner electrical energy consumption—surged above $130,000 for the primary time this month.

With the spot market buying and selling close to $94,000, Bitcoin subsequently sits at an “virtually 40% low cost to truthful worth,” a depth of undervaluation that Edwards calls “fairly uncommon” within the first yr after a halving and “a really welcome sight.” Traditionally, the power worth has acted as a gravitational pull on worth; gaps of this measurement have narrowed in each prior cycle.

Edwards tempers the bullish image with caveats. “Political and volatility threat stay, and new coverage adjustments are the best threat to derailing markets at current,” he writes, including that Capriole will look ahead to Bitcoin to defend $91,000 on a weekly shut and for the Macro Index to stay in enlargement.

But his general tone is unmistakably optimistic: “Because it sits as we speak, the outlook for Bitcoin could be very bullish with confluence throughout technicals, fundamentals and sentiment,” he concludes. If the week ends above present ranges, Edwards “suspect[s] we shall be pushing new all-time highs on Bitcoin fairly quickly.”

At press time, BTC traded at $93,723.

Featured picture created with DALL.E, chart from TradingView.com