Over the previous few months, Ethereum has skilled a major decline in person exercise on its blockchain. This slowdown has decreased the community’s burn price—a mechanism that helps lower ETH provide over time.

With fewer tokens being burned, ETH’s circulating provide has risen, placing inflationary stress on the asset. Because of this, the coin has struggled to take care of a steady worth above the $2,000 stage in current months.

Low Burn Price Equals Extra Cash in Circulation

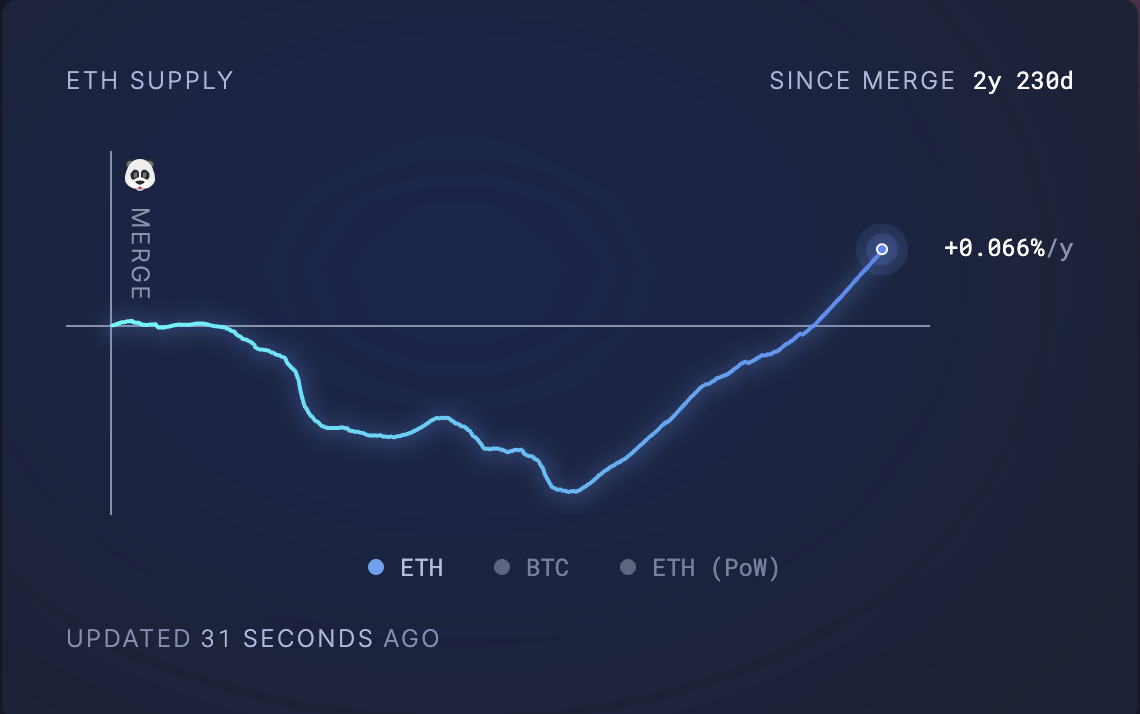

In accordance with Ultrasoundmoney, 72,927 ETH, valued at $134 million at present market costs, have been added to ETH’s circulating provide up to now month alone.

At press time, this sits at 120,730,199 ETH, considerably above pre-merge ranges.

