Stablecoins—cryptocurrencies pegged to secure property just like the USD—are drawing growing consideration from prime cost firms. Current stories declare stablecoin transaction volumes over the previous 12 months have surpassed Visa.

Nevertheless, trade specialists are skeptical of those numbers. This text explores the explanations behind that skepticism.

Why Specialists Suspect Stablecoin Quantity Would possibly Be Inflated

Not too long ago, Chamath Palihapitiya, CEO of Social Capital, posted on X that the weekly transaction quantity of stablecoins has exceeded that of Visa, reaching over $400 billion. He added that firms like Visa, Mastercard, and Stripe are actively embracing the development.

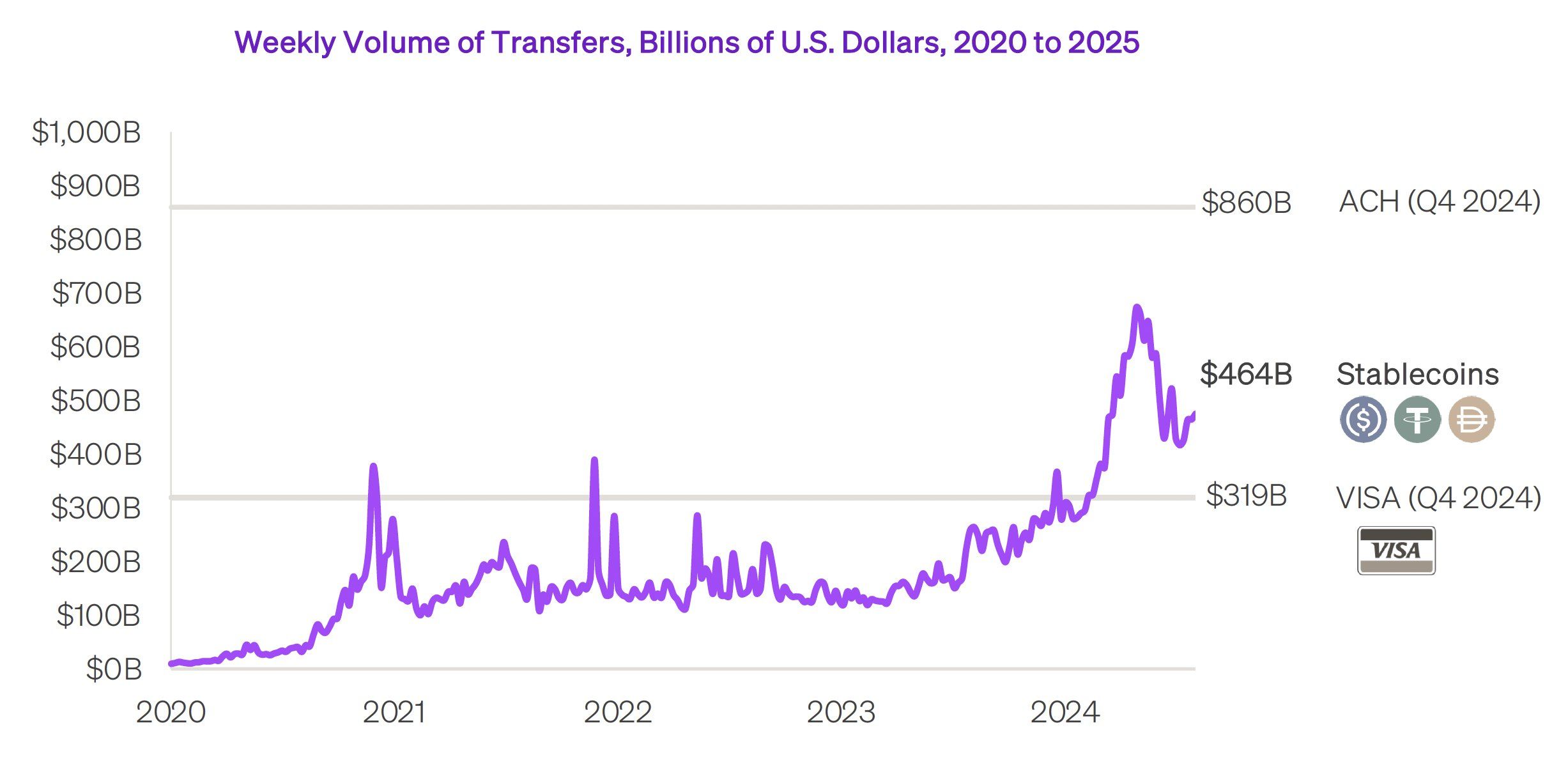

In line with the information, in This autumn of 2024, the typical weekly stablecoin transaction quantity reached $464 billion. That’s considerably larger than Visa’s $319 billion. A Bitwise report estimates that stablecoins processed about $13.5 trillion in complete transaction quantity in 2024. This marks the primary time stablecoin quantity surpassed Visa’s annual complete.

At first look, this looks as if a significant milestone, suggesting that stablecoins might reshape the way forward for world funds. Citigroup even tasks that the stablecoin market might attain $3.7 trillion by 2030.

Not everybody shares the passion. Some specialists have warned that the reported stablecoin quantity may be inflated. They argue it doesn’t mirror actual financial exercise and shouldn’t be straight in contrast with conventional techniques like Visa.

Joe, an advisor at Maven 11 Capital, identified that skilled merchants can generate lots of of tens of millions in quantity utilizing little or no preliminary capital.

“If in case you have $100,000 of USDC on Solana, you are able to do ~$136 million of ‘stablecoin quantity’ for $1 in charges,” Joe stated.

He used Solana for instance. Solana is a quick blockchain with extraordinarily low transaction charges—about $0.0036 per transaction. Joe even joked that with $3,400, somebody might double weekly stablecoin transaction volumes. He implied that the metric is straightforward to control and never really dependable.

Dan Smith, an information skilled at Blockworks Analysis, strongly supported Joe’s view. Dan defined that utilizing flash loans—uncollateralized loans in DeFi—can inflate quantity even additional at decrease prices.

Flash loans permit customers to borrow massive sums with out collateral, so long as they repay inside the similar transaction. This permits quantity manipulation with out requiring important capital, additional casting doubt on the numbers cited by Palihapitiya.

Rajiv, a member of Framework Ventures, was much more direct. He known as stablecoin quantity a “ineffective metric.” Dan Smith agreed. He added that the unusually excessive quantity typically indicators exploitative conduct inside the system.

Wash Buying and selling and Bot Buying and selling Undermine Financial Worth

One key purpose specialists doubt stablecoin quantity is the presence of wash buying and selling and bot buying and selling.

Wash buying and selling entails repeatedly shopping for and promoting between wallets managed by the identical individual or entity. The objective is to artificially inflate transaction quantity. Bot buying and selling makes use of automated applications to conduct trades, typically for arbitrage or pretend liquidity.

A $1 million stablecoin transaction may simply be cash transferred between two wallets owned by the identical individual. It provides no actual financial worth. This contrasts sharply with Visa, the place every transaction sometimes represents an actual buy or cost, like shopping for items or providers.

Final 12 months, Visa’s dashboard additionally reported that solely 10% of stablecoin transactions had been real. A wash buying and selling report by Chainalysis discovered that wash trades involving ERC-20 and BEP-20 tokens might complete as much as $2.57 billion in quantity in 2024.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.