The cryptocurrency market is experiencing a major shift in investor sentiment this month. Bitcoin’s value restoration has sparked a ripple impact in demand, from massive traders to smaller ones.

Bitcoin has rebounded by 25% from its early April lows. On-chain information and up to date forecasts from business specialists supply insights into the sustainability of this rally.

Market Sentiment Shifts from Concern to Greed

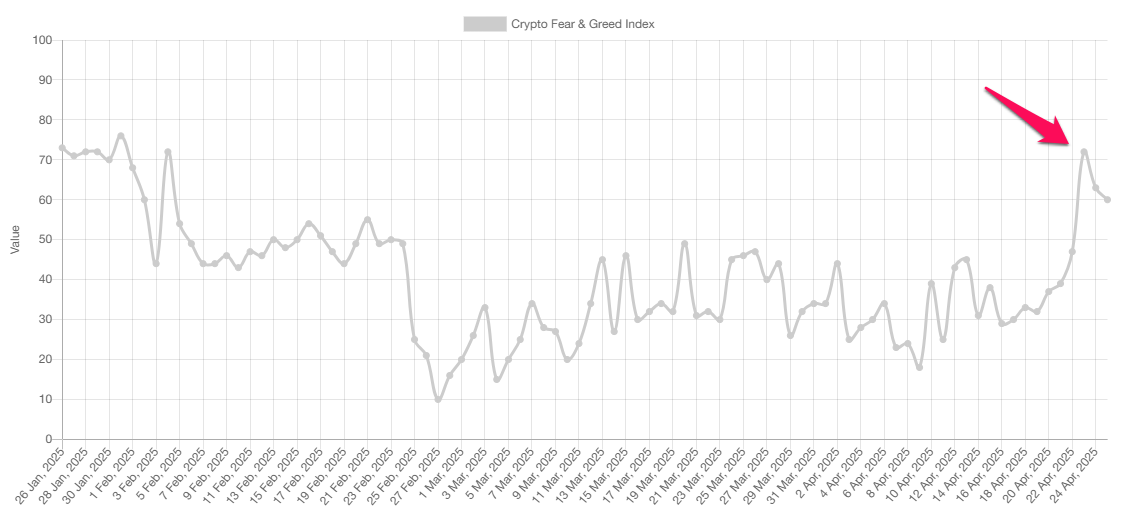

In keeping with information from Various.me, the Concern and Greed Index surged from a low of 18 to a excessive of 72 in April. That is the best degree since February and marks a transparent shift from worry to greed.

In the meantime, CoinMarketCap’s model of the index exhibits a barely totally different image. It rose from 15 to 52 factors, transferring from excessive worry to a impartial state. Though the 2 indices differ, each verify a notable shift in investor sentiment. Buyers have moved previous the worry that usually triggers panic promoting.

This impartial or grasping mindset lays the groundwork for additional optimism. If it continues, the market could attain a state of utmost greed earlier than any main correction happens. This sentiment shift has led to 5 divergence indicators that help the potential continuation of the restoration for each Bitcoin and altcoins.

Bitcoin Accumulation Spreads from Massive to Smaller Wallets, Indicating a Constructive Outlook

On-chain information exhibits that whale accumulation has helped Bitcoin maintain above $93,000 within the closing week of April.

A chart from Glassnode reveals a transparent transition from a distribution part (marked in purple) to an accumulation part (marked in inexperienced) throughout April. This timing aligns with Bitcoin’s rebound from its month-to-month low.

Particularly, Bitcoin whales—wallets holding over 10,000 BTC—have been accumulating at near-perfect ranges. Their Pattern Accumulation Rating is round 0.9.

Following the whales, wallets with 1,000 to 10,000 BTC progressively elevated their accumulation rating within the second half of April. Their rating reached 0.7, as seen by the chart’s coloration shift from yellow to blue. Different pockets tiers additionally present indicators of accumulation, reflecting altering sentiment amongst smaller whales.

“Thus far, massive gamers have been shopping for into this rally,” Glassnode defined.

Moreover, a current report from BeInCrypto highlights that Bitcoin ETFs recorded $2.68 billion in inflows final week. These ETFs have seen 5 consecutive days of optimistic inflows. These metrics verify that demand is returning and lay the inspiration for continued value positive factors.

