Bitcoin might face three potential pattern eventualities sooner or later, with probably the most optimistic one forecasting a surge to $150,000 to $175,000 throughout the subsequent 12 months.

This prediction is supported by elements reminiscent of a robust inflow of institutional capital and constructive investor sentiment following the Trump administration’s plans to determine a nationwide Bitcoin reserve.

Optimistic Forecasts from Consultants and Market Alerts

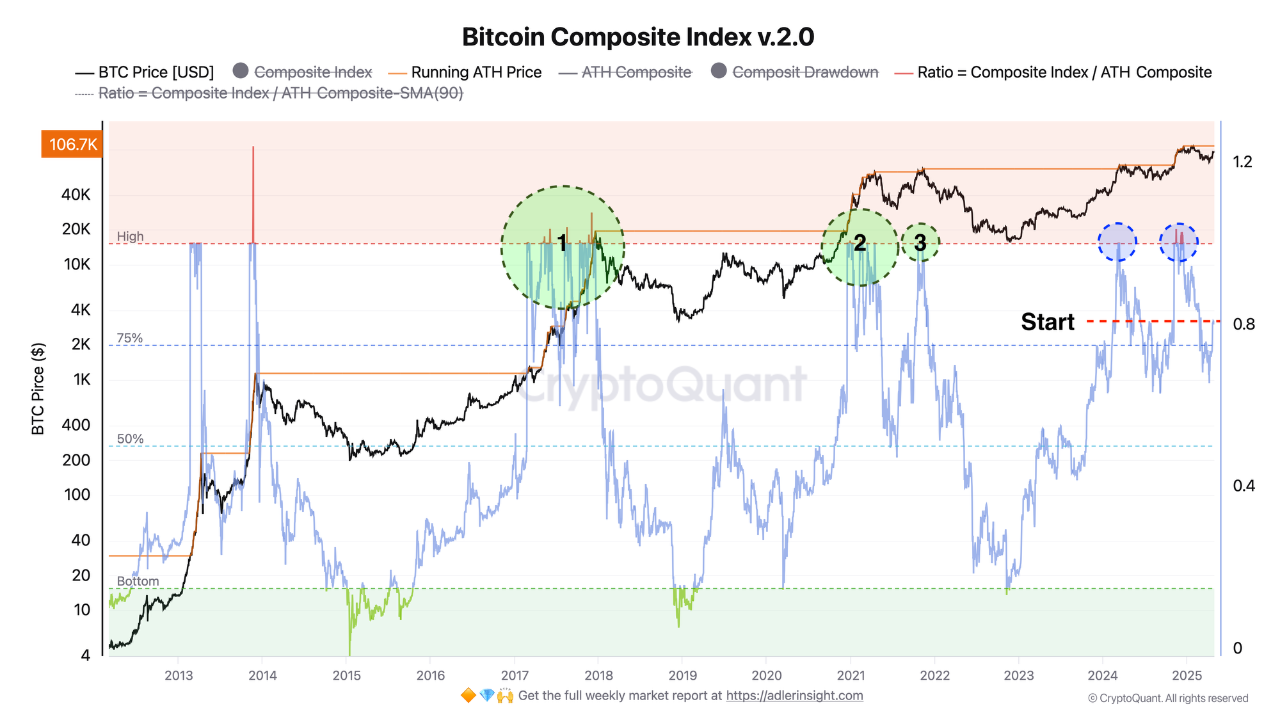

Bitcoin (BTC) is exhibiting promising prospects as quite a few constructive alerts from the market and skilled predictions emerge in early Might 2025. In an evaluation by AxelAdlerJr, as of immediately, on-chain momentum is within the “beginning” part of a bull run.

The Bitcoin Composite Index presently stands at ≈ 0.8 (80%). Based mostly on this indicator, AxelAdlerJr outlined three potential eventualities.

In probably the most optimistic situation, BTC’s worth may attain $150,000 to $175,000, following the cyclical logic of 2017 and 2021. This is able to happen if the Bitcoin Composite Index surpasses 1.0 and stays above that degree.

If the ratio stays throughout the 0.8–1.0 vary, the market would seemingly consolidate in a broad hall between $90,000 and $110,000, indicating that members are sustaining positions with out growing publicity.

