As Bitcoin flirts with the important thing psychological threshold of $100,000, derivatives merchants are intently awaiting alerts that might mark the ultimate leg up—and are already positioning for what might comply with.

Derivatives specialists Gordon Grant and Joshua Lim informed BeInCrypto that Bitcoin’s transfer previous $100,000 now displays a long-term holding technique, in contrast to the speculative buying and selling seen when it first crossed that threshold after Trump’s election victory.

Bitcoin Nears $100K: A Completely different Form of Ascent?

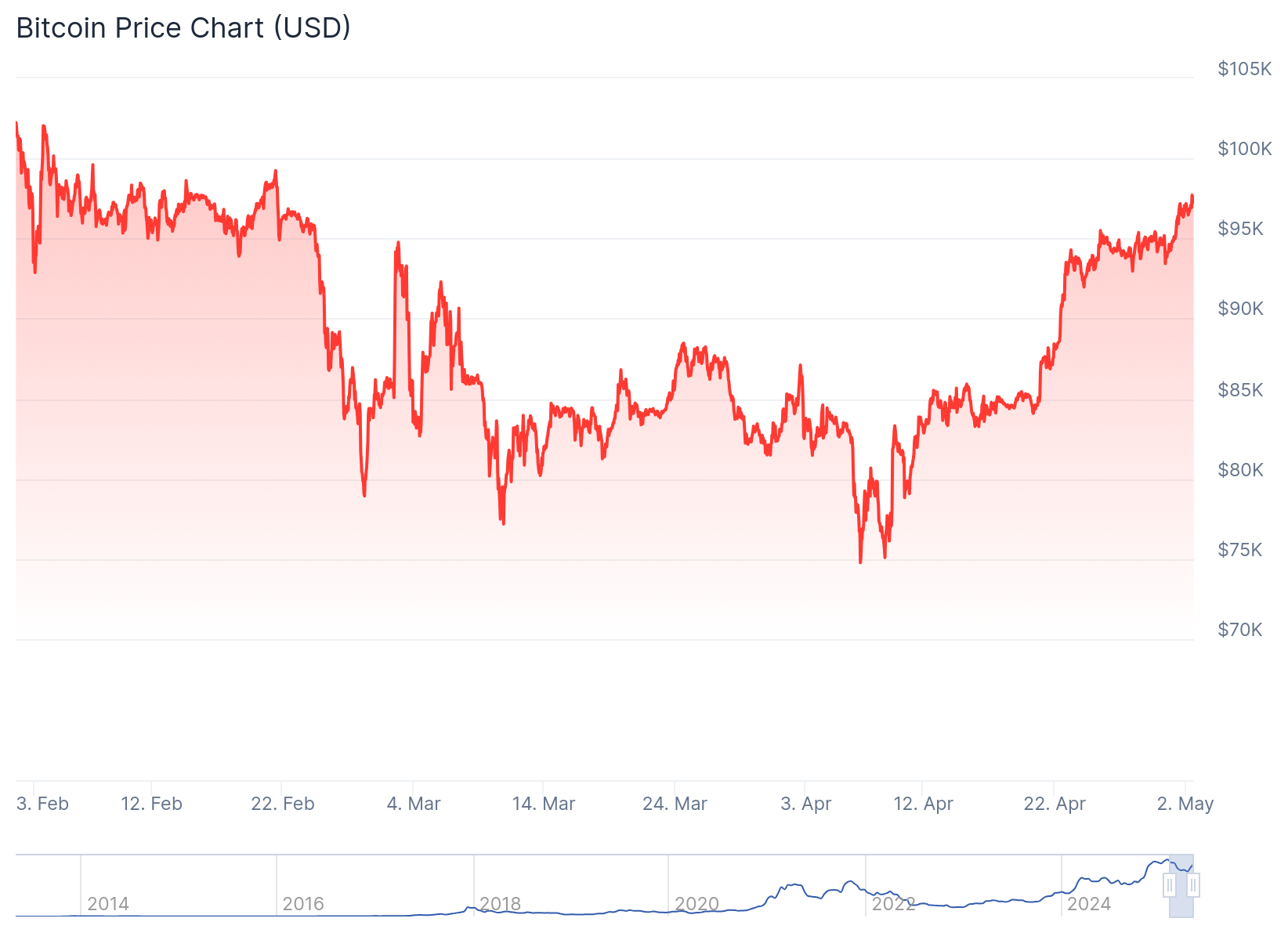

On the time of press, Bitcoin’s value hovers just under $98,000. Because it grows, merchants anxiously look ahead to it to surpass the $100,000 threshold. When it does, it is going to be the second time in crypto historical past that this can occur.

In keeping with Cryptocurrency Derivatives Dealer Gordon Grant, the present transfer towards six figures lacks the euphoric power of previous rallies, such because the one after Trump gained the US common election final November. Nevertheless, that could be factor.

