- Bitcoin’s MVRV ratio nears a essential breakout as leverage throughout futures markets surges quickly.

- A decisive transfer above $95,783 might unlock fast upside, however heavy liquidations nonetheless threaten.

Bitcoin’s [BTC] MVRV ratio just lately hovered at 2.13, sitting slightly below its essential 365-day Easy Transferring Common (SMA365) of two.14 — a traditionally decisive pivot for mid-term bullish reversals.

Nonetheless, regardless of this promising setup, Bitcoin should obtain a confirmed weekly shut above the SMA365 to validate the potential pattern shift.

Due to this fact, market members are carefully monitoring this crossover, understanding it might mark the start of a stronger restoration section.

Moreover, failure to reclaim this stage might expose Bitcoin to renewed promoting stress, undermining the present momentum.

Bitcoin – Is concept spiraling increased?

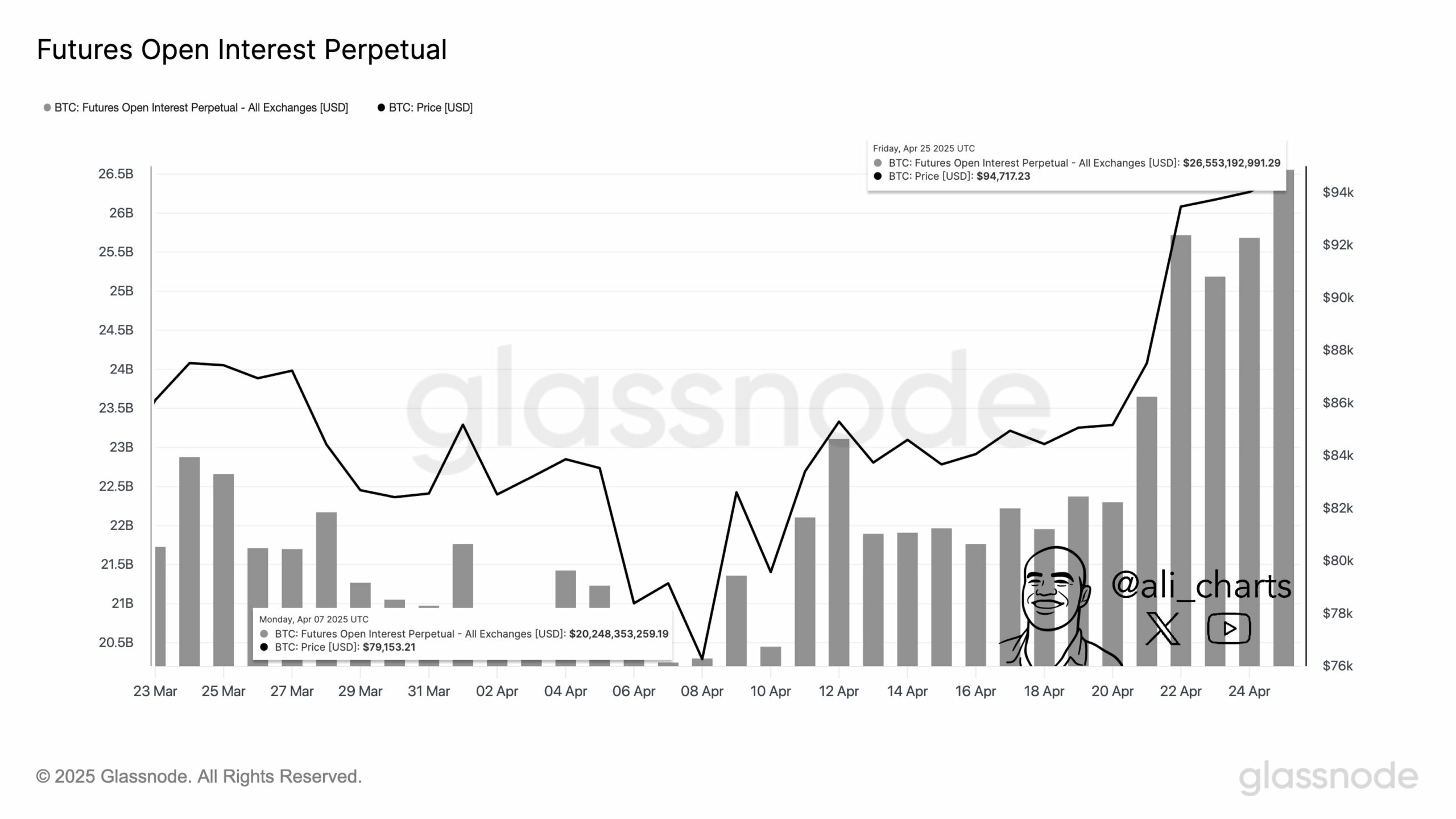

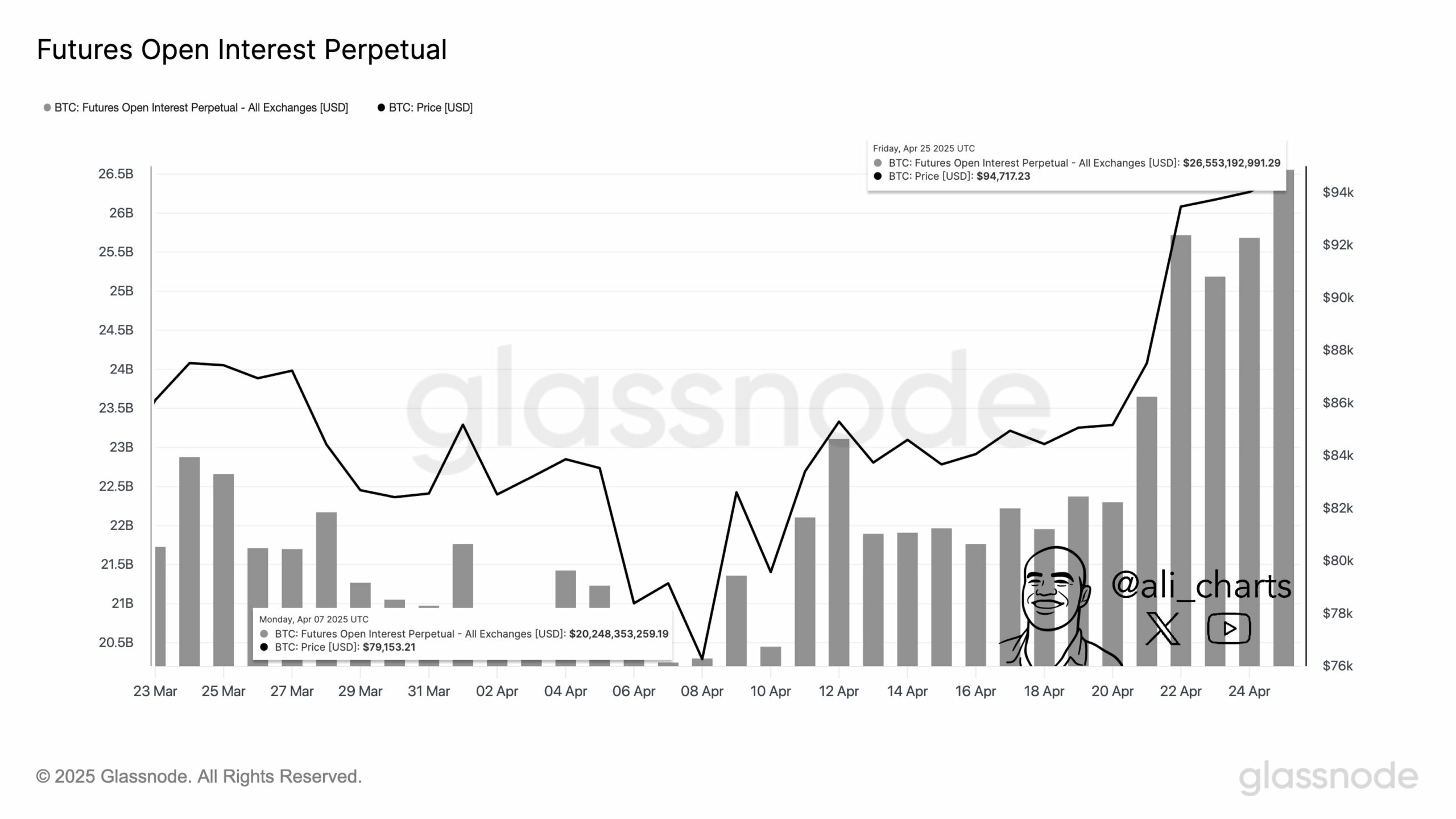

Open Curiosity throughout Bitcoin Futures markets surged by 20% previously 20 days, now exceeding $26 billion, signaling an aggressive buildup in speculative positioning.

Moreover, the Estimated Leverage Ratio has risen by 0.99%, displaying that merchants are more and more counting on margin to amplify their bets.

Nonetheless, whereas rising leverage typically fuels stronger short-term value strikes, it concurrently will increase the chance of risky liquidation cascades if sentiment abruptly shifts.

Supply: X

BTC technical value construction – Is the breakout shedding steam?

Bitcoin just lately broke out of a falling wedge formation, usually a bullish technical sign, suggesting the potential for sustained upside.

Nonetheless, at press time, Bitcoin traded at $94,036, slipping 0.71% over 24 hours.