Alternatively, if the ratio drops to 0.75 or under, short-term holders might begin taking earnings, doubtlessly resulting in a worth correction to $70,000–$85,000. Nonetheless, AxelAdlerJr notes that this situation is much less seemingly than the opposite two.

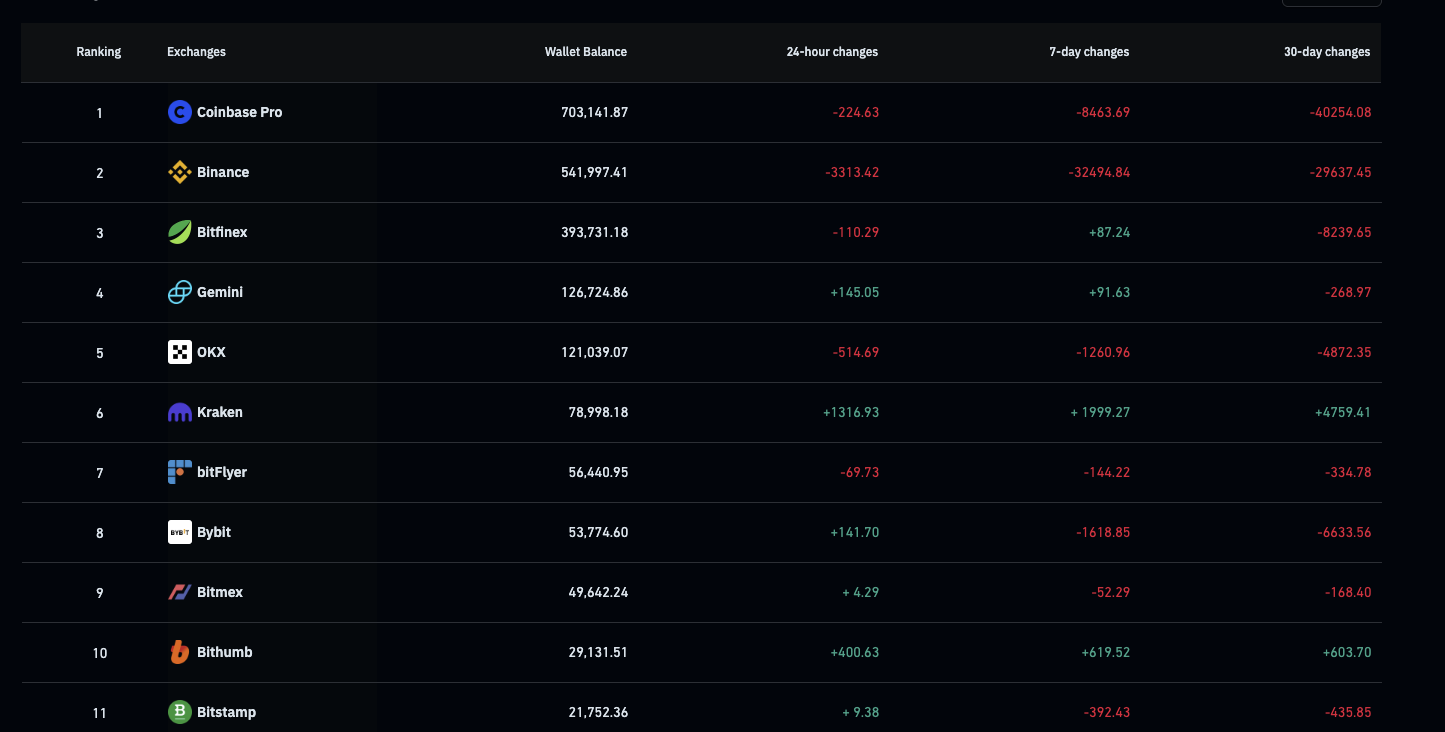

On-chain alerts additional bolster the bullish outlook. In keeping with Coinglass, over the previous 7 days, roughly 42,525.89 Bitcoins have been withdrawn from centralized exchanges (CEX), lowering the availability on exchanges to a 7-year low of about 2.48 million BTC.

The pattern of Bitcoin withdrawals from exchanges is commonly seen as a constructive signal, because it signifies investor accumulation and decreased promoting strain, paving the best way for worth progress.

