- XRP dipped 5% however could rebound quickly if it breaks out of a falling wedge sample.

- Analysts predict a possible rally, with targets as excessive as $3.74 and even $19.27.

- Odds of an XRP ETF approval in 2025 have jumped to 85%, boosting investor optimism.

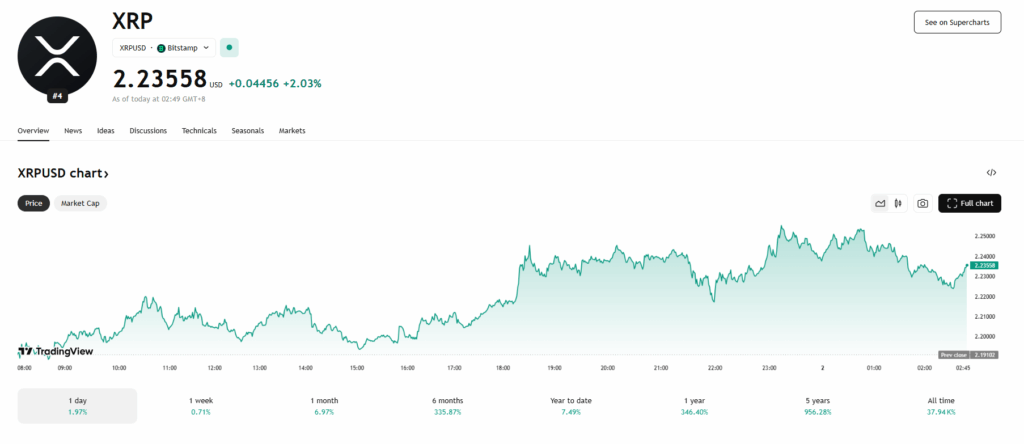

XRP took a little bit of successful—dropped 5% within the final 24 hours—after contemporary U.S. GDP information got here in weak, flashing indicators of a slowing economic system. However even with that dip, there’s nonetheless an honest buzz round XRP probably retesting its April excessive of $2.36 quickly, due to a stronger-looking market setup and rising chatter about an XRP spot ETF really getting the inexperienced gentle within the U.S.

That wedge sample? It’s wanting kinda bullish

Zooming into the each day chart, XRP’s value is cruising inside this falling wedge sample—yep, that bullish one the place the highs and lows maintain getting tighter. It often hints at promoting strain fading out. Proper now, XRP is floating round $2.23.

If (and that’s a giant if) the worth manages to interrupt out above the highest of that wedge—round $2.40—issues may warmth up quick. The following massive goal? $3.74. That’d be a 71% leap from the place we at the moment are, which, yeah, isn’t any joke.

RSI is holding up… for now

Taking a look at indicators, the relative energy index (RSI) continues to be above the midway mark. Which means bulls aren’t completely out of gasoline. However for this bounce to stay, XRP actually wants to remain above that $2.20 help. And after that? It’s gotta wrestle previous the resistance zone between $2.80 and $3.00, which received’t be straightforward.

Analysts nonetheless feeling kinda bullish

Some merchants nonetheless imagine XRP’s acquired extra within the tank. Darkish Defender (massive title within the XRP camp) says this correction is simply half of a bigger Elliott Wave setup—principally, XRP’s nonetheless marching greater, simply taking its time.

Then there’s Allincrypto, who thinks XRP is on a path towards… $19.27. That’s based mostly on a breakout from the identical falling wedge sample. He known as the present pullback “textbook excellent,” which, okay, sounds a bit dramatic—however hey, that’s crypto for you.

XRP ETF odds are climbing, quick

Right here’s the place issues get attention-grabbing. ETF analysts over at Bloomberg now say there’s an 85% shot that one of many 5 XRP spot ETFs—Grayscale, 21Shares, WisdomTree, Bitwise, Canary, or Franklin Templeton—will get accredited in 2025. That’s up from 65% only a couple months in the past.

And should you’re into prediction markets: Polymarket now has the chances of an XRP ETF approval by Dec. 31 sitting at 80%. That’s a 17% bump in only a week. Fairly wild swing.

On April 29, the SEC pushed again its determination on Franklin Templeton’s XRP ETF—new assessment deadline’s set for June 17. So yeah, extra ready.

A greenlight may change the sport

If any of those ETFs get accredited, it may pull in some severe institutional cash. That’d increase demand and perhaps… lastly… push XRP nearer to mainstream adoption. Nothing’s assured, timelines are fuzzy, and delays are kinda regular at this level. However nonetheless—it’s wanting extra probably than ever.