- BNB Chain has proven sturdy resilience in the course of the 2023–2026 cycle, reaching a brand new all-time excessive and sustaining a comparatively small drawdown in comparison with different main altcoins, backed by sturdy fundamentals and low dilution threat.

- BNB Chain leads in blockchain exercise metrics, together with over 4 million day by day transactions and the best variety of supported DApps, whereas rating third in DeFi complete worth locked (TVL) behind Ethereum and Solana.

- Regardless of decrease blockchain income in comparison with rivals like Ethereum and Tron, BNB Chain’s huge DApp ecosystem and regular consumer progress place it as a critical contender for long-term Web3 dominance.

Altcoin efficiency has been fairly disappointing all through the 2023–2026 cycle, pushing many merchants to place most of their consideration again on Bitcoin. However regardless of the general sluggishness, a more in-depth look exhibits that not all altcoins are struggling. The truth is, the full altcoin market cap stays comfortably above $1 trillion — $1.17 trillion, to be actual — and a 9% surge over the previous week is beginning to restore some optimism.

Among the many greater names, BNB Chain has stood out for its relative power and stability. At present ranked because the fifth-largest cryptocurrency by market cap, simply behind BTC, ETH, USDT, and XRP, BNB sits round an $89 billion valuation. Some analysts are even calling it one of the crucial resilient altcoins of this cycle.

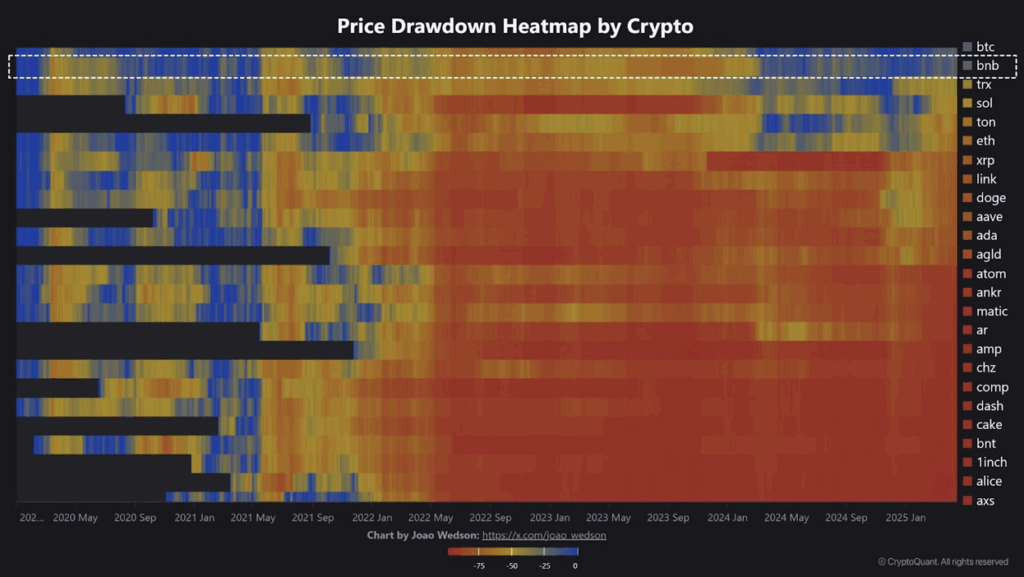

João Wedson, founding father of Alphractal, not too long ago identified utilizing a cryptocurrency drawdown heatmap that whereas most altcoins have suffered catastrophic drops of as much as -98.5% from their all-time highs, BNB has managed to keep away from that destiny. Much more impressively, it’s one of many only a few altcoins that has really hit a brand new all-time excessive throughout this cycle. For Wedson, this resilience goes means past simply worth motion — he highlights BNB Chain’s strong foundations, rising DeFi footprint, and real-world utility. In his phrases, BNB is “one of many uncommon altcoins with actual utility, sturdy fundamentals, and rising adoption, making it the strongest-performing altcoin alongside BTC.”

Is BNB Actually the Most Resilient Altcoin?