“This present bounce again feels far more of a low-key, torpid reclamation of these highs,” Grant informed BeInCrypto, referencing Bitcoin’s restoration from lows round $75,000 in early April. “The positioning rinsedown by way of all key transferring averages… was a correct washout.”

He added that this washout, a pointy transfer decrease that flushed out weak fingers, cleared the decks for a more healthy rebound. A “high-velocity bounce” adopted, as Grant phrased it.

“[It] has since responsibly slowed down on the $95,000 pivot—a stage at which Bitcoin has been centered, +/- 15%, for over 5 months now,” he added.

In Grant’s view, this units the stage for Bitcoin to attain a extra important and lasting climb by way of the $100,000 mark. This might lead its value in direction of the $110,000 peak it touched across the time of the US inauguration earlier this 12 months.

Nevertheless, he additionally identified a number of key elements that should be aligned within the derivatives marketplace for Bitcoin to launch increased.

Contained Volatility: A Key Ingredient for Bitcoin’s Subsequent Surge

For Bitcoin to achieve unprecedented ranges, volatility wants to stay in examine.

Volatility measures the extent and pace of Bitcoin’s value adjustments. A bullish state of affairs favors secure or step by step rising costs over wild swings.

In keeping with Grant, merchants who promote choices on Bitcoin volatility now exhibit calmer conduct than throughout January’s value rally.

“Present complacency amongst vol sellers in fading the technical threshold at $100K is markedly totally different,” he stated.

Grant added that, again in December, volatility spiked on expectations of a speedy moonshot towards $130,000–$150,000. Now, nonetheless, implied volatility has truly fallen by round 10 factors in the course of the last 10% of Bitcoin’s climb—an uncommon dynamic that has punished merchants holding out-of-the-money choices who have been betting on massive value swings.

This time, the substantial lack of market optimism additionally contributes to the state of affairs.

The Rise of Institutional Consumers

Market sentiment has shifted considerably since January. The joy seen throughout Trump’s election has been changed by uncertainty. In keeping with Grant, souring macro situations similar to tariff-driven fairness selloffs and rising warning amongst merchants have contributed to this temper shift throughout markets.

“Whereas BTC on first launch to/by way of $100K was accompanied by euphoria about presidential insurance policies… the re-approach has been marred by malaise,” Grant defined.

Briefly, the motivation to purchase might now be pushed extra by worry than greed.

Joshua Lim, World Co-Head of Markets at FalconX, agreed with this evaluation, highlighting a notable shift within the major supply of Bitcoin demand.

“The dominant narrative is extra round Microstrategy-type equities accumulating Bitcoin, that’s extra constant consumers than the retail swing merchants,” Lim informed BeInCrypto.

In different phrases, extra speculative retail shopping for might need fueled earlier enthusiasm round Bitcoin’s value hitting $100,000. This time, the extra constant and important shopping for is coming from massive corporations adopting a long-term Bitcoin holding technique, just like the one adopted by Michael Saylor’s Technique.

The latest formation of 21 Capital, backed by mega corporations like Tether and Softbank, additional confirms this shift in motivation.

Constant institutional shopping for may maintain a rise in Bitcoin’s value over time.

Why Are Establishments More and more Bullish on Bitcoin?

With rising momentum from sovereign gamers and company treasuries, institutional shopping for could also be essential in sustaining Bitcoin’s subsequent upward trajectory.

Grant highlighted that creating nations looking for to maneuver away from a weakening greenback and in direction of a extra impartial asset like Bitcoin might play a big function. If this have been to occur, it’d signify a probably tectonic shift to international financial coverage.

“The World South, tiring of wonky and inconstant greenback insurance policies, could also be really interested by dumping {dollars} for BTC,” Grant defined, clarifying, “That’s a reserve supervisor choice, not a spec/leverage place.”

Elevated institutional adoption strengthens the concept that Bitcoin now serves as a approach to scale back threat in opposition to points pertinent to monetary methods, like inflation or forex devaluation.

In the meantime, extra firms are viewing Bitcoin as a respectable treasury asset.

“The proliferation of SMLR, 21Cap, and plenty of others, together with NVDA deciding they should derisk their stability sheets by rerisking on BTC—even because it approaches the highest decile of all-time costs,” Grant pointed to as proof.

Merely put, even massive establishments are selecting to tackle the chance of Bitcoin’s value fluctuations as a possible offset to different, probably bigger monetary dangers.

Regardless of the joy surrounding Bitcoin’s strategy to $100,000, the true anticipation facilities on its persevering with improvement as an more and more everlasting part of the monetary system.

Disclaimer

Following the Belief Venture pointers, this characteristic article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with an expert earlier than making selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.