Tether simply launched its Q1 2025 Attestation Report, describing a large improve in US Treasury bond holdings. The agency bought over $65 billion in these belongings between January 1 and the top of the quarter.

Tether’s report additionally repeatedly talked about a possible position in world US greenback flows, calling USDT “the main digital illustration” of this foreign money. The agency’s treasury holdings now signify greater than 80% of its complete belongings.

Why is Tether Shopping for US Treasury Bonds?

When Tether, the world’s largest stablecoin issuer, publicized its This fall 2024 Attestation Report, it reported $33 billion in held US Treasury bonds.

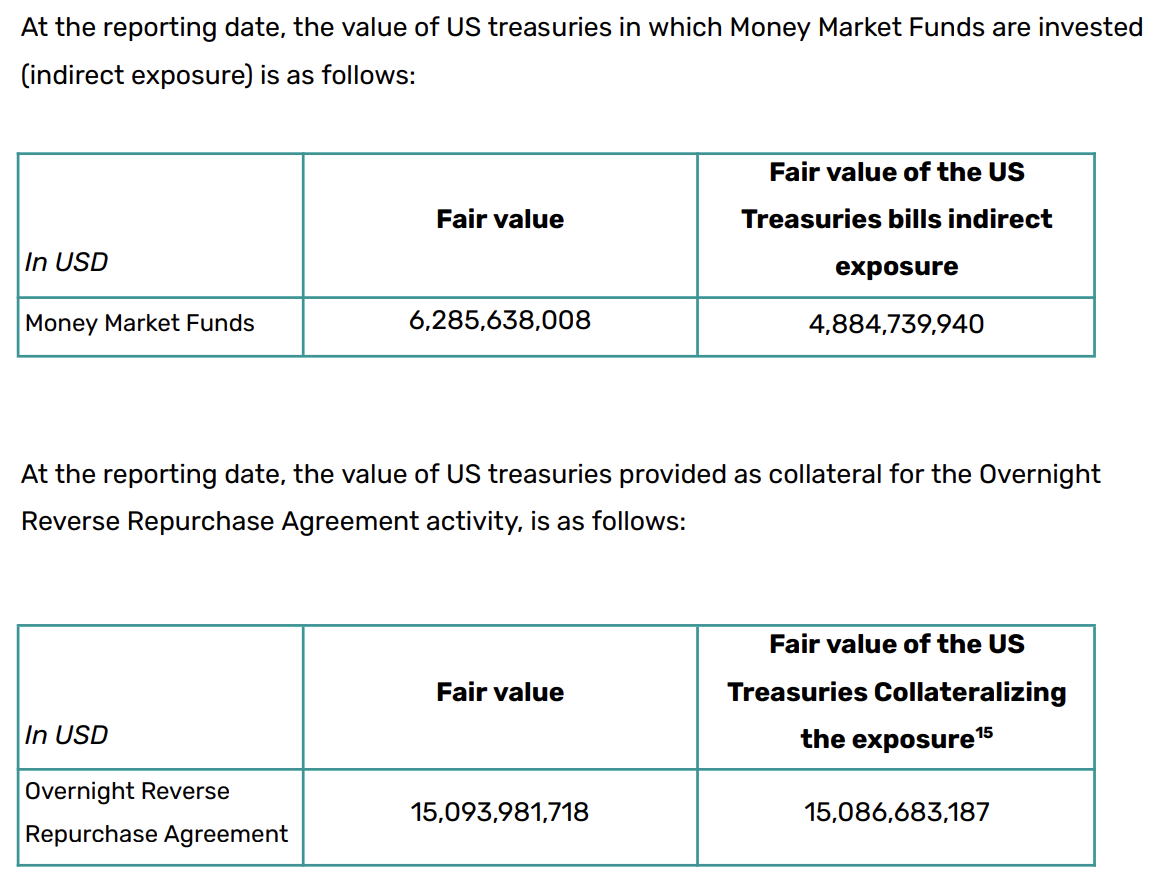

A whole quarter has since handed, and the agency’s latest report particulars a large sample of acquisitions. By March 31, it held $98.5 billion in Treasury bonds, with one other $21.3 billion in oblique publicity.

The corporate’s report additional claims that its complete belongings quantity to $149.2 billion. In different phrases, greater than 80% of Tether’s belongings are immediately and not directly held in US Treasury bonds.

Comparatively, it solely holds $7 billion in BTC, which the agency has constantly acquired prior to now.

Rumors advised that the agency would de-prioritize Bitcoin to raised align with US stablecoin rules, and this occasion could also be going down. If proposed laws turns into regulation, the US would require Tether to carry most of its reserve belongings in Treasury bonds. Thanks to those acquisitions, that requirement has been fulfilled.

Tether has been reorienting its enterprise in a couple of key methods to facilitate compliance with US rules. In late March, President Trump advised that stablecoins might assist greenback dominance, and Tether appears on this objective.

The report repeatedly talked about ideas like “Tether’s rising position in distributing dollar-denominated liquidity” and “supporting the worldwide relevance of the US greenback in a quickly evolving economic system.”

The agency described USDT as “the main digital illustration of the US greenback,” and its CEO, Paolo Ardoino, echoed these sentiments:

“Our mission is evident: to responsibly and compliantly energy the digital economic system and strengthen the position of the US greenback on the worldwide stage,” he claimed.

If Tether desires to tackle this transformative position, its large US Treasury holdings will considerably assist that job. Its holdings are vastly bigger than most governments’, to the extent that it might transfer the worldwide treasury market.

Total, these purchases will possible drive Tether’s substantial enterprise ventures within the US market quickly.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.