- BONK dropped 13.25% previously 24 hours, touchdown close to a key help stage that would set off both a 25% additional dip or a 71% bounce, relying on how the market reacts subsequent.

- Bullish sentiment stays sturdy, with $1.77M in spot accumulation, open curiosity hitting $22M, and secure funding charges — all suggesting merchants are positioning for upside.

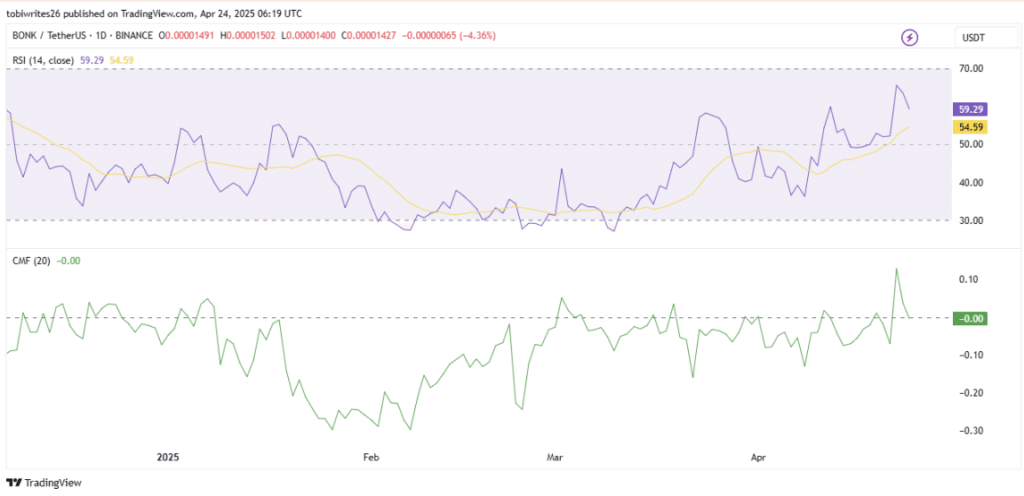

- Technical indicators like RSI (59.29) and CMF (impartial at 0.00) present non permanent cooling, but when CMF traits upward and help holds, BONK may rally towards $0.00002655 within the close to time period.

BONK took successful—down 13.25% within the final 24 hours, as broader promoting strain dragged it right into a key help zone. However right here’s the factor: regardless of the pink candle, the market’s temper? It’s nonetheless leaning bullish.

If this zone holds, a rebound may very well be proper across the nook. That’s what the charts — and the wallets — are hinting at.

Holding This Degree Is Crucial

Let’s rewind for a sec. BONK’s slide kicked off after it smacked right into a resistance zone earlier this week. Basic rejection. Since then, it’s been dripping decrease… and now it’s sitting on a significant help stage.

Break that ground? We may very well be taking a look at one other 25.8% drop, with value focusing on $0.00001043.

But when bulls defend this zone (and there are indicators they could), BONK may bounce as much as $0.00002076 — and presumably run all the way in which to $0.00002655, which might be a 71% rally from right here.

There’s additionally a 3rd possibility — sideways motion. If BONK consolidates right here, that may recommend accumulation is going on below the floor.

Merchants Are Nonetheless Shopping for the Dip

The vibes on-chain? Surprisingly bullish.

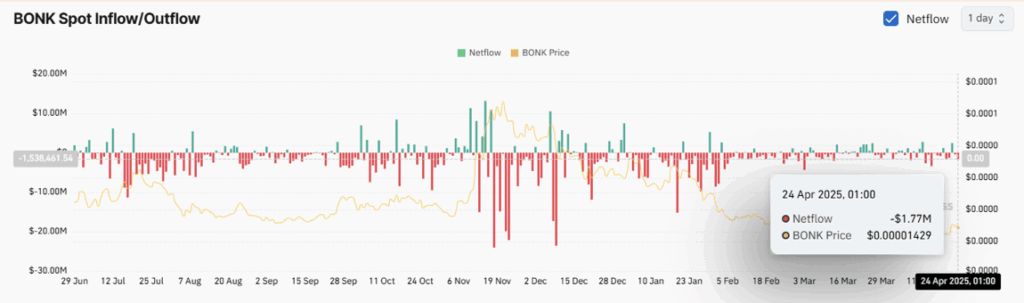

Coinglass Netflow knowledge exhibits $1.77 million in BONK purchased and moved to non-public wallets. That normally factors to accumulation — not panic promoting.

It’s not simply spot patrons both. Open Curiosity in BONK futures has surged to $22 million, the best it’s been since December 2024. That, plus secure funding charges, paints an image of confidence, not concern.

Why Did BONK Dip Anyway?

Technical stuff principally. RSI dropped to 59.29, sliding out of its latest consolation zone. Not bearish but, only a breather. It’s nonetheless properly above 50, which suggests momentum is undamaged — simply cooling off a bit of.

In the meantime, CMF (Chaikin Cash Stream) sat flat at 0.00. That’s impartial — not bullish, not bearish. However it’s value watching. If CMF begins trending upward, it may affirm that shopping for strain is returning.