Bitcoin (BTC) is up almost 12% over the previous seven days, gaining momentum because it reclaims key technical ranges and approaches main resistance zones. The latest worth surge has been supported by a slight restoration within the variety of Bitcoin whale addresses, hinting at renewed accumulation from giant holders.

Technical indicators just like the Ichimoku Cloud and EMA traces level to a powerful uptrend, with bullish formations suggesting continued purchaser management. As BTC flirts with the $100,000 mark once more, whale exercise and chart alerts will decide whether or not this rally has extra room to run.

Refined Accumulation: What the Rise in BTC Whales May Imply

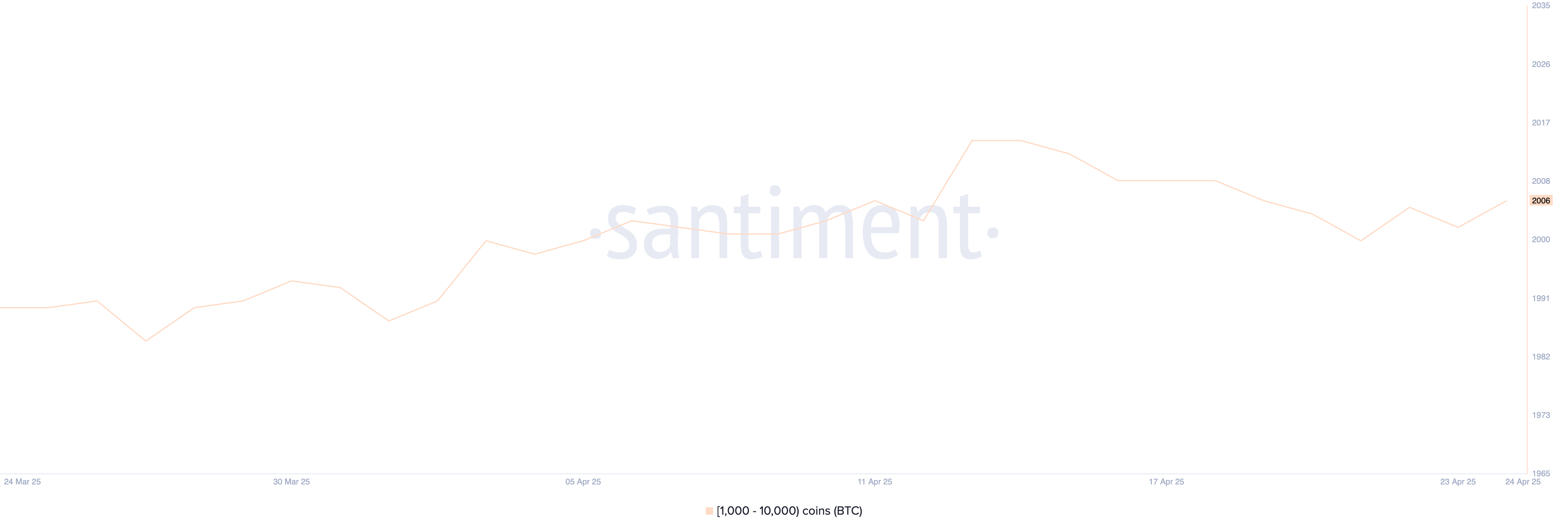

The variety of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—has been making an attempt to recuperate over the previous few days, exhibiting delicate however notable motion.

There are 2,006 BTC whale addresses, barely larger than the two,000 recorded on April 21. The rely briefly rose to 2,005 on April 22 earlier than dipping to 2,002 the subsequent day, and now it’s again above that degree.

Whereas these every day fluctuations could seem minor, they typically mirror deeper shifts in sentiment and positioning amongst among the largest gamers within the crypto market. The latest stabilization means that accumulation may be selecting up once more after a interval of distribution or hesitation.

Monitoring whale exercise is vital as a result of these entities are likely to have an outsized affect on market developments. Whether or not institutional traders, long-term holders, or high-net-worth people, whales typically act with a degree of strategic perception and endurance that retail traders can’t at all times match.

Their conduct can sign confidence or warning within the broader market. The variety of whale addresses exhibiting a slight upward development may point out renewed curiosity in accumulating Bitcoin at present ranges.

This won’t instantly translate to a pointy worth transfer. Nonetheless, it does add a layer of underlying help to the market, probably decreasing draw back threat and paving the best way for extra sustained bullish momentum if broader situations align.

Ichimoku Alerts Power in Bitcoin Development

Bitcoin’s Ichimoku Cloud chart is exhibiting indicators of continued bullish momentum.

The value trades above the blue conversion line (Tenkan-sen) and the purple baseline (Kijun-sen), indicating short-term power and development alignment.

These traces have acted as dynamic help ranges all through the latest transfer, with worth bouncing off them a number of occasions in latest candles. This means that consumers stay in management, and any dips have been met with demand.

The inexperienced cloud (Kumo) forward is thick and rising, signaling a powerful help zone and a optimistic development outlook.

The space between the purple and inexperienced boundaries of the cloud additionally suggests increasing volatility, which tends to help stronger directional strikes.

As a result of the worth is nicely above the cloud and all key Ichimoku parts are aligned in bullish formation, the present setup helps the thought of an ongoing uptrend—not less than within the brief to mid-term—except worth sharply reverses and closes under the blue and purple traces.

Will Bitcoin Break Above $100,000 Earlier than Might?

Bitcoin just lately broke above the $90,000 mark for the primary time since early March.

Its EMA traces help the bullish narrative, with all short-term shifting averages positioned above the long-term ones and spaced broadly aside—typically an indicator of a powerful uptrend.

Bitcoin worth may problem key resistance ranges at $96,484 and $99,472 if this momentum continues. A break above these may open the door for a push previous the psychological $100,000 mark, with the subsequent main goal close to $102,694—the best degree since early February.

Nevertheless, there’s nonetheless room for warning. It could lose its short-term footing if Bitcoin retests and fails to carry the help degree at $92,920.

In that case, worth may slide towards $88,839, and if a downtrend takes form, additional losses all the way down to $86,533 grow to be extra seemingly.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.