Constancy and ARK Make investments Replace Bitcoin Forecasts

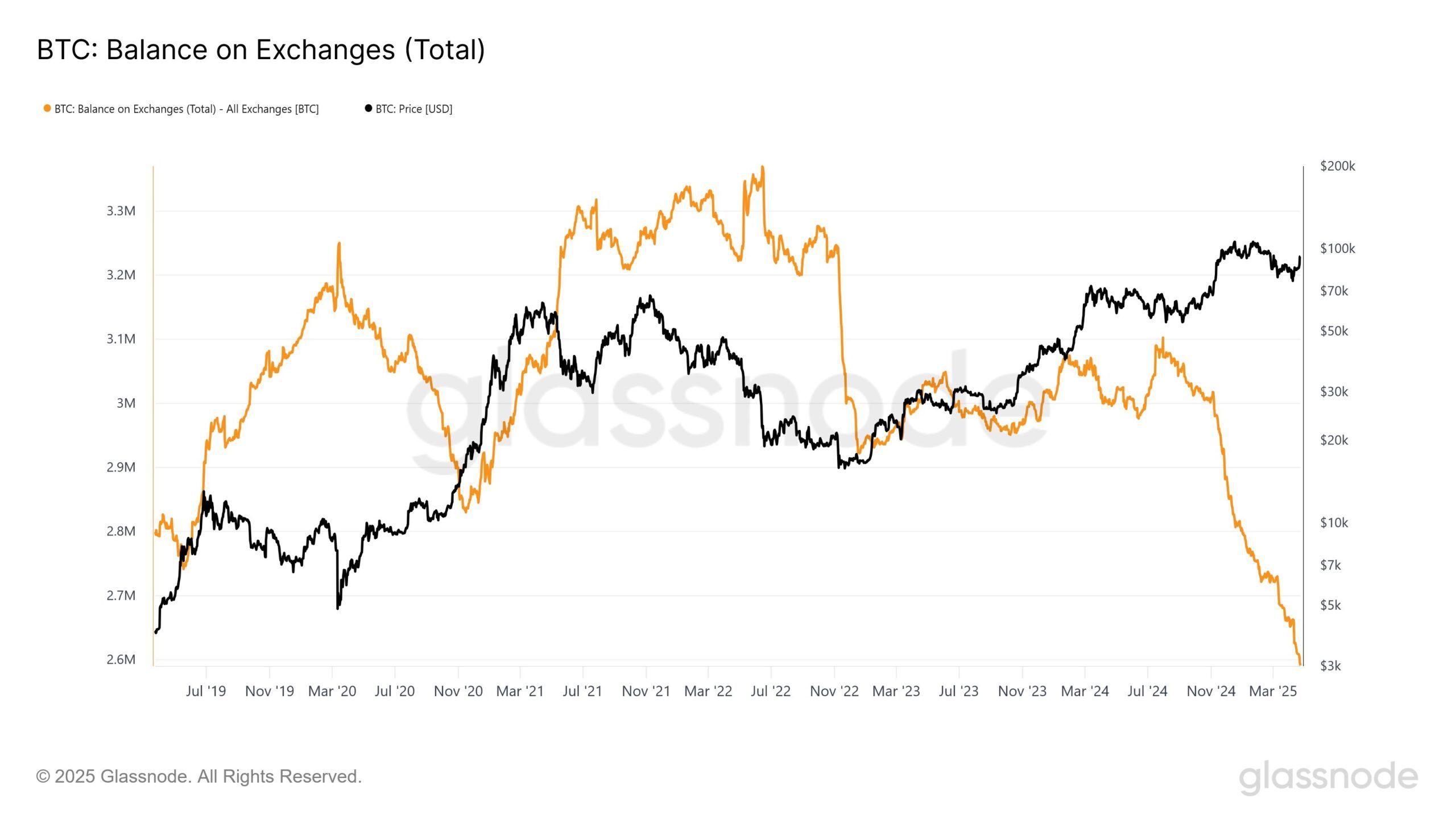

Constancy Digital Belongings, a department of the $5.8 trillion asset administration large Constancy Investments, reviews that Bitcoin provide on exchanges has dropped to its lowest degree since 2018, with solely about 2.6 million BTC remaining.

Constancy additionally famous that greater than 425,000 BTC have left exchanges since November 2024. Public corporations have added practically 350,000 BTC because the US election and are shopping for over 30,000 BTC month-to-month in 2025. Constancy expects this pattern to proceed.

“We have now seen Bitcoin provide on exchanges dropping as a consequence of public firm purchases—one thing we anticipate accelerating within the close to future,” Constancy Digital Belongings acknowledged.

