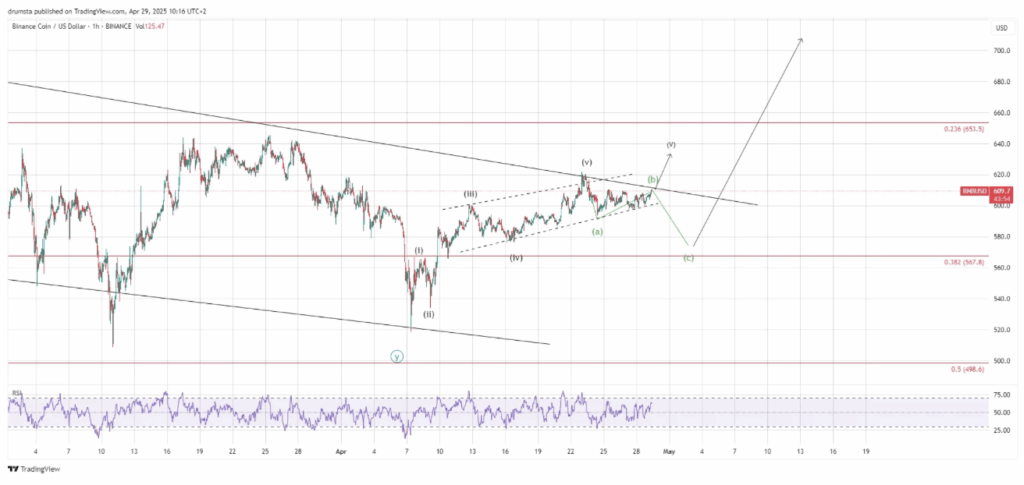

- BNB Nears Breakout Zone: Binance Coin (BNB) is buying and selling close to $610, urgent in opposition to the highest of a long-term descending wedge. A breakout might set off a rally towards $700–$792, however it wants robust quantity and a confirmed day by day shut above resistance.

- Quick-Time period Pullback Probably: The intraday chart reveals indicators of a possible dip into the $580–$600 zone to reset RSI earlier than a bigger bullish transfer. This could supply a stronger setup for a sustained rally.

- Key Ranges to Watch: Assist sits at $567.8 and $580; resistance stands at $653.5 and $700. A confirmed breakout above $653.5 could ignite bullish momentum, whereas a fall under $567.8 weakens the bullish case.

Binance’s native token, BNB, is flirting with a breakout. Value motion’s been tightening up inside a descending wedge formation that’s been round for fairly some time now. And truthfully, it seems like issues are about to get fascinating.

Merchants are watching intently as this wedge sample nears its apex. It’s a type of “any second now” form of setups—both we get a clear breakout and bulls go wild, or we see a fakeout adopted by a basic dip. Both means, the subsequent few periods? Gonna be essential.

Zooming Out: The Each day Chart Story

Let’s begin with the larger image. BNB hit its all-time excessive at $792, and since then, it’s been caught in a corrective part—a WXY complicated correction, to be particular (for the chart nerds on the market).

Now, the worth is sitting slightly below the wedge’s higher boundary, proper round $610. That’s additionally the place we’ve obtained a key Fibonacci stage—the 0.236 retracement at $653.5, with one other main one at $567.8 (0.382 Fib). Coincidence? Probably not.

RSI on the day by day can be perking up, displaying energy however not screaming “overbought” but. So yeah, the engine’s warming up.

A robust day by day shut above $610 and ideally pushing previous $653.5 might be the spark that sends BNB flying towards $700and possibly even retesting $792. However—and it’s an enormous “however”—with out affirmation and quantity? It might all fizzle quick.

The Quick-Time period Setup: A Little Shakeout First?

Hop right down to the 1-hour chart and also you’ll discover BNB already made a pleasant five-wave transfer inside a smaller ascending channel. However right here’s the factor: short-term RSI is getting a little bit overheated. A little bit of a cool-off could be within the playing cards.

We’d see a little bit (a)-(b)-(c) corrective transfer subsequent, dipping down into the $580–$600 zone earlier than the subsequent leg up. That pullback wouldn’t be a foul factor—really, it might be simply what bulls must recharge.

If BNB catches a bounce off that zone, a brand new impulse wave might launch it straight to $653.5, with potential extension to $700 and past. Nevertheless, a direct blast by means of resistance remains to be technically attainable—it’s simply not the upper chance path proper now, given present RSI ranges.

Key Ranges Value Watching

- Assist zones: $580 (native low), $567.8 (0.382 Fib), and $498.6 (0.5 Fib).

- Resistance ranges: $653.5 (0.236 Fib), $700 (psychological), and $792 (all-time excessive).

- Breakout affirmation: Each day shut above $653.5 on large quantity.

- Bullish invalidation: A clear drop under $567.8? That’d poke some severe holes within the breakout concept.

- Fractal Watch Zone: Keep watch over that $580–$600 space—it’s probably the place the subsequent large bounce begins.

Ultimate Take

BNB’s been coiling for some time, and now we’re staring down a choice level. With RSI displaying life, Fib ranges lining up, and value hovering close to the wedge’s high—momentum is certainly brewing.

However earlier than we pop champagne, keep in mind: affirmation is essential. Look ahead to quantity, candlestick closes, and RSI resets. If issues fall into place, BNB might be gearing up for a severe transfer.

Hold it in your radar.