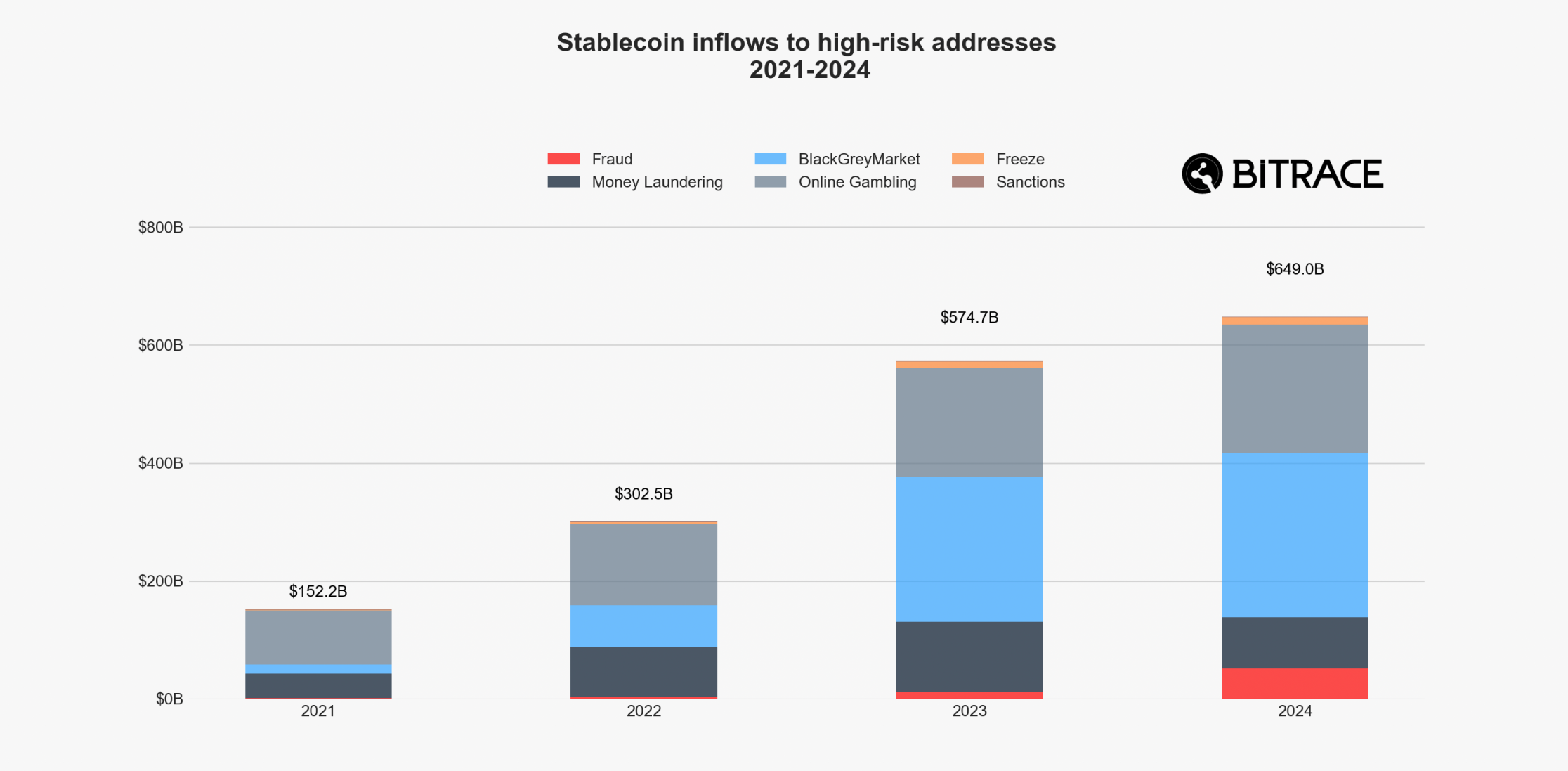

Bitrace’s 2024 Crypto Crime Report exhibits that criminals moved $649 billion in stablecoins to high-risk addresses. Stablecoins’ complete use in fraud and cash laundering grew, however the legit sector grew even sooner.

The report additionally tracked a couple of different parts, like playing and darknet markets. It highlighted the rising enforcement actions towards stablecoin cash laundering, as Tether and Circle froze over $1 billion in belongings final 12 months.

Stablecoins and Crypto Crime – A Regarding Development?

Stablecoins are a significant part of the worldwide crypto ecosystem, however they fulfill the same position in crime. For instance, crypto sleuth ZachXBT alleged final month that North Korean hackers have “epidemic” participation on this house.

Bitrace’s 2024 Crime Report particulars illicit actions all throughout the business, but it surely focuses particularly on stablecoins.

Its information claimed that $649 billion in stablecoins went to high-risk addresses final 12 months, a particular enhance from 2023. Nonetheless, these transactions solely amounted to five.14% of worldwide stablecoin quantity, a lower from 5.94% the earlier 12 months.

In different phrases, the stablecoin sector is rising sooner than its utilization in crypto crime.

Naturally, Tether makes up the overwhelming majority of those transactions because it’s the preferred stablecoin. Tron and Ethereum have been the preferred blockchains for USDT stablecoins, making up round 90% of the crime-related quantity.

Ethereum’s presence grew relative to Tron, however the latter blockchain nonetheless represents greater than 75% of transactions.

Bitrace’s Crypto Crime Report principally centered on the stablecoin business but additionally lined a number of different sectors.

For instance, illicit commerce on the darknet grew by greater than $30 billion as distributors switched to DeFi to keep away from regulation enforcement. Crypto playing can be on the rise, rising 17.5% to $217.84 billion.

Nonetheless, the business can be taking a number of initiatives of its personal. Scams and frauds have ballooned final 12 months, leaping from $12 billion in 2023 to $52 billion in 2024.

Escrow providers like Huione play a significant middleman position, and Tether has been working to freeze its wallets. They’ve solely neutralized a tiny fraction of Huione’s commerce, but it surely’s a very good begin.

Tether and Circle have been energetic in freezing crypto wallets utilized by criminals since stablecoins are a lynchpin of this ecosystem.

The amount of complete frozen belongings grew by practically $1 billion in 2024, double the quantity of the previous three years mixed. That is far under the mandatory quantity, however hopefully these operations can scale up.

To summarize, stablecoins are a thriving part of crypto’s prison underworld, however enforcement is turning into extra decided and complex.

If the business continues to concentrate on combating fraud and cash laundering, it might make an actual distinction. Stablecoin’s legit makes use of dwarf this sector, and criminals’ complete market share is lowering.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.