KCS, the native token of cryptocurrency change KuCoin, is holding sturdy amidst a market-wide downturn. The altcoin has defied the broader market downturn with a 1% value enhance previously 24 hours.

This modest uptick might sign the start of a bigger bullish pattern, as technical indicators present strengthening upward momentum. This evaluation holds the small print.

Shopping for Stress Intensifies for KCS

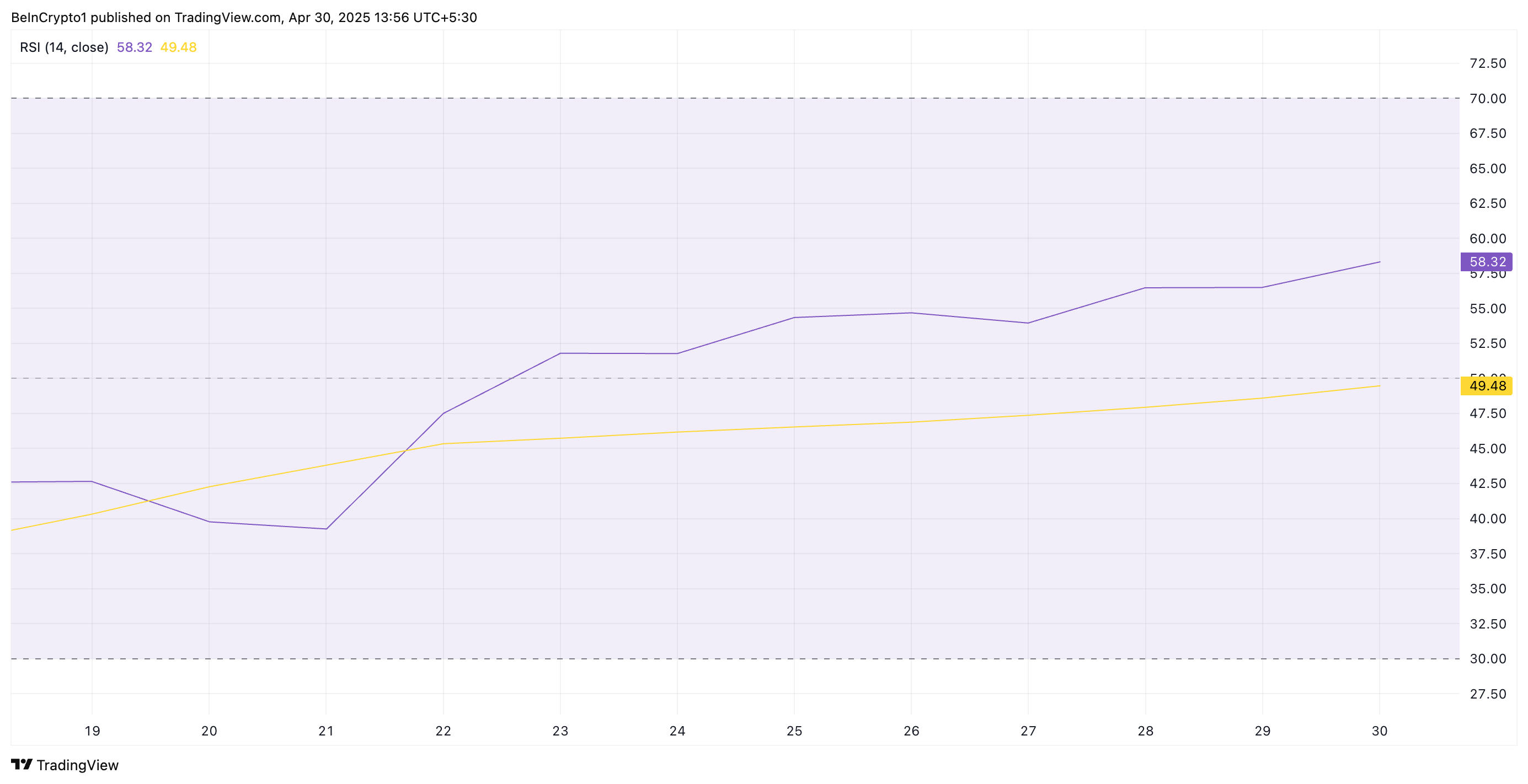

Readings from KCS’ each day chart recommend that bullish strain is constructing. Notably, its Relative Energy Index (RSI) is presently at 58.32 and is on an upward pattern, confirming the strengthening demand for the altcoin.

The RSI indicator measures an asset’s overbought and oversold market situations. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a value decline. Converesly, values beneath 30 point out that the asset is oversold and will witness a rebound.

At 58.32 and climbing, KCS RSI indicators that bullish momentum is gaining traction and shopping for strain is intensifying.

Furthermore, the token’s Shifting Common Convergence Divergence (MACD) confirms this optimistic pattern. As of this writing, KCS’ MACD line (blue) rests above its sign line (orange).

An asset’s MACD indicator identifies traits and momentum in its value motion. It helps merchants spot potential purchase or promote indicators via crossovers between the MACD and sign strains.

As in KCS’ case, when the MACD line is above the sign line, it signifies bullish momentum out there. Additionally, merchants typically view this setup as a purchase sign; therefore, they is perhaps prompted to purchase extra KCS tokens, additional driving up its short-term worth.

KCS Exams Essential Degree as Bulls Purpose for 58-Day Excessive

KCS presently trades at $10.71, resting slightly below the resistance shaped at $10.90. If the demand for the altcoin grows and it efficiently flips this value barrier right into a assist ground, it might propel KCS to $11.77, a excessive final reached on March 3.

Nevertheless, if KCS holders resume profit-taking, it might lose its latest good points and fall to $10.027.

If the bulls fail to defend this assist degree, KCS might prolong its decline, break beneath $10 to commerce at $8.94.

Disclaimer

In keeping with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.