Stripe, a worldwide chief in cost infrastructure, is getting into the stablecoin market amid the sector’s continued development.

On April 25, CEO Patrick Collison confirmed that the corporate is actively creating a stablecoin-based product, marking a significant milestone after almost a decade of inside discussions.

Stripe to Launch Stablecoin Product Powered by Bridge Acquisition

Collison revealed that Stripe had lengthy envisioned this undertaking however had solely now discovered the best surroundings to maneuver ahead.

The corporate has but to share in-depth particulars about its strikes. Nonetheless, plans recommend the preliminary rollout will goal companies outdoors america, the European Union, and the UK.

Stripe’s enterprise into stablecoins comes shortly after its February $1.1 billion acquisition of Bridge, an organization specializing in stablecoin infrastructure. Bridge’s expertise is predicted to be the inspiration for Stripe’s upcoming digital forex initiatives.

The affirmation follows mounting hypothesis about Stripe’s curiosity in blockchain applied sciences. Stripe, which handles transactions throughout greater than 135 currencies and helps billions of {dollars} in international commerce yearly, sees stablecoins as a pure extension of its providers.

Including a stablecoin product may supply companies sooner, cheaper, and extra environment friendly methods to deal with cross-border transactions.

The cost large’s transfer comes as different main fintech corporations are additionally exploring stablecoins. Main conventional monetary establishments like PayPal are already interacting with the sector, highlighting its rising momentum.

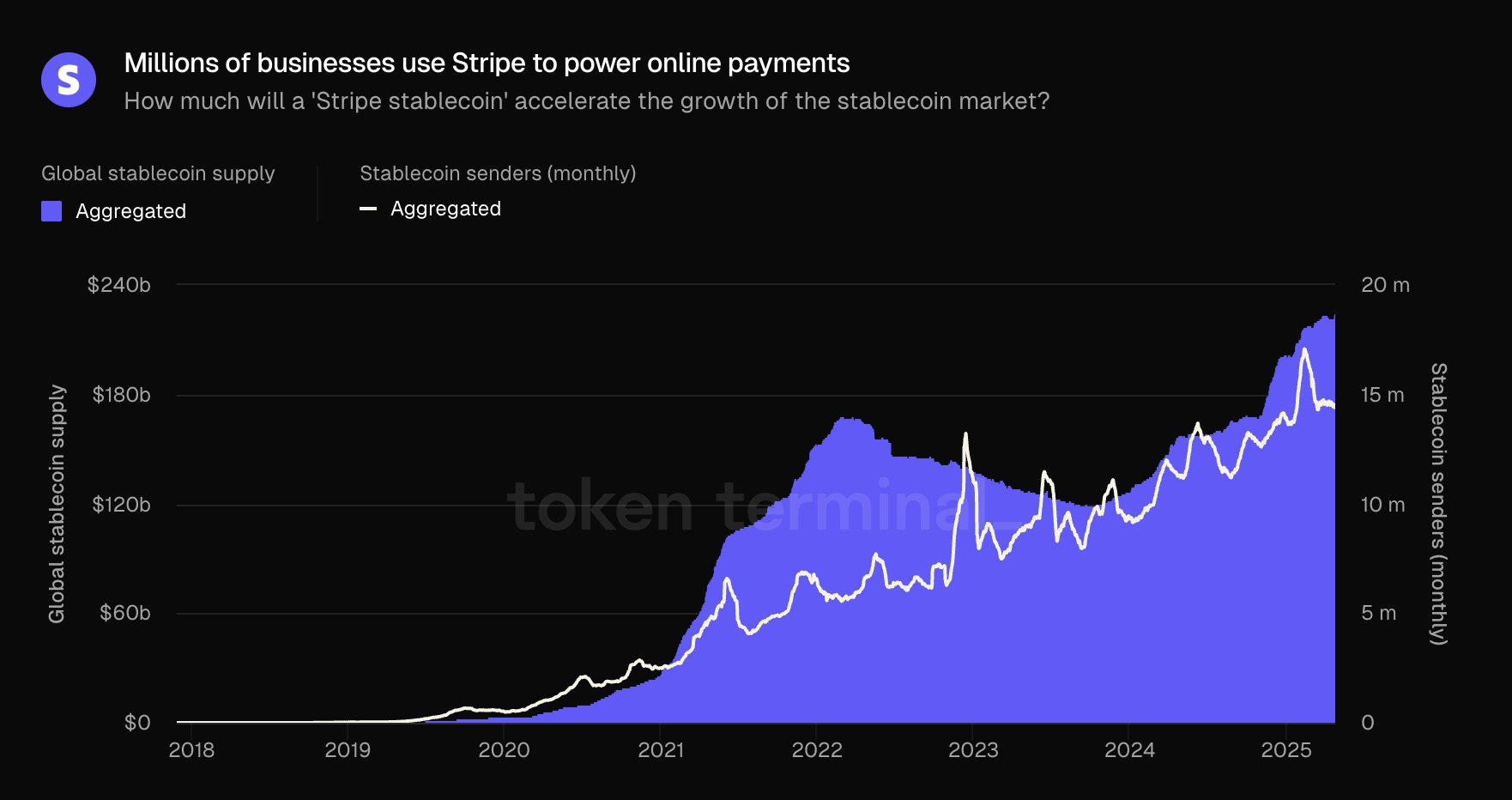

Right this moment, the stablecoin market is dominated by main gamers like Tether (USDT) and Circle (USDC).

Nonetheless, trade analysts, together with these at Customary Chartered, consider stablecoin circulation may surge previous $2 trillion by 2028, pushed by elevated regulatory readability.

In Washington, lawmakers are advancing laws to supply oversight and construction to the stablecoin trade.

Two key payments — the Stablecoin Transparency and Accountability for a Higher Ledger Economic system (STABLE) Act and the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act — suggest stronger liquidity necessities and anti-money laundering requirements.

These efforts purpose to foster higher belief in US-issued stablecoins and protect the greenback’s dominance in international finance.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.