- SOL held sturdy above $140 for every week, sparking discuss of a attainable rally towards $200.

- Regardless of rising open curiosity, bearish bets are rising as merchants anticipate a pullback.

- Solana’s DEX quantity leads the market, with ETF approval odds hitting 90% for October.

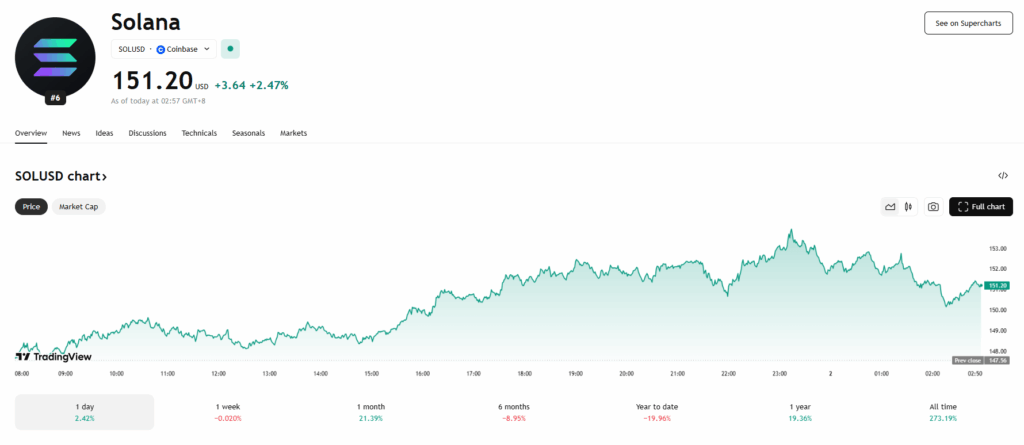

Solana’s token, SOL, slipped about 4% between April 29 and 30. Not an amazing look—however right here’s the factor: it held the $140 assist stage for a full week, and that hasn’t occurred in months. So despite the fact that it dipped, some merchants are feeling… oddly assured. That form of value stability has been uncommon recently.

Now with demand for leveraged SOL positions hitting some loopy highs, persons are beginning to marvel—may we truly see a transfer previous $200 quickly?

Derivatives market heating up (like, lots)

On April 30, open curiosity in SOL futures hit 40.5 million tokens. That’s a 5% soar from final month, placing the greenback quantity at a hefty $5.75 billion. That makes SOL the third-largest derivatives market in crypto proper now—yep, it even beat XRP by greater than 50%.

This type of futures exercise normally indicators institutional curiosity creeping in. However right here’s the twist: extra merchants are literally betting towards SOL proper now.

Bearish bets piling up, regardless of current rally

Although open curiosity is method up, the funding price on SOL perpetuals is sitting within the destructive. That mainly means there’s extra urge for food for brief positions—people predict a drop. The final burst of optimism fizzled out on April 25 when SOL couldn’t break above $156. A few of that hesitation may come from the truth that SOL already jumped 43% between April 8 and 29… that’s an enormous transfer in simply three weeks.

A $200 goal? Possibly formidable. However not unattainable. The token was proper round $195 again in mid-February, even when exercise on Solana dApps had fallen off a cliff.

Solana isn’t nearly memecoins (significantly)

Folks prefer to clown on Solana for being memecoin central, however there’s extra occurring beneath the hood. Proper now, Solana’s received $9.5 billion locked up throughout its ecosystem—staking, lending, yield platforms, artificial property… you identify it.

Meteora pulled in $19.1 million in charges in only a week. Pump.enjoyable wasn’t far behind with $18.6 million, and Jito introduced in $14.6 million. These aren’t simply hype numbers—they present actual exercise, and actual utilization.

Solana crushing it on DEX quantity

Regardless of Ethereum’s base layer charges dropping to round $0.65 since mid-April, Solana’s decentralized exchanges (DEXs) have seen practically 90% extra quantity. Even if you throw Ethereum’s layer-2s into the combination, Solana nonetheless got here out forward final week—$21.6 billion in DEX quantity.

There have been large features throughout the board too. Raydium volumes jumped 87% week-over-week. Meteora was up 58%. These numbers kinda converse for themselves.

SOL ETF approval odds rising quick

After which there’s the ETF angle. If a spot Solana ETF will get permitted within the U.S., it may herald an entire new wave of retail and institutional patrons. Analysts say there’s a 90% probability the SEC provides it the go-ahead by October 10.

That stated, SOL may not even wait that lengthy to maneuver. Between the strong on-chain exercise and rising market curiosity, a run previous $200 may occur method earlier than the SEC makes up its thoughts.

Need this changed into a thread or key highlights? Simply say the phrase.