- Bittensor (TAO) rose 2.34% previously 24 hours and has gained 48% over the past month, with sturdy efficiency persevering with to outpace Bitcoin, Ethereum, and different high AI tokens like FET and RENDER.

- Institutional curiosity and consumer progress (200,000+ new customers) are fueling momentum, whereas Coinglass information exhibits $3.11M in internet shopping for and a bullish long-to-short ratio within the derivatives market.

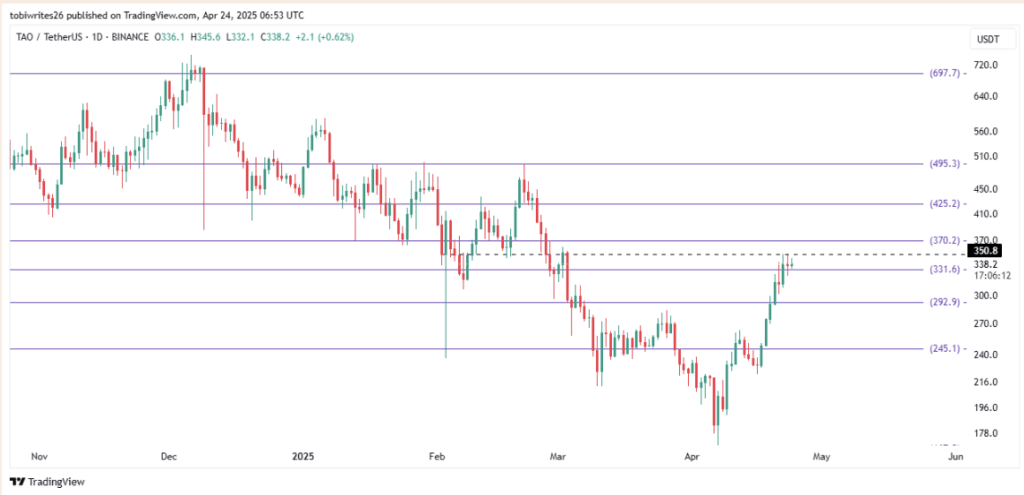

- Primarily based on technicals, TAO may goal $697.70 within the coming weeks, although it should first break by key resistance ranges at $370.2, $425.2, and $495.3.

Bittensor (TAO) noticed a quiet however assured 2.34% push upward previously 24 hours, a small inexperienced candle that’s catching some consideration. The transfer comes on the heels of recent analysis backing the token’s long-term upside — and could possibly be a warm-up for one thing larger if the development holds.

If momentum retains constructing, TAO may tack on much more positive factors to its already strong 48% surge over the previous monthand 23% rise in simply the final 30 days. Not too shabby, particularly in a market nonetheless looking for its legs.

Outpacing the Huge Canines

Contemporary information from Funstrat paints a reasonably bullish image for TAO. The token’s been outperforming some heavy hitters, together with none aside from Bitcoin and Ethereum.

Let’s break it down:

- Since March 2023, Bitcoin is up 195%, whereas TAO has risen 169%. So positive, BTC is forward—however solely barely.

- In comparison with Ethereum although? TAO is crushing it. ETH solely notched a 2% acquire in the identical time interval, whereas TAO soared.

TAO can be main the pack when stacked towards different AI tokens—beating out names like Render (RENDER), Close to Protocol (NEAR), and FET (now below the Synthetic Superintelligence Alliance umbrella). Mixed, these different tasks clocked in a 140% acquire, whereas TAO stays forward of the curve.

Establishments & Accumulation: The Quiet Frenzy

A part of what’s driving this? Adoption.

There’s been notable institutional curiosity, together with uptake from Grayscale traders. On the similar time, the entire variety of customers interacting with TAO has climbed by 200,000 since final 12 months — a surge that appears to be pushing the worth up steadily.

And the market? It’s reacting.

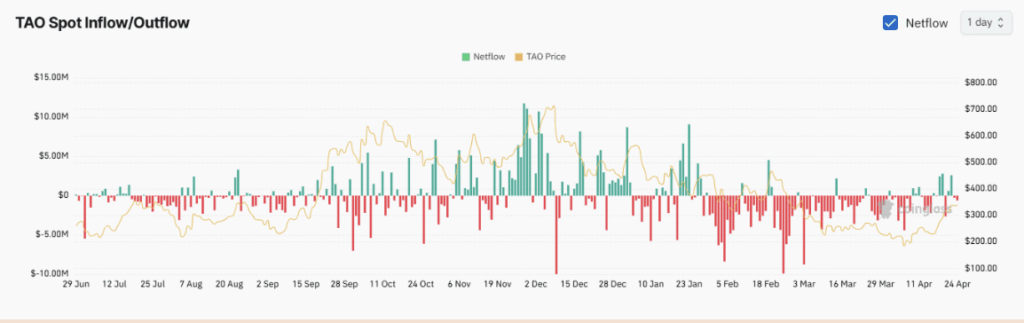

Coinglass information exhibits merchants scooped up about $3.11 million price of TAO previously 24 hours alone — internet shopping for strain, plain and easy.

Within the derivatives area, the long-to-short ratio is sitting at 1.0105, that means there’s extra bullish motion than bearish bets. Not a blowout quantity, but it surely leans inexperienced — and that issues.

TAO Worth Outlook: Eyes on $697?

So how far can TAO run?

Utilizing Fibonacci retracement ranges, the subsequent main ceiling could possibly be up close to $697.70. But it surely’s not a straight line from right here to there.

First, TAO must clear three key resistance zones:

Any of those may gradual issues down — assume short-term consolidation or a dip earlier than a breakout. But when patrons preserve exhibiting up? These boundaries could be velocity bumps.

Remaining Thought: Nonetheless Early?

Backside line? TAO’s momentum may be very a lot intact, and the mixture of institutional accumulation, sturdy on-chain exercise, and first rate technical construction suggests there’s room to run.

Certain, resistance ranges may stall issues brief time period — but when this tempo retains up, TAO could possibly be organising for one more breakout, probably even a recent 2025 excessive.

Watch these quantity spikes. The group’s getting louder.