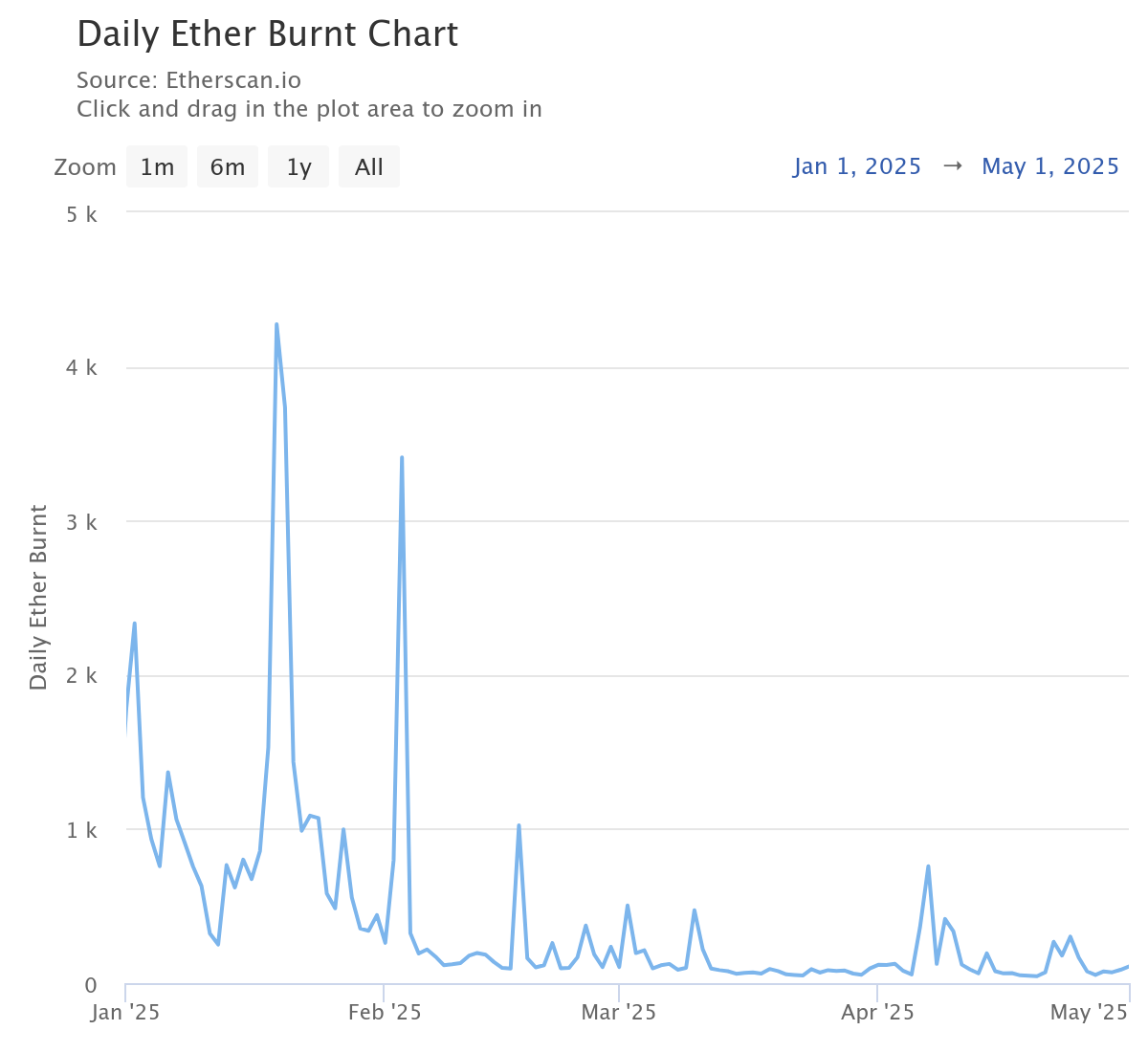

This enhance in ETH’s provide is pushed by a decline in person exercise on the Ethereum community, lowering its burn price. Ethereum’s burn mechanism, launched via EIP-1559, destroys a portion of transaction charges to cut back the circulating provide of ETH.

Nonetheless, this mechanism is instantly tied to community utilization. So, when fewer transactions happen like this, much less ETH is burned, leading to ETH’s provide spiking.

In accordance with Etherscan, the day by day quantity of ETH burnt has dropped by 95% year-to-date. The truth is, the community just lately recorded its lowest quantity of cash burnt in a single day on April 20.

Why Are Ethereum Customers Leaving the Blockchain?

