In accordance with the most recent information, synthetic intelligence (AI) agent tokens have outperformed different crypto sectors over the previous 30 days, experiencing a outstanding double-digit worth progress.

This surge comes amid a broader market restoration, with AI brokers rising because the dominant narrative.

AI Brokers Lead Crypto Market Restoration

After enduring vital losses in Q1 2025, the AI agent sector has seen a notable turnaround. In early March, BeInCrypto reported that its market capitalization fell as little as $4.4 billion, marking a pointy 77.5% decline from its all-time excessive.

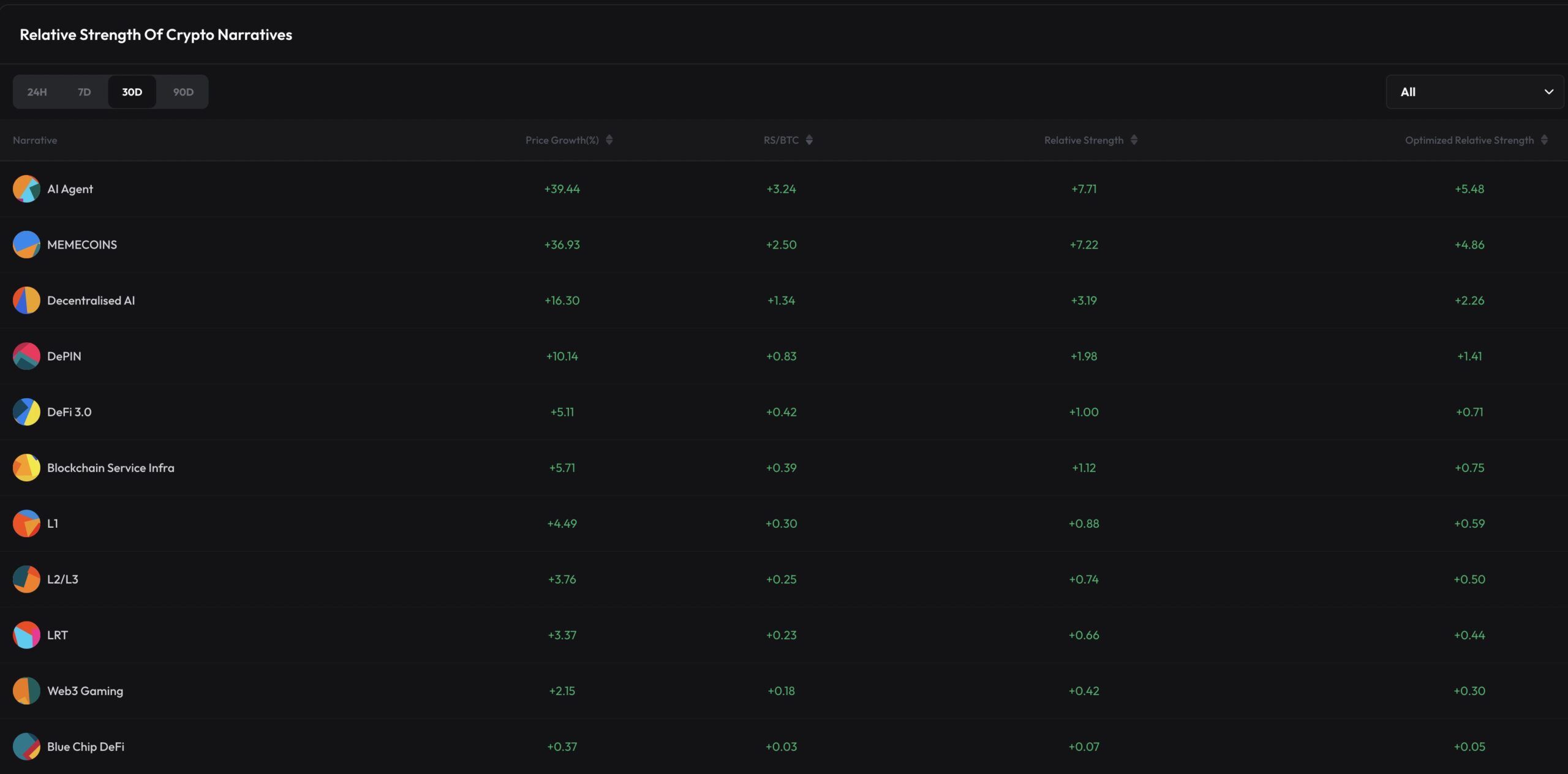

But, the momentum has reversed. Over the previous month, AI brokers have seen a 39.4% worth progress. The sector has outpaced different narratives like meme cash (+36.9%) and decentralized AI (+16.3%) over the previous 30 days.

With the best relative energy rating of +7.7, the tokens have demonstrated distinctive momentum, highlighting their growing attraction amongst buyers.

CoinGecko information exhibits that this surge has propelled the entire market capitalization of AI agent tokens to $6.4 billion. Among the many high ten tokens, Virtuals Protocol (VIRTUAL) has seen a unprecedented 142.8% improve in worth, hitting a two-month excessive. The token’s progress is underpinned by a notable uptick in energetic customers, signaling sturdy neighborhood engagement and adoption.

Furthermore, ai16z (AI16Z) and aixbt by Virtuals (AIXBT) have jumped 72.1% and 66.1%, respectively.

“AI brokers are the new rotation proper now — and Santiment backs it up with a transparent surge in social dominance for “AI brokers,” mirroring the sharp sector-wide worth rebound,” a consumer famous on X.

The broader curiosity within the sector extends past the crypto market, as evidenced by Google Tendencies information. Final week, the search quantity for the key phrase “AI Brokers” peaked at 100. On the time of writing, it stood at 94. This mirrored rising public curiosity, each inside and out of doors the blockchain area.

Is FOMO Fueling the Newest Surge in AI Brokers?

Nonetheless, regardless of the bullish sentiment, some consultants stay skeptical. Simon Dedic, CEO of Moonrock Capital, drew consideration to AI and meme cash’ latest outperformance.

In accordance with him, this pattern displays what he describes because the “final mid-curve commerce.” In different phrases, many buyers who had beforehand remained on the sidelines are actually speeding to put money into these sectors. Nonetheless, they’re pushed by the worry of lacking out (FOMO) on potential positive aspects as market circumstances enhance.

Thus, Dedic is very crucial of this conduct. He advised that these buyers focus extra on chasing traits than making sound, long-term funding choices.

“They need to lose all of it – and most of them most likely will. The true alpha can be within the elementary catch-up commerce and it’ll outperform every part else,” Dedic claimed.

Because the market continues to evolve, solely time will reveal whether or not these tokens can keep their momentum or if the speculative hype will finally fade.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.