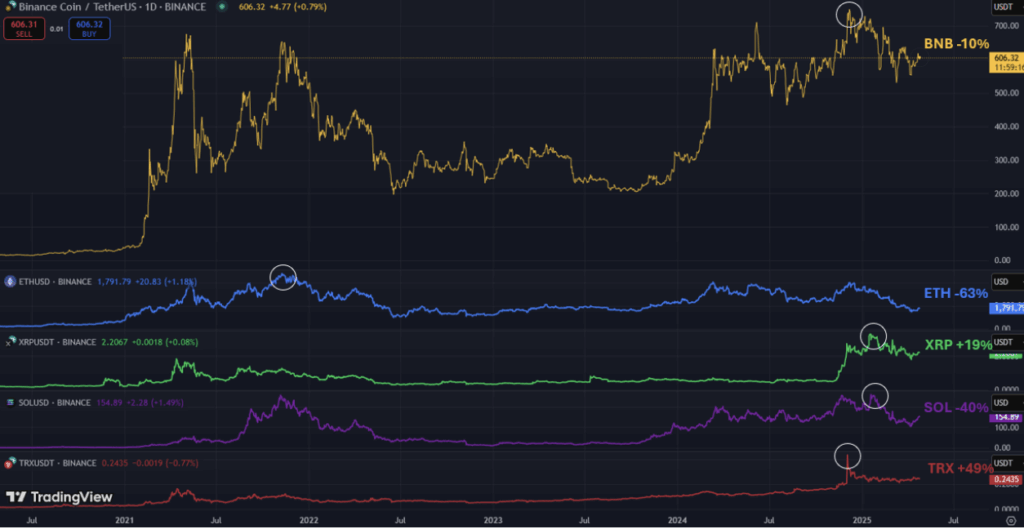

While you dig into the numbers, the story will get a bit extra nuanced. Certain, BNB has hit a brand new all-time excessive this cycle — however so have XRP, TRX, and Solana. (Although to be truthful, Solana’s new peak barely edged previous its 2021 excessive.) Evaluating present costs to earlier cycle highs, BNB is down about 10%, which is miles higher than Ethereum, down 63%, and Solana, down 40%. Nonetheless, XRP and TRX have outperformed BNB percentage-wise, with beneficial properties of 19% and 49%, respectively.

One large benefit BNB enjoys is its low dilution threat. Based on Messari’s FDV ratio, 96.51% of BNB’s complete provide is already in circulation, just like Ethereum and TRX, whereas Solana (86.33%) and particularly XRP (58.33%) have much more future provide set to hit the market. Much less dilution often interprets to extra worth stability, giving BNB an edge over a few of its rivals.

Nonetheless, as sturdy as BNB’s worth motion has been, its true endurance comes from fundamentals — not simply market hype.

BNB Chain’s Ecosystem Is Booming

BNB’s worth is tied carefully to its blockchain, BNB Chain — a combo time period that now contains each BNB Sensible Chain and the Beacon Chain. It’s a critical participant throughout gaming, DeFi, launchpads, and even the memecoin sector. Plus, being the centerpiece of the world’s largest centralized crypto trade doesn’t damage.

BNB Chain processes about 4 million day by day transactions — means forward of Ethereum (round 1 million) and XRP Ledger (1.8 million), however behind Tron’s 5.5 million and means behind Solana’s huge 54 million non-vote transactions day by day.

By way of day by day lively customers, BNB Chain additionally performs fairly properly, boasting round 1.1 million day by day lively addresses. It beats Ethereum (about 384,800) and XRP Ledger (roughly 55,600) however once more trails Tron (2.4 million) and Solana (3.7 million).

The place BNB Chain actually flexes its muscle mass is within the DApp ecosystem. Based on DappRadar, BNB Chain helps 5,686 DApps, edging out Ethereum’s 4,987 and dwarfing Polygon’s 2,402. This helps Wedson’s view that BNB Chain has constructed a “huge” and deeply rooted ecosystem — one that might assist it dominate as soon as Web3 adoption really takes off.

BNB Chain additionally ranks third in complete worth locked (TVL) in DeFi, with round $5.8 billion, behind Ethereum’s $50.5 billion and Solana’s $8 billion, based on DefiLlama. It even managed to briefly outperform all different blockchains in DEX buying and selling quantity again in March 2025, hitting a weekly complete of $14.3 billion.

BNB Chain’s Income Lags Behind — For Now

One space the place BNB Chain nonetheless lags is income era — the full transaction charges collected by the community. In 2024, Ethereum was the clear chief with $2.5 billion in charges, adopted by Tron ($2.1 billion), Bitcoin ($923 million), and Solana ($751 million). BNB Chain was a distant fifth, with simply $194 million.

The pattern has continued into 2025. Over the previous 30 days, Tron leads with $272 million, Solana with $34.7 million, Ethereum with $20.8 million, and BNB Chain trailing at $17.1 million. In comparison with its dimension and consumer exercise, BNB’s price era is comparatively modest — one thing it might want to handle as competitors in Web3 heats up.

Ultimate Ideas: Is BNB Chain Constructed for the Lengthy Run?

BNB Chain may not prime each single metric, but it surely persistently ranks among the many prime good contract platforms throughout consumer exercise, DApp growth, and DeFi TVL. Its resilience throughout one of many hardest altcoin cycles in current reminiscence speaks volumes. Whereas low blockchain income stays a weak spot for now, the rising power of BNB Chain’s ecosystem positions it to thrive if Web3 adoption actually explodes.

In a market filled with flashy tasks and short-term hype, BNB’s slow-and-steady strategy — backed by real-world use instances — may simply be its largest superpower.