Ethereum (ETH) has been exhibiting indicators of renewed power, gaining 14% over the previous seven days. Regardless of the current rally, Ethereum has been buying and selling beneath the $1,900 mark since April 2, highlighting the significance of key resistance ranges forward.

Whether or not Ethereum can reclaim greater floor or faces renewed promoting strain will doubtless rely upon its subsequent strikes round main help and resistance zones.

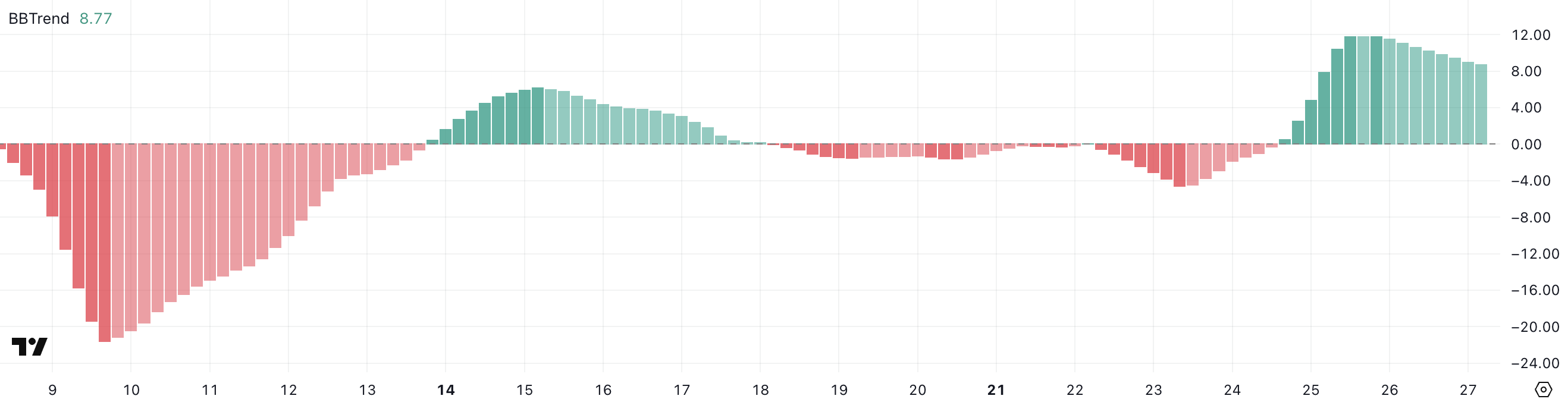

Ethereum’s BBTrend Cools: What It Indicators Subsequent

Ethereum’s BBTrend at the moment sits at 8.77, marking a noticeable decline from 11.83 two days in the past.

Regardless of the drop, the indicator has remained constructive for the previous three days, suggesting that Ethereum has maintained an underlying bullish construction at the same time as momentum cools off.

This shift might sign the early phases of a possible consolidation part, throughout which the market takes a breather earlier than deciding on its subsequent main transfer.

BBTrend, or Bollinger Band Development, is a technical indicator that measures the power of a development by analyzing how value behaves relative to the Bollinger Bands.

When BBTrend values are excessive and constructive, they typically sign a powerful uptrend; when they’re unfavourable, they level to a downtrend. Ethereum’s BBTrend, now at 8.77, signifies that whereas the uptrend remains to be current, its power is fading.

Consumers failing to reassert management might result in elevated volatility, potential pullbacks, or sideways motion.

Ethereum Whales Maintain Regular: What It Means for Value

The variety of Ethereum whales — wallets holding between 1,000 and 10,000 ETH — at the moment stands at 5,458.

This determine rose barely from 5,442 on April 21 to five,457 on April 23, and has remained secure round this stage for the previous 4 days.

The current stabilization suggests a pause in accumulation or distribution exercise amongst giant holders, providing a possible sign that the market may very well be ready for a catalyst earlier than making its subsequent important transfer.

Monitoring Ethereum whales is vital as a result of these giant holders can have an outsized influence on value actions. When whale numbers rise, it usually alerts confidence and potential accumulation, which might be bullish for value.

Conversely, a declining whale rely would possibly recommend promoting strain forward.

With the variety of Ethereum whales holding regular round 5,458, it might indicate a impartial stance amongst main gamers — neither aggressively shopping for nor promoting — probably resulting in diminished volatility and range-bound value motion till a clearer development emerges.

Ethereum’s Battle Round $1,828: Breakout or Breakdown?

Ethereum’s EMA (Exponential Transferring Common) traces are at the moment aligned in a bullish formation, with the short-term EMAs positioned above the long-term ones — a traditional signal of upward momentum.

Over the previous few days, ETH tried to interrupt by the resistance zone round $1,828 however was unsuccessful. If Ethereum checks this stage once more and efficiently breaks above it, the following upside targets could be the $1,954 resistance, adopted by a possible transfer to $2,104.

A break above $2,000 could be important, marking the primary time ETH trades above this psychological stage since March 27.

Nonetheless, Ethereum value might fall again to check the help at $1,749 if the bullish momentum fades and the development reverses. Shedding this stage might expose ETH to additional declines towards $1,689.

Ought to promoting strain intensify, deeper help ranges at $1,537 and even $1,385 might come into play.

Disclaimer

In step with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.