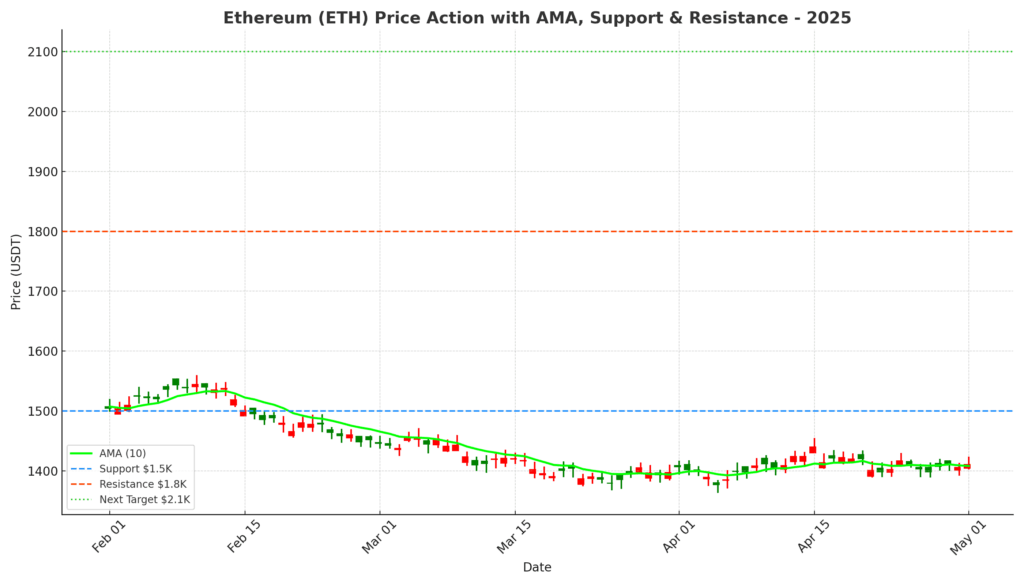

- Ethereum bounced exhausting from $1.5K help, now testing main resistance at $1.8K, with a breakout probably focusing on $2.1K subsequent.

- Latest worth surge was fueled principally by spot market shopping for, with futures market funding charges nonetheless flat—exhibiting cautious sentiment.

- Quick-term consolidation seemingly round $1.8K, but when bulls push by means of, ETH might see a robust rally within the coming days.

Ethereum’s lastly exhibiting indicators of life once more after bouncing exhausting off that crucial $1.5K help. Patrons got here again swinging, and now ETH is pushing proper up towards a key wall at $1.8K. The large query now? Whether or not it’s robust sufficient to smash by means of—or if we’re about to see a bit breather first.

Each day Chart: Essential Check at $1.8K Incoming

After weeks (severely, it felt like perpetually) of simply drifting sideways round $1.5K, Ethereum bought a much-needed surge in shopping for stress. That pop has despatched the value straight towards $1.8K—which isn’t just a few random quantity.

It’s an vital order block zone, the place good cash often units up store. So yeah, breaking above this isn’t gonna be simple.

If bulls can lastly shove ETH previous $1.8K and maintain it? That may in all probability verify a significant bullish reversal, and $2.1K might come into play fairly quick. However realistically, don’t be shocked if ETH chops sideways right here a bit earlier than making its subsequent large transfer.

4-Hour Chart: Breakout Momentum Constructing

On the 4H chart, you may actually see how that consolidation broke—ETH cracked out of its descending channel with a clear, impulsive transfer. Tons of shopping for got here in directly, shoving the value proper as much as $1.8K.

Now, this space’s difficult. It matches up with earlier swing lows, which suggests a whole lot of sellers are watching this stage. Count on some short-term tug-of-war right here. If ETH can construct sufficient stress and break by means of, it’s bought a transparent runway to $2.1K.

Sentiment Examine: Funding Charges Keep Flat

Right here’s the place issues get a bit fascinating. You’d count on that with ETH pumping, funding charges (which present how futures merchants are betting) would spike greater. However… they haven’t.

Funding’s nonetheless kinda flat. Which means this transfer is being pushed principally by spot market consumers—actual, non-leveraged demand—which is often a more healthy setup early in a bull transfer.

Nonetheless, if funding doesn’t begin selecting up quickly, it might trace that momentum would possibly stall out. Ideally, you’d need to see rising funding charges quickly, exhibiting futures merchants leaping on board too.

Ethereum’s made a robust comeback, however the actual battle is occurring now at $1.8K. Break it cleanly—and $2.1K could possibly be subsequent. Stall out? May see a bit cooling-off first.