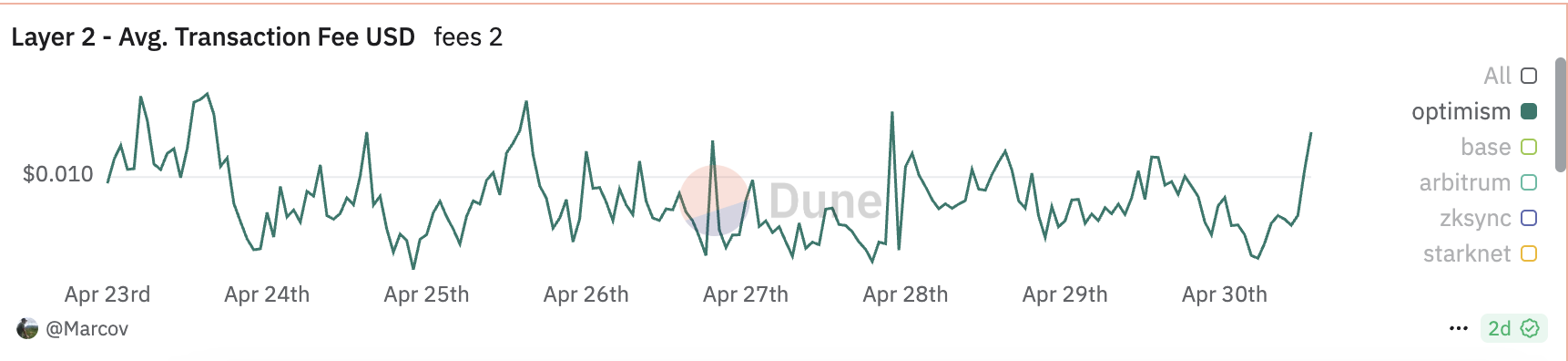

Many customers and builders are migrating from Ethereum to Layer-2 (L2) options like Optimism and Arbitrum. These networks provide considerably decrease transaction charges and sooner execution, lowering person exercise on Ethereum’s mainnet.

For instance, as of April 30, the common transaction price on Optimism’s mainnet was simply $0.024. In contrast, finishing a transaction instantly on Ethereum value customers a median of $0.18 on the identical day, which is over seven instances costlier.

Furthermore, because of the current meme coin mania, “Ethereum killers,” comparable to Solana, have gained vital traction over the previous few months, drawing customers away from the L1.

Collectively, these traits have led to a decline in Ethereum’s transaction rely, therefore the community’s low burn price.

How Do Ethereum’s Fundamentals Stack Up?

The drop in Ethereum’s person demand and the following rise in ETH’s provide have raised essential questions concerning the power of its fundamentals.

When requested how Ethereum at present compares to different Layer-1 (L1) networks amid broader market weak spot, Vincent Liu, Chief Funding Officer at Kronos Analysis, supplied his perspective.

“Ethereum’s fundamentals stay robust relative to different Layer 1s, significantly when you think about its complete worth locked (TVL) of $368.921 billion, which positions it on the prime of the leaderboard,” Liu stated.

Though Liu acknowledged that Ethereum ranks fifth in 24-hour charges, behind Tron, Solana, HyperLiquid, Bitcoin, and BNB Chain. He emphasised that the community nonetheless “demonstrates vital demand and utilization.”

Temujin Louie, CEO of Wanchain, shares the same perspective. Whereas talking with BeInCrypto, Louie famous:

“In comparison with different Layer 1s, fundamentals stay Ethereum’s power. Not like many Layer 1s with aggressive inflation as a part of their design, Ethereum’s post-merge structure makes it probably deflationary. Nonetheless, the advantages of EIP-1559 rely on on-chain exercise. However, it is a structural benefit over most competing Layer 1s.”

Whereas elevated exercise throughout Layer-2 (L2) options and “Ethereum killers” like Solana might have contributed to a decline in person demand on Ethereum itself, Louie believes that the L1 community “stays a frontrunner in decentralization and has a near-unmatched monitor document that continues to safe its place out there.”

What About ETH Worth?

Even with robust fundamentals, declining exercise on Ethereum poses challenges for ETH within the short- to mid-term. Commenting on this, Liu defined that decrease community exercise usually indicators weaker demand for ETH.

On the identical time, elevated coin issuance on the community undermines Ethereum’s deflationary mannequin, which was designed to help worth appreciation.

“This mix may lead to bearish worth actions,” Liu warned, “particularly as traders look to different Layer 1s providing higher scalability and decrease charges.”

Kadan Stadelmann, CTO of Komodo Platform, additionally highlighted the function of macroeconomic elements:

“If Ethereum experiences an prolonged lower in utilization, the value may fall significantly relying on how a lot use drops, particularly if the Fed continues its coverage of quantitative tightening in comparison with quantitative easing. Brief-term, this might imply worth drops all the way down to the $2,000 vary. If the pattern continues, nevertheless, then Ethereum may discover itself in a chronic consolidation interval or outright downtrend.”

ETH Eyes $2,000 Breakout Amid Strengthening RSI

ETH at present trades at $1,834, noting a 1% worth dip over the previous day. Regardless of the transient pullback, the bullish stress within the coin’s spot markets continues to strengthen, mirrored by the coin’s climbing Relative Energy Index (RSI).

At press time, this momentum indicator is at 57.68. ETH’s RSI readings sign rising bullish situations. This means that the altcoin has room for upward motion if shopping for stress will increase.

On this situation, its worth may break above $2,027.

Nonetheless, if shopping for stress loses momentum, ETH’s worth may fall to $1,733.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.