- Shiba Inu (SHIB) jumped 18% this week, however now faces robust resistance between $0.000014 and $0.000019, the place many holders could promote to recoup losses—over 82% of wallets are nonetheless at a loss.

- On-chain exercise is weakening, with energetic addresses down 17.88% and short-term holders dropping over 12%, signaling a shift away from speculative buying and selling towards longer-term holding.

- Regardless of near-term hurdles, analysts stay bullish long-term, with forecasts inserting SHIB close to $0.0001971–$0.000199 by 2030–2031 if adoption and market circumstances enhance.

Shiba Inu (SHIB) has had a strong week. Between April 18 and April 25, the meme coin climbed 18%, leaping from $0.0000118 to as excessive as $0.0000139. Not unhealthy, proper? And it wasn’t simply value motion—buying and selling quantity rose too, signaling that the broader market was vibing bullish.

However right here’s the catch: SHIB simply ran headfirst right into a wall of resistance. And it’s not a small one.

The Resistance Zone: A Pileup of Baggage

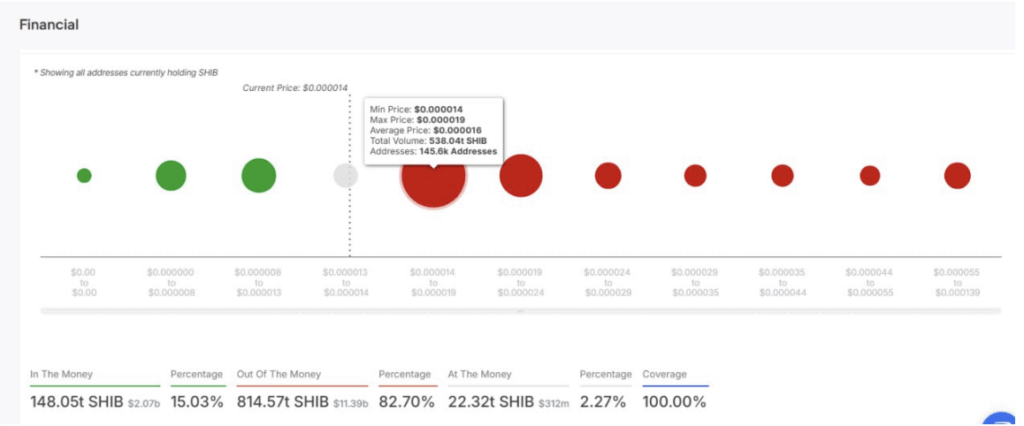

Let’s discuss numbers for a sec. In line with IntoTheBlock, there’s an enormous cluster of SHIB held between $0.000014 and $0.000019—round 538 trillion SHIB unfold throughout 145,600 pockets addresses.

That’s… a lot of potential promote stress.

On the present value (~$0.000014), solely about 15% of holders are in revenue, which implies most holders are both barely breaking even or sitting on massive unrealized losses. To be actual:

- 148T SHIB is within the inexperienced (value round $2.07B)

- Simply 2.27% of wallets are break-even

- An enormous 82.7% of holders are nonetheless at a loss, holding over 814T SHIB (round $11.4B in paper ache)

So what does this imply? If SHIB retains inching towards that resistance vary, lots of people could begin promoting to interrupt even or minimize losses—which might drag the worth again down.

Additionally value noting: a number of the token knowledge contains burned or inactive provide. The precise circulating provide is round 589 trillion SHIB.

On-Chain Exercise’s… Meh

Right here’s the place the hype fades a bit.

Though the worth is up, on-chain exercise hasn’t saved tempo. IntoTheBlock’s deal with knowledge reveals:

- Energetic addresses down 17.88% in 7 days

- New addresses up simply 0.99% (a reasonably weak soar)

This factors to much less engagement total—not precisely what you need to see when a coin’s testing resistance.

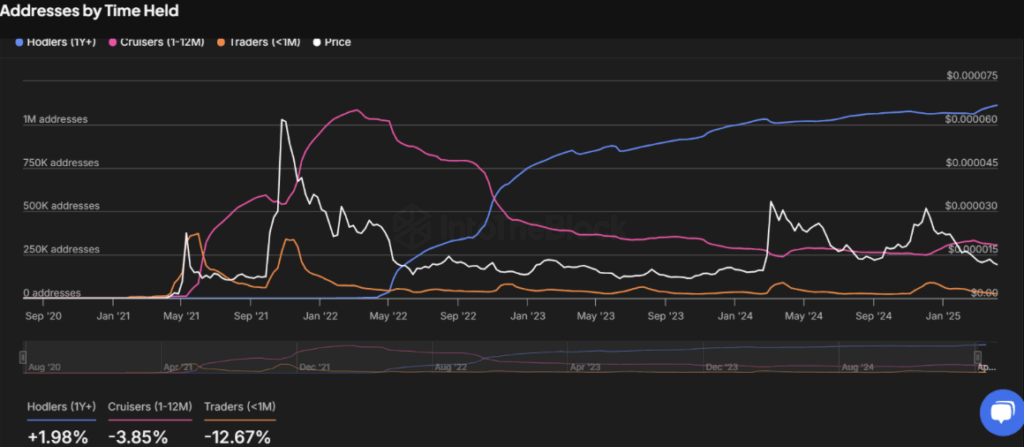

And the breakdown by time-held tells a narrative too:

- Lengthy-term holders (1+ yr): up 1.98% ✅

- Cruisers (1–12 months): down 3.85% ❌

- Brief-term holders (<1 month): down a steep 12.67% ❌❌

Translation? There’s a shift away from fast hypothesis towards long-term holding. That’s nice for stability, nevertheless it additionally means much less short-term quantity and momentum, which is precisely what’s wanted to push by means of robust resistance zones.

Wanting Manner Down the Street…

Regardless of all that near-term noise, some analysts are staying optimistic. Lengthy-term forecasts are… kinda wild.

- Finder’s knowledgeable panel sees SHIB hitting $0.0001971 by 2030

- Changelly’s group targets $0.000199 by Might 2031

That’s a large leap from present ranges—however that form of development will want time, infrastructure, and doubtless a pair bull markets between every now and then.

Last Take

Proper now, SHIB’s value is robust, nevertheless it’s bumping up towards severe resistance. Most holders are nonetheless underwater, and lots of could look to exit as value climbs again towards their purchase zones. Mix that with weak on-chain exercise and a shrinking short-term dealer base… and it’s gonna be a tricky climb.

However zoom out? There’s nonetheless a strong long-term case if SHIB can hold constructing, increasing, and surviving the grind.

For now? All eyes on $0.000014–$0.000019. That’s the battle zone. Let’s see who flinches first.