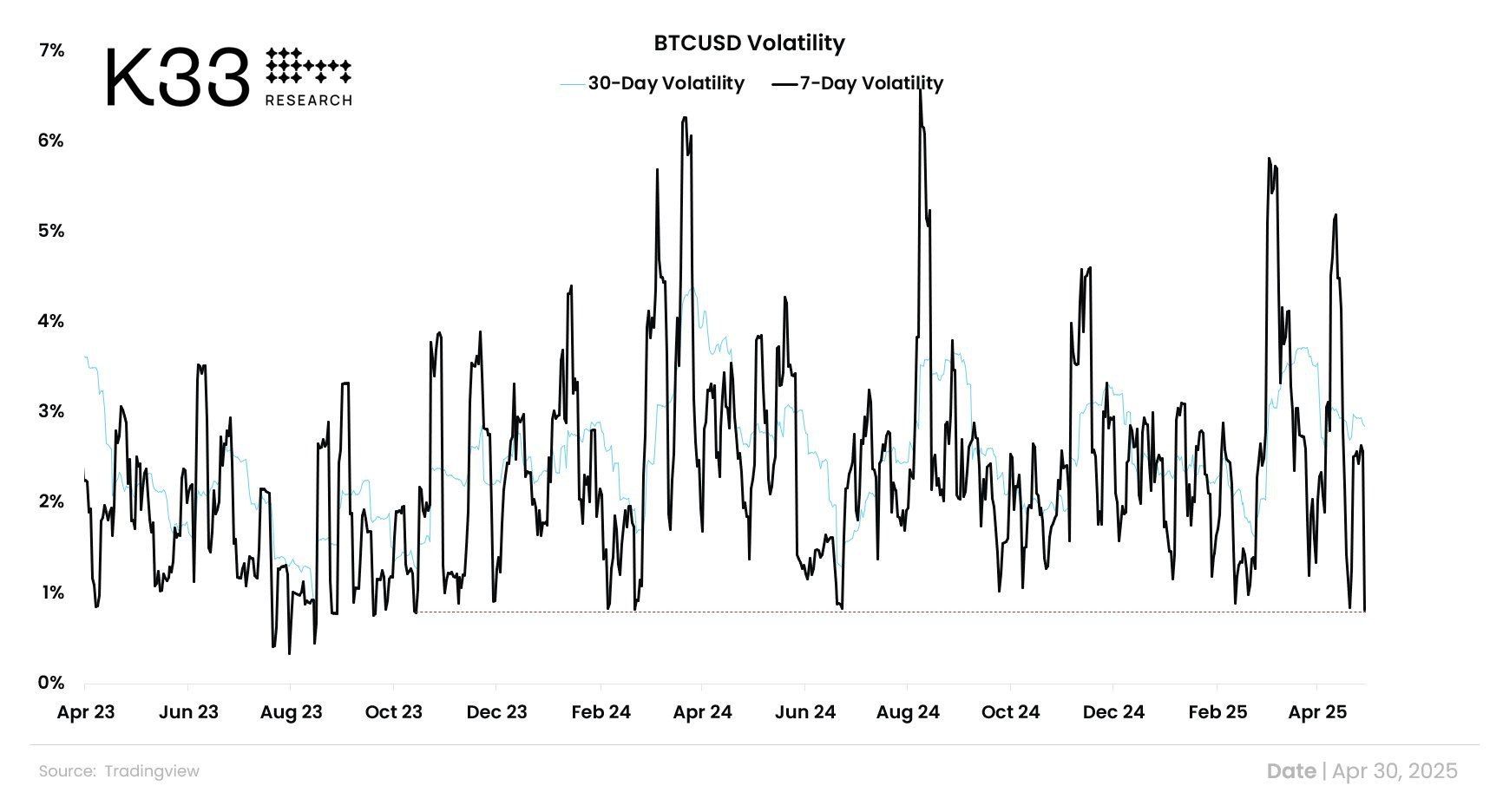

Bitcoin’s 7-day volatility has additionally hit its lowest degree in 563 days. Low volatility usually alerts a interval of accumulation earlier than a worth breakout, as noticed throughout previous main rallies, reminiscent of in 2020 earlier than Bitcoin peaked at $69,000.

Technical Evaluation and Key Worth Ranges

Technical evaluation additionally helps Bitcoin’s bullish situation. In keeping with a put up on X by Ali, Bitcoin’s key help ranges are at $93,198 and $83,444, indicating sturdy consolidation above these thresholds.