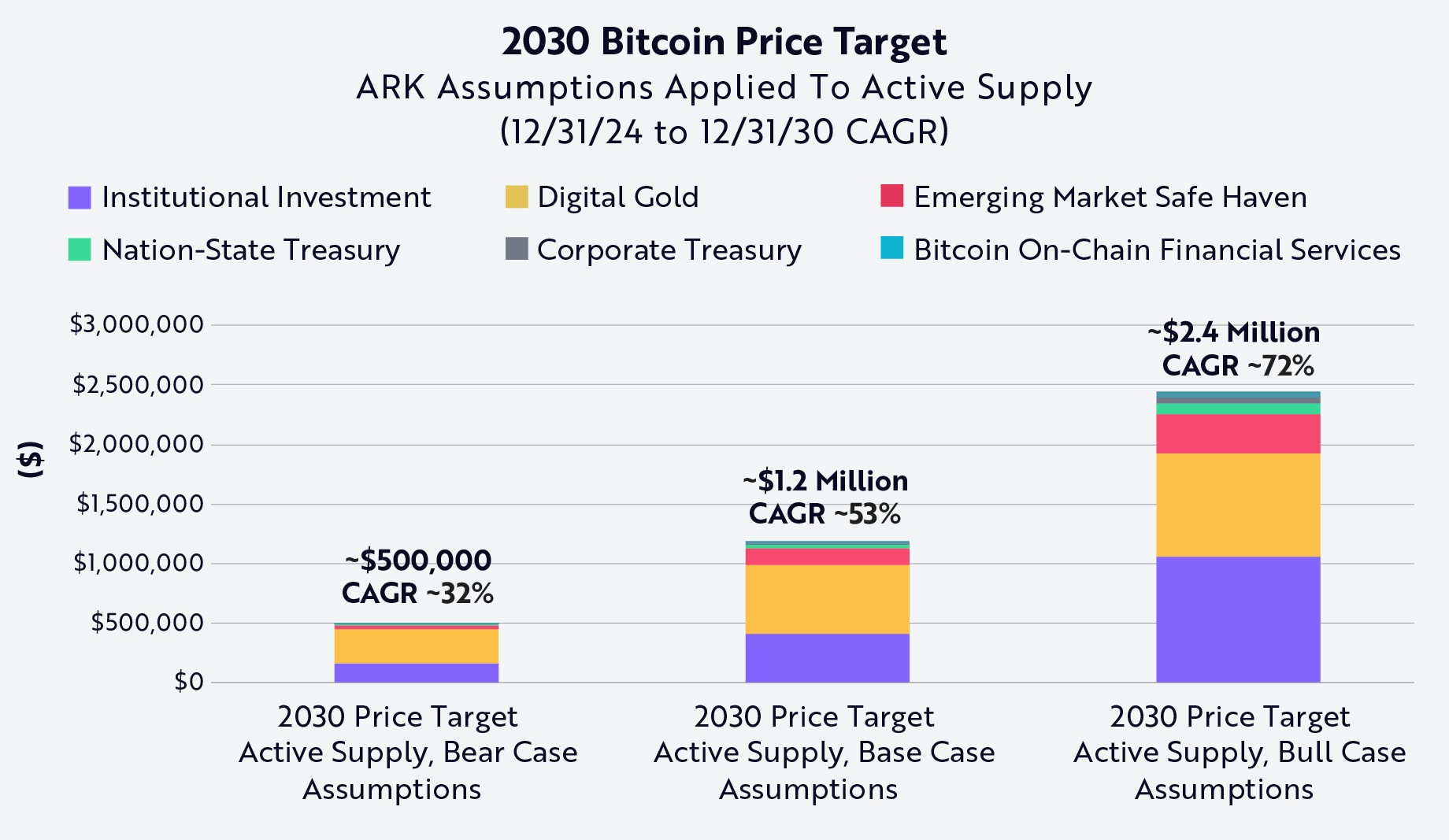

In the meantime, ARK Make investments has up to date its Bitcoin value projection within the Huge Concepts 2025 report. Underneath its most bullish situation, Bitcoin might attain $2.4 million by 2030—far above its earlier forecast of $1.5 million.

This projection depends on a number of elements: rising institutional funding, the opportunity of nations treating Bitcoin as a strategic reserve asset, and its rising function in decentralized finance.

Whereas fund managers like Constancy and ARK Make investments have a optimistic outlook for April, some retail traders are starting to specific warning. The thought of “promote in Could” is beginning to floor, reflecting concern amid unpredictable macroeconomic elements, similar to tariffs and rate of interest shifts, that might strongly impression the market within the close to future.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.