Onyxcoin (XCN) has risen greater than 3% within the final 24 hours and almost 12% over the previous week, bringing its market cap again to round $640 million.

After a unstable week, XCN’s technical indicators present necessary shifts that might form its subsequent transfer. The token’s RSI, ADX, and EMA constructions all counsel a mixture of stabilizing momentum and warning indicators. Right here’s a better have a look at the present setup for Onyxcoin heading into the primary week of Might.

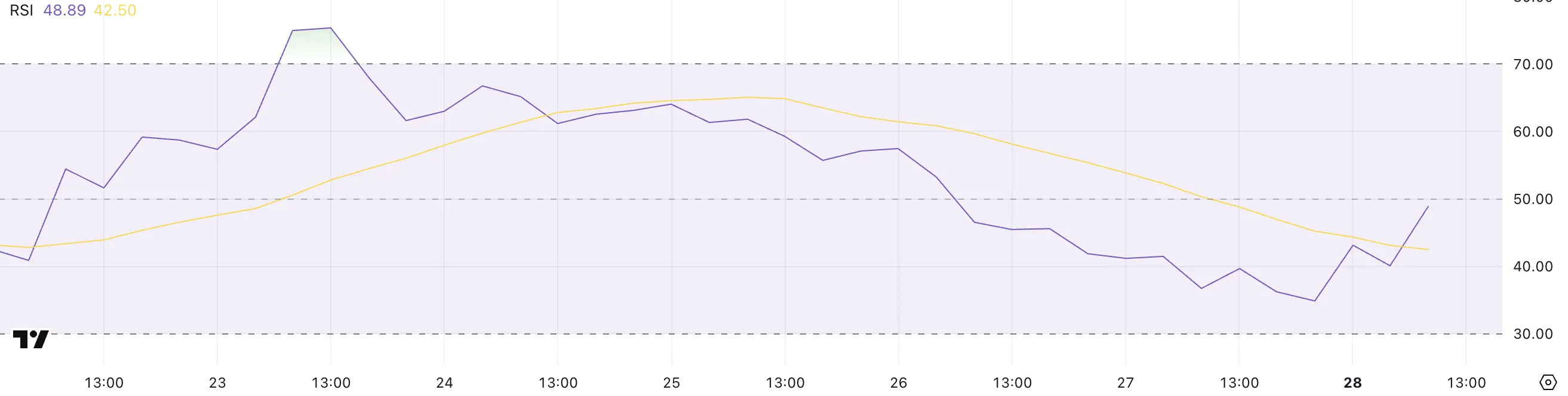

Onyxcoin RSI Bounces Again, Setting Impartial Stage for Subsequent Transfer

Onyxcoin’s Relative Energy Index (RSI) is presently at 48.89, after reaching as excessive as 75 simply 5 days in the past. The RSI had fallen sharply to 34.88 yesterday however has since recovered, suggesting that promoting stress could also be easing.

This latest bounce reveals momentum is making an attempt to stabilize, though the token stays nicely beneath the latest overbought zone it touched earlier within the week.

The shift additionally indicators that Onyxcoin is not near oversold territory, however has but to indicate a transparent route for its subsequent main transfer.

The RSI is a extensively used technical indicator that measures the pace and magnitude of an asset’s latest value actions to evaluate whether or not it’s overbought or oversold.

Usually, an RSI above 70 signifies overbought situations and potential for a pullback, whereas an RSI beneath 30 indicators oversold situations and potential for a rebound.

With XCN’s RSI now sitting at 48.89, the token is in a impartial zone, offering room for additional upside if constructive momentum continues. If shopping for stress will increase from right here, XCN might construct a stronger restoration with out instantly dealing with technical resistance from overbought situations.