If Bitcoin sustains above $93,198, the chance of constant its upward pattern to achieve the $150,000 goal turns into extremely possible.

“Essentially the most important help ranges for #Bitcoin $BTC are $93,198 and $83,444. Key zones to look at if momentum shifts,” Ali shared.

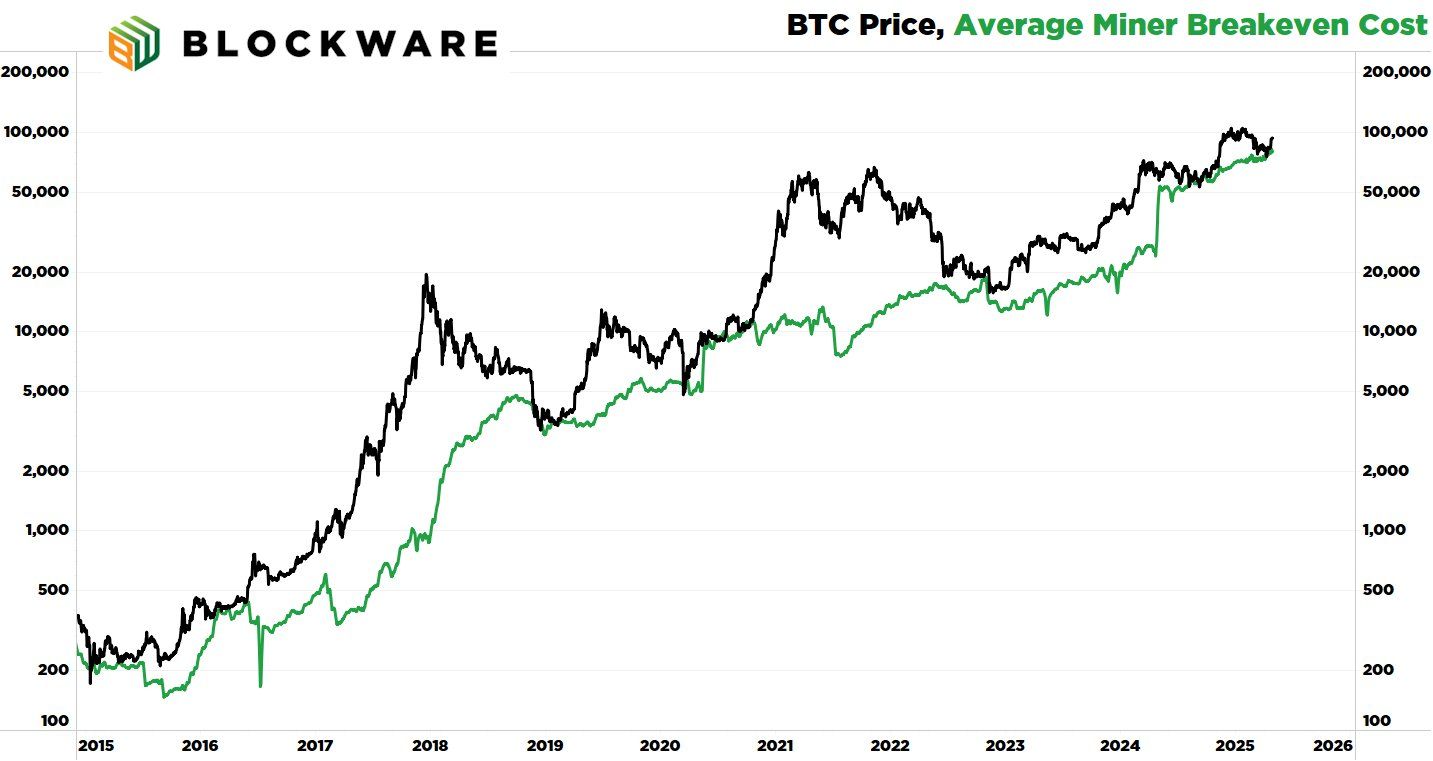

Furthermore, Breedlove22, a well known analyst, shared on X about three indicators signaling optimism for Bitcoin. The primary is the Common Miner Price of Manufacturing. In keeping with Breedlove22, this metric is at a backside, suggesting a major bull market could also be on the horizon.

The second indicator is the availability held by long-term holders, which measures Bitcoin unmoved on-chain for at the least 155 days. Breedlove22 famous that over the previous 30 days, long-term holders have acquired a further ~150,000 BTC.

