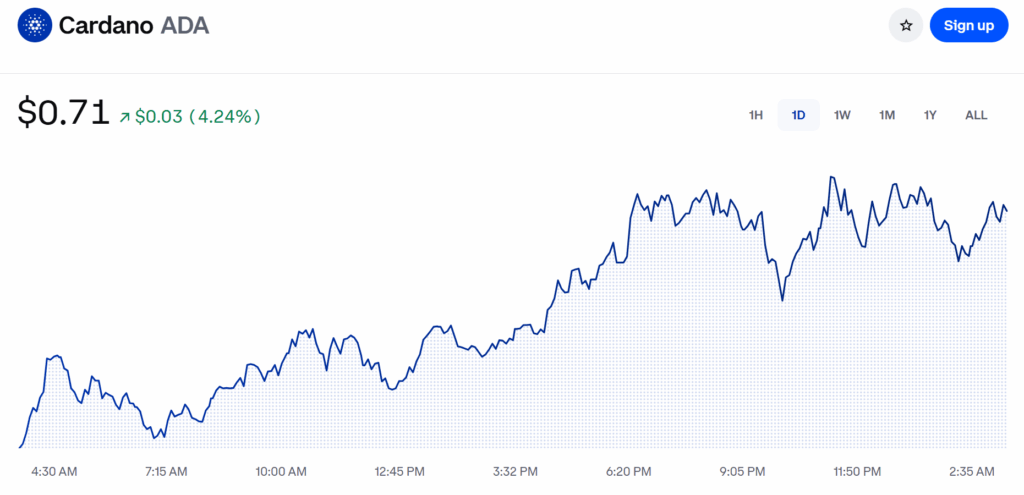

- Cardano could also be getting into Wave 5 of its cycle, with analysts eyeing a possible surge to $14.

- ADA’s technicals look stable, with RSI close to impartial and value holding above key long-term assist.

- Robust fundamentals and rising community exercise may gasoline a significant rally if market circumstances keep favorable.

There’s a little bit of buzz constructing round Cardano (ADA) once more—this time because of a contemporary Elliott Wave evaluation from TapTools. Based on their charts, ADA could be on the sting of kicking off Wave 5… and if that occurs, they’re throwing out a goal as excessive as $14. Yep, $14. It’s daring, however the wave construction? It strains up a bit too nicely with previous cycles to disregard.

The setup appears eerily acquainted

TapTools factors out that ADA has already knocked out Waves 1 by means of 4. Meaning, technically talking, the following large push—Wave 5—could possibly be essentially the most aggressive of the cycle. And in case you’re having déjà vu, that’s as a result of one thing very related performed out between 2020 and 2021 when Cardano exploded from below 10 cents to greater than $3.

In addition they famous some symmetry within the construction and timing. Not an ideal mirror of the previous… however shut sufficient that numerous merchants are beginning to watch this another intently.

Technicals are lining up, too

ADA’s RSI is sitting round 49.5 proper now—not overbought, not oversold—so there’s room for a transfer with out it wanting overheated. And it’s at present floating above the 200-week EMA, which sits close to $0.55. Traditionally, that stage’s been a fairly sturdy assist zone throughout previous uptrends.

So, from a technical angle? Nothing’s damaged—if something, it’s wanting prefer it’s holding agency.

Fundamentals aren’t lagging both

Cardano isn’t simply shifting on chart vibes. The undertaking’s pushing by means of its Basho and Voltaire phases, which give attention to scalability and governance—fairly large upgrades. Plus, its DeFi ecosystem is increasing, and there’s extra curiosity in real-world asset tokenization on the community.

Builders are displaying up. Use instances are rising. There’s an precise basis below this forecast—not simply hopium.

$14 received’t occur in a single day… however the window is open

Elliott Wave principle suggests this run—if it occurs—may take 6 to 12 months to totally play out. And usually, with most of these strikes, many of the motion occurs in the previous couple of months. You get some gradual build-up, then all of the sudden everybody notices directly and issues simply go vertical.

Quantity developments proper now are displaying elevated shopping for throughout rallies and lighter promoting throughout dips. That form of setup usually comes earlier than a breakout.

A couple of issues may nonetheless go sideways

Nothing’s assured. Despite the fact that the setup appears stable, stuff like sudden market shifts, regulation surprises, or sturdy competitors from different sensible contract platforms may mess with the timeline—or derail the rally altogether.

Additionally, let’s not overlook ADA’s bought to push by means of outdated resistance ranges if it desires to set new highs. That’s by no means straightforward.

So… is that this the beginning of one thing large?

If Elliott Wave principle holds up—and the market doesn’t throw a curveball—Cardano could be lining up for certainly one of its greatest rallies but. The $14 goal is formidable, positive, however it’s not completely out of attain.

ADA’s technical construction and community progress recommend that, if the celebs align, 2025 could possibly be the 12 months it makes its mark once more.