- HBAR is buying and selling round $0.193, slightly below essential resistance at $0.20, with optimistic momentum and bullish sentiment proven by two weeks of optimistic funding charges and a heavy dominance of lengthy contracts.

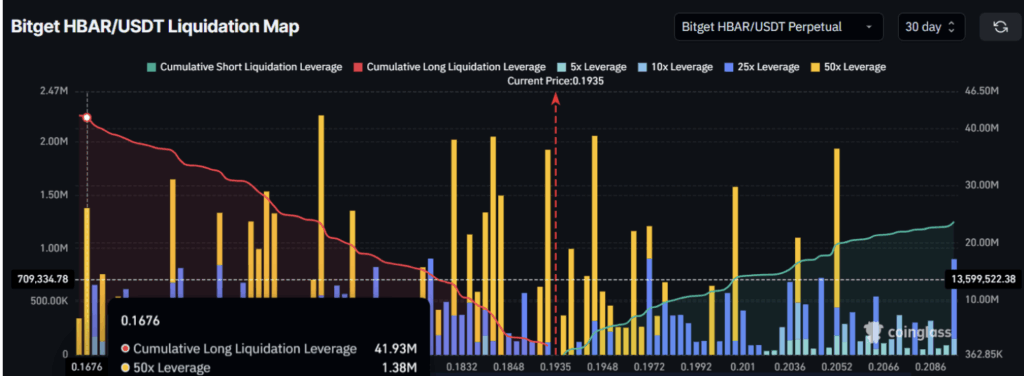

- Round $42 million price of lengthy contracts are in danger if HBAR fails to carry present ranges and falls towards $0.167, making the $0.200 resistance a pivotal make-or-break level.

- If HBAR breaks above $0.20, it may goal $0.222 subsequent, however failure to take action could set off a deeper decline, beginning with a drop to $0.182 and probably intensifying if liquidation cascades kick in.

HBAR’s been making some actual noise these days. After a robust rally, the altcoin has clawed its means again right into a key consolidation zone, sitting slightly below that essential $0.20 stage. Momentum’s wanting fairly sturdy proper now — however whether or not HBAR can truly break by means of is the actual query hanging over merchants’ heads.

A clear break above $0.20 may very well be the beginning of one thing greater, if bullish vibes throughout the market stick round to again it up.

Merchants Are Feeling Good — However Dangers Are Lurking

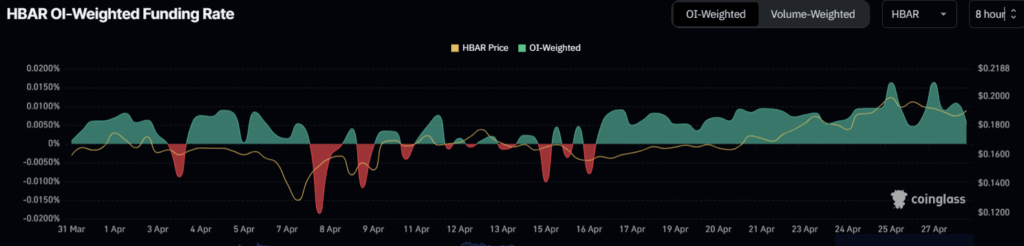

Sentiment round HBAR is buzzing. You possibly can see it within the funding charges — they’ve stayed optimistic for nearly two straight weeks. When funding charges are up like that, it often means merchants are assured and loading up on lengthy positions, anticipating larger costs.

Coinglass information exhibits the dominance of lengthy contracts is fairly overwhelming proper now, including extra gasoline to the concept that merchants are positioning for a breakout.

That mentioned, it’s not all easy crusing.

The liquidation map reveals a giant crimson flag: about $42 million price of lengthy contracts may get worn out if HBAR dips to $0.167.

So yeah, that $0.20 resistance? It’s not only a psychological line — it’s mainly make or break for now.

If patrons lose their nerve right here, it may result in a nasty cascade of liquidations.

HBAR Worth Motion: Staring Down a Pivotal Degree

On the time of writing, HBAR’s buying and selling round $0.193 — only a breath away from that cussed $0.200 resistance.

This isn’t the primary time both — HBAR’s been rejected at this stage a number of occasions over the previous month and a half.

And traditionally? Repeated failures to smash by means of a significant resistance usually finish badly… often with a fairly tough pullback.

If HBAR can’t break $0.200 quickly, it dangers slipping again to $0.182, and if that assist cracks too, we’re most likely a slide towards $0.167 — which, once more, would set off that $42 million liquidation bomb.

Bullish Situation Nonetheless in Play — If $0.20 Falls

However hey, it’s not all gloom. If market situations keep favorable and buyers hold exhibiting up with purchase strain, there’s nonetheless an actual shot at HBAR lastly busting by means of $0.20.

If it does?

The following large goal could be round $0.222, and breaking that resistance may kickstart a contemporary wave of bullish momentum — placing the bears on the again foot for as soon as.

Remaining Ideas: Crunch Time for HBAR

HBAR’s sitting at a significant crossroads proper now. The following few days may determine whether or not it’s heading for a breakout run or slipping into one other tough patch.

One factor’s for positive although — with funding charges excessive, bullish merchants locked in, and liquidation dangers looming, it’s shaping as much as be a fairly wild trip.