Bitcoin’s value jumped over 12% final week to achieve $96,500, surpassing the common buy value of “short-term whales”—massive holders who purchased Bitcoin inside the final six months.

CryptoQuant analyst JA Maartunn instructed BeInCrypto that these whales have reclaimed their break-even stage of $90,890. It means they’re now in revenue and fewer more likely to promote, which provides stability to the market.

Brief-Time period Bitcoin Whales Return to Revenue

Brief-term whales are addresses which have held Bitcoin for beneath six months. These whales are actually sitting in combination revenue as BTC outpaces their common realized value.

Traditionally, when these members cross into profitability, they have a tendency to pause or scale back promoting strain.

CryptoQuant’s Brief/Lengthy-Time period Whale Realized Value chart exhibits the orange line (short-term whale value foundation) rising towards the white market value curve in latest weeks.

It confirms that almost all short-term holders would web positive factors in the event that they bought at present ranges.

On-chain information reinforce the importance. Funding charges on perpetual swaps stay deeply unfavourable, indicating heavy brief positions poised for a possible squeeze if shopping for continues.

In the meantime, long-term holders have steadily rebuilt their accumulation. Additionally, the community hash price topped a document at 1.04 ZH/s this month.

These metrics sign miners and affected person traders are assured in sustaining the rally’s trajectory.

Seasonal and Macro Dynamics Bolster Outlook

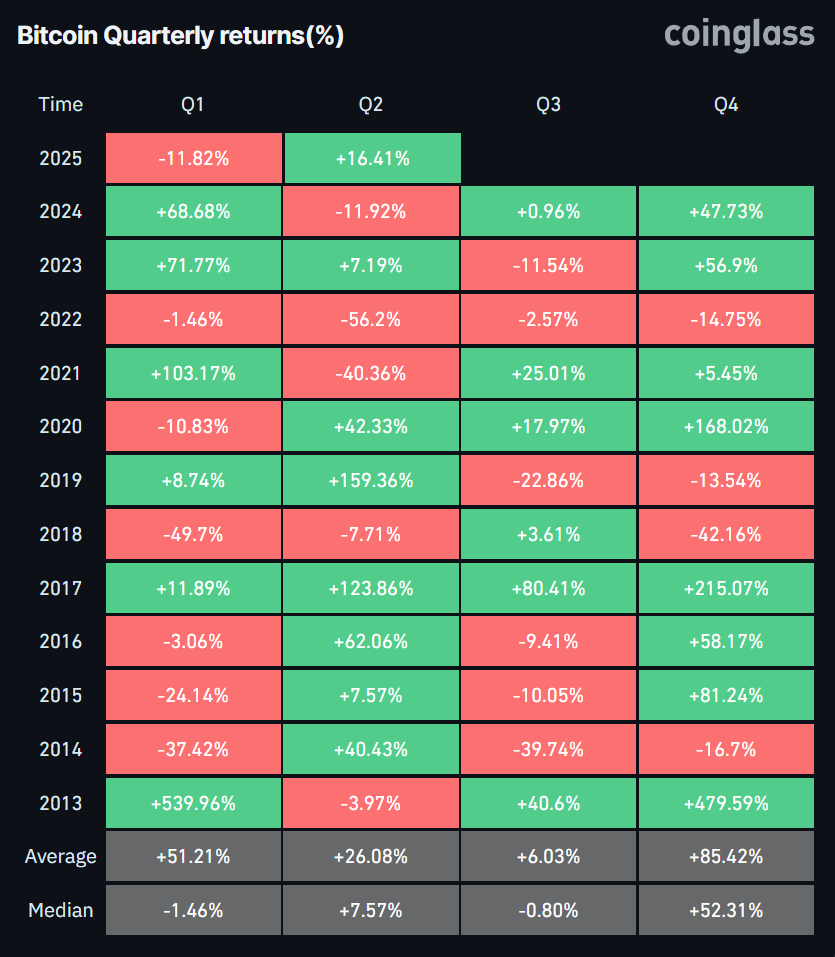

Seasonal tendencies usually cool summer time rallies. Traditionally, Bitcoin gained 26% in Q2 on common, however the median has been simply 7.6% since 2013. Sharp drops—just like the 56.2% plunge in Q2 2022—have occurred.

Q3 is normally weaker, averaging 6% returns and a barely unfavourable median. As Might nears, many brace for the “promote in Might” impact seen in equities, the place the S&P 500 has returned just one.8% from Might via October since 1950.

Macro elements additionally matter. US inflation has eased to 2.4%, and markets now anticipate Fed price cuts later in 2025.

A weaker greenback boosts danger property like Bitcoin. Spot Bitcoin ETFs noticed $3 billion in web inflows in late April, exhibiting sturdy institutional demand.

Total, whale income, wholesome on-chain indicators, and supportive macro tendencies underlie Bitcoin’s rally.

But seasonal headwinds and spinoff imbalances stay. Merchants ought to set clear danger limits and watch funding charges and financial information this summer time.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.