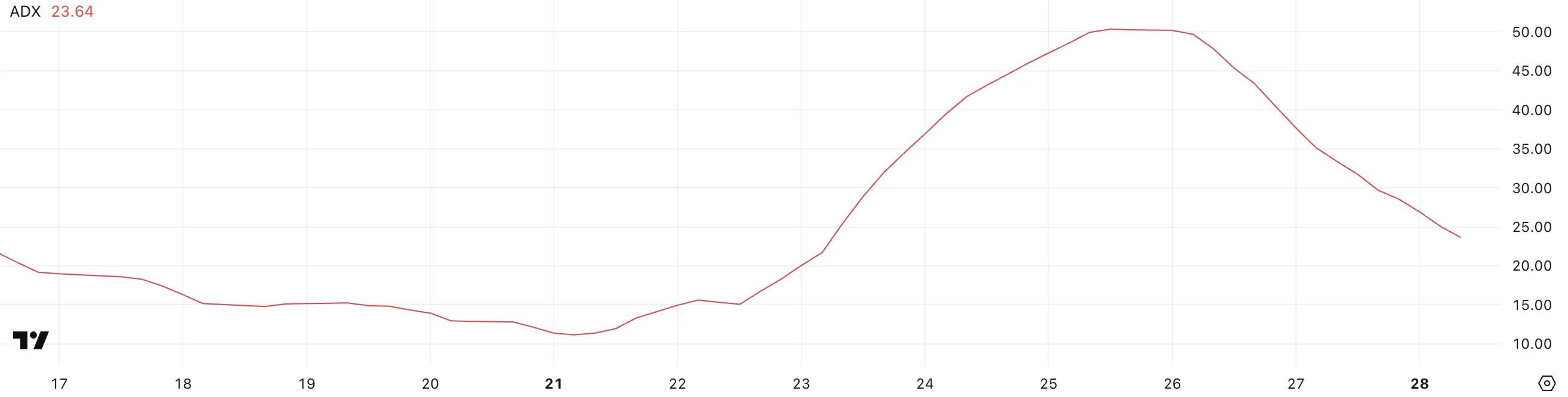

XCN Uptrend Stays, However Development Energy Weakens

Onyxcoin Common Directional Index (ADX) is presently at 23.64, a big drop from the 50 degree it reached simply two days in the past.

This sharp lower means that the power of the latest pattern has weakened, though Onyxcoin stays technically in an uptrend.

The decline in ADX displays a cooling in momentum after a robust directional transfer earlier within the week. Whereas the uptrend remains to be intact, the decrease ADX studying indicators that the pattern’s power is not as dominant because it was a couple of days in the past.

The ADX is a technical indicator that measures a pattern’s power, however not the route. Values above 25 usually counsel a robust pattern, whereas values beneath 20 level to a weak or directionless market.

With XCN’s ADX now sitting at 23.64, the pattern remains to be reasonably sturdy however near shedding power if the studying continues to fall.

Which means whereas Onyxcoin’s uptrend stays, it could require renewed shopping for stress quickly to keep away from slipping right into a interval of consolidation or sideways motion.

Onyxcoin Holds Assist, However EMA Hole Indicators Warning

XCN gained round 112% in April, making it one of many best-performing altcoins for the month. Its Exponential Shifting Common (EMA) traces stay bullish, with the short-term EMAs nonetheless positioned above the long-term ones.

Nevertheless, the hole between the short-term and long-term EMAs has narrowed in comparison with earlier days, indicating that the bullish momentum is shedding some power.

Whereas the final pattern stays constructive, the shrinking distance between the EMAs means that the market is approaching a important level the place a clearer route might quickly emerge.

In the previous few days, Onyxcoin efficiently examined and held the help zone round $0.018, however this degree stays fragile.

If XCN assessments this help once more and fails to carry it, the value might drop towards the subsequent help close to $0.016. On the upside, if shopping for momentum returns, XCN might rally to check the $0.024 resistance.

A breakout above $0.024 might open the door for a continuation towards $0.027, providing a robust bullish setup if momentum strengthens.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.