- Stellar (XLM) broke out of an extended bearish channel, surging 8.5% in 24 hours with a 25% spike in buying and selling quantity, signaling robust renewed curiosity from merchants and buyers.

- On-chain information exhibits 65% of high Binance merchants holding lengthy positions, whereas thousands and thousands of {dollars} in bullish bets have been positioned close to key assist and resistance ranges, backed by important trade outflows hinting at accumulation.

- Technical evaluation factors to a possible 30% rally towards $0.375, so long as XLM holds above crucial assist at $0.275, with a warning that dropping beneath $0.26 might invalidate the bullish setup.

Stellar (XLM) has lastly busted outta its lengthy, painful bearish stretch — one which began means again in November 2024. Throughout that tough trip, XLM’s worth dropped by about 65%, carving out a fairly clear bearish channel on the charts.

However now? That breakout has not simply stopped the bleeding, it’s really lit the fuse for what could possibly be a giant upside run. On the time of writing, XLM was buying and selling near $0.284, after leaping up about 8.5% in simply the final 24 hours.

Even higher, buying and selling quantity spiked 25% throughout the identical window — a transparent signal that merchants and buyers are pouring again in.

Fairly apparent that this breakout and the bullish worth motion have caught a whole lot of eyes.

Merchants Are Leaning Exhausting Into Bullish Bets

Peeking on the on-chain information, it’s clear: most merchants are betting that XLM’s gonna maintain pushing increased.

Proper now, Binance’s XLMUSDT Lengthy/Brief Ratio is sitting at 1.89 — fairly dang bullish. Digging deeper, 65.37%of high merchants on Binance are holding lengthy positions, whereas solely 34.63% are daring to brief it.

That’s a giant cut up. Confidence within the rally is unquestionably robust among the many heavy hitters.

Thousands and thousands Poured Into Bullish Positions Close to Key Ranges

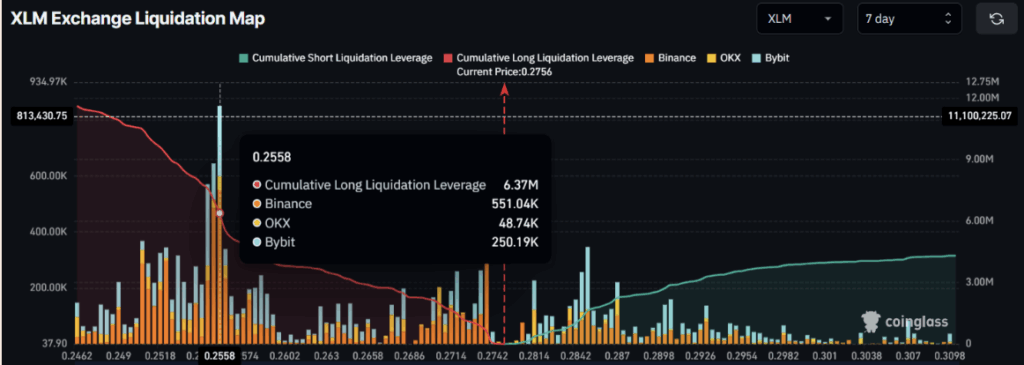

Based on Coinglass’s XLM Alternate Liquidation Map, there’s been a whole lot of high-stakes positioning taking place round vital worth factors.

- Close to $0.2558 (assist), merchants constructed up about $6.37 million price of lengthy positions.

- Round $0.285 (resistance), about $1.63 million in shorts have stacked up.

Each these zones are actually flirting with liquidation stress, which might gasoline much more unstable strikes quickly.

On the identical time, trade information exhibits about $1.19 million price of XLM has flowed out of exchanges prior to now 24 hours — and when cash go away exchanges, it normally means accumulation. Translation: consumers are getting critical.

Technicals Are Flashing Inexperienced Lights

AMBCrypto’s newest technical evaluation backs up the bullish vibes. On the every day timeframe, XLM has formally damaged out of that lengthy descending channel and really closed a every day candle above a key degree — a giant deal for confirming the breakout.

If Stellar can maintain its head above the $0.275 mark, the trail appears clear for a attainable 30% rally, pushing the worth towards $0.375 within the close to future.

Small warning although: if XLM slips beneath $0.26, the bullish case might crumble fairly quick. So yeah… nonetheless just a little tightrope stroll taking place right here.

Backside Line: Momentum’s Constructing for Stellar

Proper now, the celebs appear to be aligning for Stellar (pun completely supposed). Between the breakout, surging quantity, aggressive lengthy positions, and bullish technicals, XLM’s setup is wanting fairly strong — a minimum of for now.

If the token can maintain holding key assist ranges, this might simply be the beginning of a a lot greater transfer up.