Bitcoin is up 28% from its April low, exhibiting renewed power because it continues to commerce close to the $95,000 mark. Bulls are firmly in management after weeks of regular positive aspects, however momentum is starting to sluggish. Value motion at present ranges suggests some exhaustion, and the market is now ready for a transparent breakout or breakdown to find out the following route.

World tensions, notably surrounding ongoing commerce conflicts and macroeconomic instability, proceed to weigh on sentiment. Buyers are cautious, and the dearth of a decisive transfer above $100K is retaining markets on edge. Nonetheless, there are indicators of rising confidence.

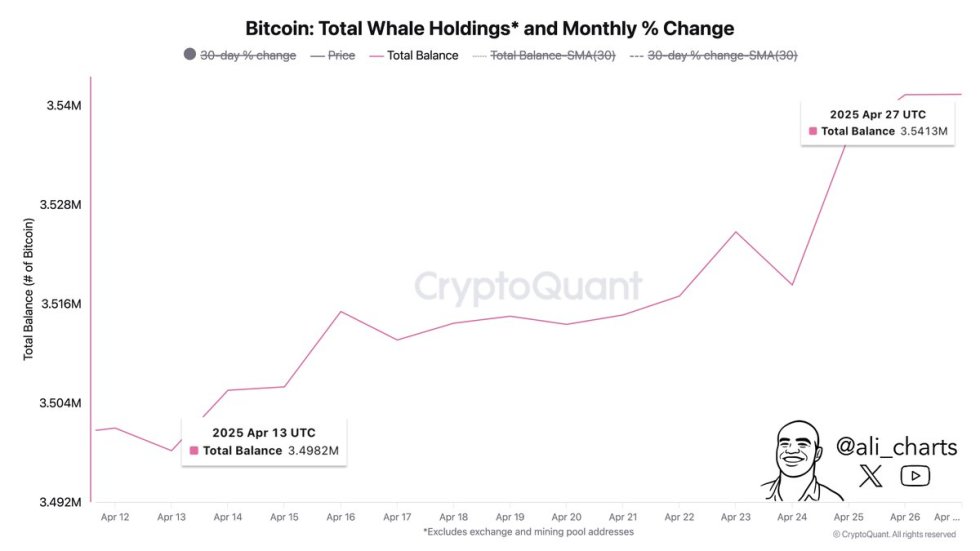

Based on on-chain knowledge from CryptoQuant, whales have quietly amassed over 43,100 BTC prior to now two weeks, value almost $4 billion at present costs. This stage of accumulation is commonly seen as a bullish sign, notably when paired with a broader risk-on surroundings.

The approaching days can be crucial for Bitcoin. A push above the $96K–$100K vary may set off a brand new leg increased, whereas a failure to interrupt out could result in a broader consolidation or perhaps a correction. For now, all eyes stay on the whales—and on whether or not retail will observe.

Bitcoin Faces A Take a look at As Whale Accumulation Strengthens Bullish Case

Bitcoin is now buying and selling at a crucial juncture as bullish momentum begins to sluggish following a robust restoration over the previous few weeks. After reclaiming the $90K stage and testing the $95K resistance zone, value motion has cooled down, and the market is getting into a consolidation section. Bulls stay in command of the short-term construction, however a transparent breakout above $100K is required to substantiate the following euphoric leg of this rally.

The present market sentiment is cautiously optimistic. On-chain exercise has improved, and technical indicators nonetheless present bullish potential. Bitcoin seems to be constructing a base for an even bigger transfer, particularly after a number of wholesome retests of decrease assist ranges round $88K–$90K. Nonetheless, macroeconomic dangers proceed to loom massive. Ongoing geopolitical tensions, notably between the U.S. and China, and fears of a worldwide recession, may inject renewed volatility and hold traders on edge.

Regardless of these headwinds, on-chain alerts are starting to align with bullish expectations. High analyst Ali Martinez shared knowledge indicating that whales have amassed over 43,100 BTC prior to now two weeks—value almost $4 billion at present costs. This surge in accumulation usually marks the beginning of stronger uptrends, as massive holders place forward of main strikes.

The market is at an inflection level. If bulls handle to reclaim the $100K stage, it might sign renewed investor confidence and sure open the door to cost discovery. Alternatively, failure to interrupt resistance may entice value in prolonged consolidation and even set off a deeper correction. The approaching days will reveal whether or not Bitcoin has the power to maintain this rally—or if extra persistence is required.

BTC Value Evaluation: Consolidation Continues Under Key Resistance

Bitcoin (BTC) is at present buying and selling at $95,140 on the 4-hour chart, persevering with its tight consolidation vary between $94,500 and $95,800. After a robust breakout in mid-April, BTC surged previous its 200-day SMA ($85,844) and EMA ($88,189), each of which at the moment are appearing as dynamic assist zones. The value motion exhibits bulls sustaining management, however going through growing resistance close to the $96,000 stage.

Quantity has declined barely in the course of the previous few periods, indicating a scarcity of sturdy conviction from both facet. This low-volatility vary might be the calm earlier than a bigger transfer. If BTC breaks above the $96,000 ceiling, a push towards the psychological $100,000 mark is probably going, with the following main resistance set round $103,600.

Nonetheless, a failure to carry this vary may lead to a wholesome retest of decrease assist ranges. Rapid draw back danger lies at $91,000, with the 200 EMA and SMA round $88,000 serving as essential assist. Shedding this zone may set off a deeper retrace towards $84,000 or decrease.

Within the brief time period, BTC should both reclaim momentum with a breakout or danger falling again right into a broader consolidation sample. All eyes at the moment are on quantity and breakout affirmation.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.