- ETH has struggled beneath $1,900, with merchants cautious after weak ETF demand and coverage setbacks.

- Ether’s market cap briefly fell behind main rivals, elevating considerations about its aggressive edge.

- The upcoming Pectra improve on Could 7 would possibly spark renewed curiosity by enhancing staking and lowering provide.

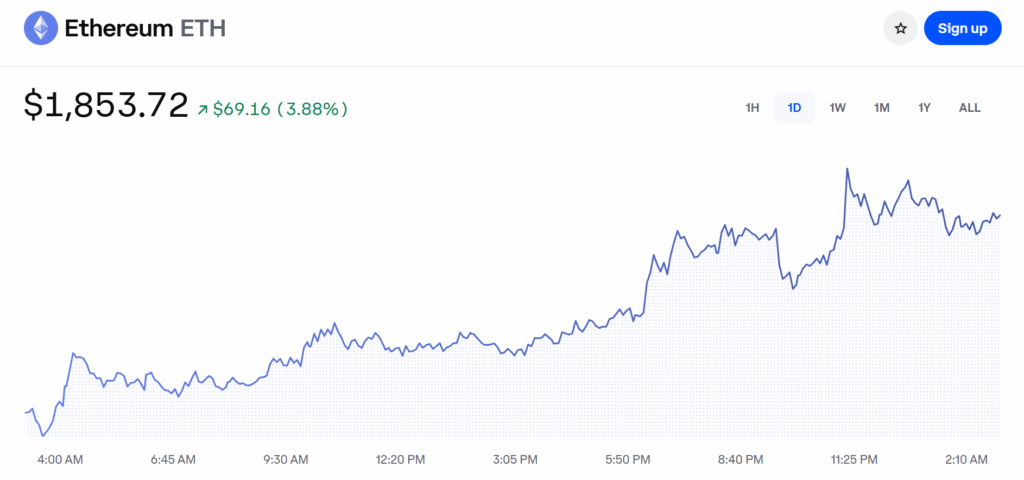

Ether’s been drifting below $1,900 since March—and truthfully, it’s making buyers a bit uneasy. The failed push to retake $4,000 again in December 2024? Yeah, that didn’t assist both. Now, some are questioning if that was the final hurrah for the second-biggest crypto on the market.

Derivatives information hasn’t precisely calmed nerves. Futures for ETH are supposed to point out a premium—like, 5% or extra—to account for his or her longer settlement intervals. Proper now? That premium’s not even hitting impartial territory. Not nice.

U.S. coverage hits more durable than anticipated

A bit of that hesitation may be tied to the entire “Digital Asset Stockpile” mess that dropped in early March. The U.S. authorities lumped ETH in with a bunch of different altcoins in an government order, principally saying: Bitcoin will get its personal “Strategic Reserve,” and every part else… doesn’t.

Translation? The feds would possibly grasp onto the ETH they have already got, however don’t count on them to purchase extra anytime quickly. That sort of labeling doesn’t do wonders for investor confidence.

ETH’s market cap slips behind the pack

In April 2025, one thing wild occurred—Ether’s complete market cap fell beneath the mixed worth of 4 rivals: Solana, BNB, Cardano, and Tron. First time ever.

It’s bounced again a bit since, sitting round $217 billion now. That’s sufficient to drag again forward, but it surely doesn’t imply the market’s feeling bullish. Until ETH can persistently outperform the opposite huge gamers, it’s exhausting to think about sentiment flipping anytime quickly.

Weak ETF demand provides extra strain

Even when ETH rallied from $2,400 to $4,000 late final yr, U.S. demand for a spot ETH ETF stayed fairly meh. In the meantime, Bitcoin ETFs had been blowing up—like, doubling in measurement from $50 billion to $110 billion. That sort of distinction doesn’t go unnoticed.

ETH’s derivatives markets replicate the identical chill vibe. Skilled merchants simply aren’t lining as much as go lengthy, which says lots about the place they suppose issues are headed.

Ethereum nonetheless leads in TVL… however there’s extra to the story

Yep, Ethereum continues to be king with regards to complete worth locked—TVL is stable. However with regards to consumer expertise? Solana’s smoother. Stablecoin dominance? Tron’s bought that on lock.

Folks simply aren’t as enthusiastic about Ethereum’s decentralization or security measures after they’re continually shifting funds round. Layer-2s assist a bit, however for fast-moving exercise, the expertise nonetheless feels clunky.

Merchants not panicking, simply ready

One fascinating factor? Choices markets aren’t exhibiting indicators of panic. The price of places (promote choices) is just about consistent with calls (buys). That tells us professionals aren’t anticipating a giant crash—they’re simply not overly hyped both.

And in comparison with two weeks in the past, they really appear a bit extra chill about draw back dangers. No big spike in protecting positions. Simply… ready.

Might Pectra be the spark?

So what’s subsequent? Properly, the Pectra community improve is about for Could 7. Some people suppose it might shift the vibe a bit—possibly carry ETH again into the highlight. It’s purported to carry higher staking instruments for establishments, which might result in extra ETH getting locked up, shrinking the availability a bit.

Traditionally, Ethereum upgrades have sparked short-term rallies. So if there’s ever a time for ETH to point out indicators of life once more, Pectra would possibly simply be it.