“Bitcoin is operating out of sellers within the $80,000 to $100,000 vary,” Breedlove22 acknowledged.

Lastly, and most significantly, is USD liquidity, which successfully represents the “demand” aspect of the equation. Extra {dollars} within the system imply extra potential bidders.

“And it’s not simply USD liquidity that’s growing – liquidity of all fiat currencies is on the rise, and Bitcoin is a worldwide asset,” Breedlove22 added.

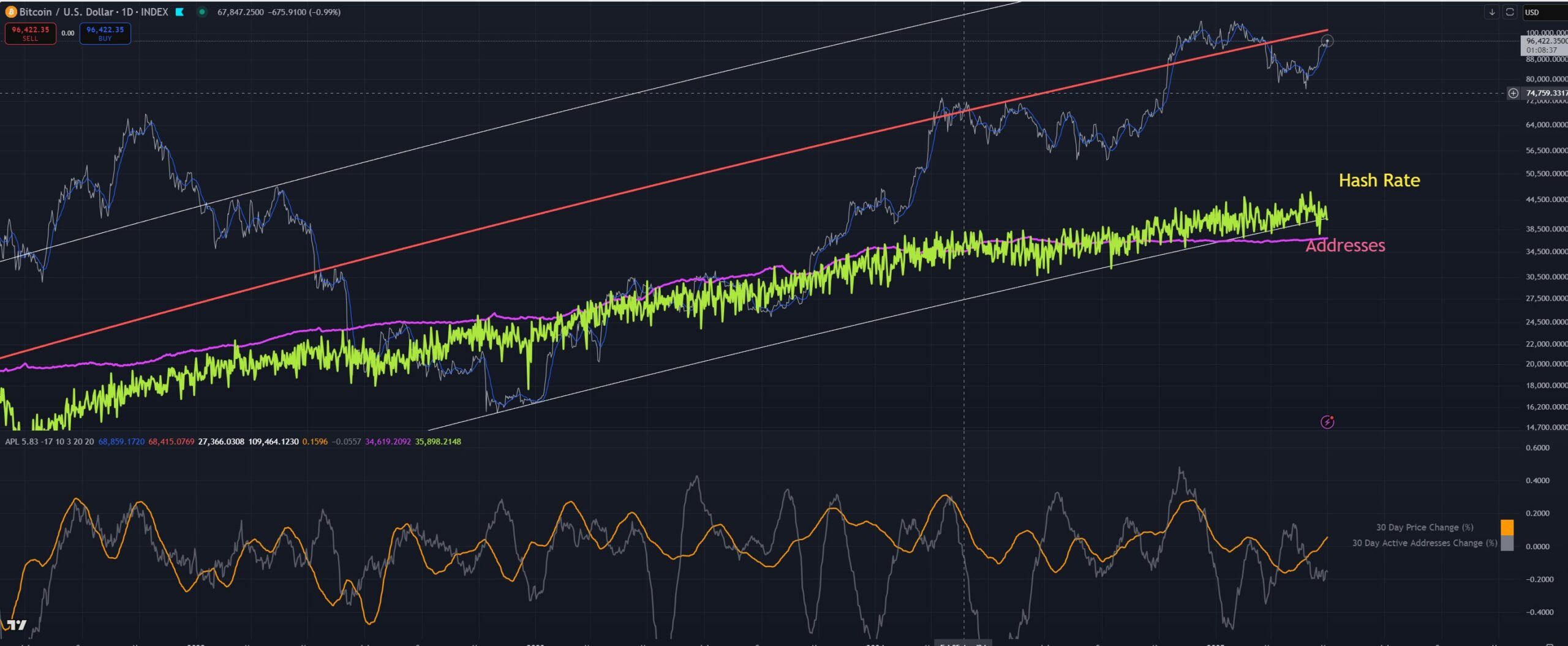

Echoing Breedlove22’s perspective, one other X consumer shared that BTC’s valuation based mostly on hash price is at a help degree, suggesting {that a} native backside might have been reached.

Within the optimistic situation, Bitcoin is poised for a major alternative to achieve $150,000 to $175,000. Nonetheless, buyers also needs to put together for dangers reminiscent of short-term worth corrections.

With sturdy help ranges at $93,198 and $83,444, Bitcoin has a stable basis for continued progress, however warning stays important.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.