This minor pullback highlights that sellers are nonetheless defending the $95,783 resistance zone aggressively. Due to this fact, Bitcoin wants a clear day by day shut above this stage to validate the bullish setup and intention for additional features.

Conversely, failure to breach this resistance might see the value slide again towards the $83,462 help stage, the place consumers beforehand confirmed robust curiosity.

Supply: TradingView

Inventory-to-Circulate ratio decline – Is the shortage mannequin beneath stress?

Bitcoin’s Inventory-to-Circulate (S2F) ratio, measuring shortage, declined 22.22%, including short-term stress to the normal bullish mannequin.

Nonetheless, the decline doesn’t fully undermine Bitcoin’s long-term fundamentals.

As an alternative, it emphasizes that quick value actions at the moment are extra delicate to liquidity traits, leverage dynamics, and investor sentiment shifts.

Supply: CryptoQuant

Liquidation map evaluation – The place might BTC transfer subsequent?

The liquidation map exhibits dense, lengthy liquidation clusters for Bitcoin between $93,000 and $94,000, making a essential help zone.

A sustained dip under these ranges might set off a cascade of liquidations, doubtlessly driving the value all the way down to $91,000.

Conversely, if Bitcoin breaks and holds above $95,783, the liquidation density thins considerably, paving the way in which for a fast upward transfer with minimal resistance.

This lowered overhead liquidation stress strengthens the bullish outlook, supplied momentum picks up once more.

Supply: CoinGlass

Conclusively, Bitcoin stood at a essential determination level.

The rising leverage, MVRV ratio positioning, and wedge breakout all recommend a bullish continuation if $95,783 resistance is flipped into help.

Due to this fact, if Bitcoin maintains power and clears this stage, the rally might lengthen aggressively. Nonetheless, failure to take action will possible expose Bitcoin to sharp corrections towards decrease liquidity zones.