In early Could 2025, the Ethereum (ETH) market witnessed contrasting actions from massive buyers, generally referred to as whales.

These opposing behaviors from whales current buyers with each dangers and alternatives.

Contrasting Ethereum Whales’ Actions

On one hand, a number of Ethereum whales are accumulating ETH in massive portions. An ETH whale bought 3,029.6 ETH valued at $5.74 million. Nevertheless, this whale at the moment faces a short lived lack of $142,000 as the worth has dropped to $1,842 per ETH.

On Could 1, 2025, Lookonchain reported that a number of whale addresses gathered 1000’s of ETH inside two hours. These actions point out that some main buyers stay assured in ETH’s long-term potential regardless of short-term value volatility.

Then again, promoting stress from Ethereum whales is critical. On Could 2, 2025, OnchainLens reported {that a} whale deposited 2,680 ETH on Kraken, incurring an estimated lack of round $255,000.

In the meantime, analysts revealed that one other whale transferred 3,000 ETH to Kraken inside 10 minutes on the identical day, signaling a robust intent to promote.

Notably, a whale who obtained 76,000 ETH throughout the 2015 ICO bought 6,000 ETH, probably securing a revenue of $10.92 million.

Moreover, on Could 1, 2025, on-chain information confirmed a whale rising their quick place by borrowing a further 4,000 ETH. This whale is bringing their complete quick place to 10,000 ETH, equal to roughly $18.4 million.

These strikes spotlight a transparent divergence in Ethereum whale methods, with accumulation and promoting creating important stress on ETH’s value.

Market Context and Investor Sentiment

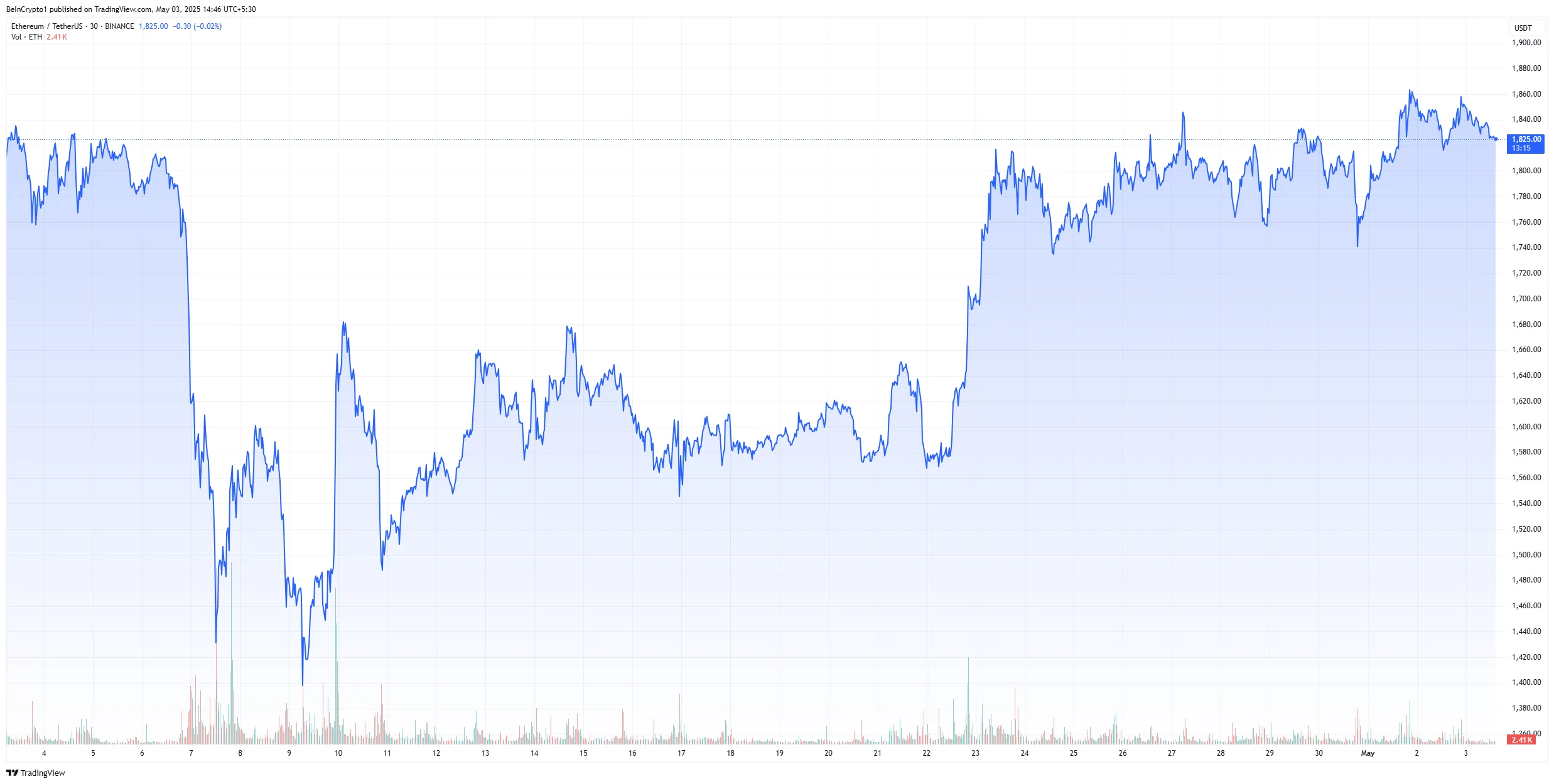

The volatility in whale conduct coincides with a crypto market influenced by varied components. In response to BeInCrypto, ETH’s value gained 10% in every week however barely decreased within the final 24 hours. It’s hovering round $1,842—a notable decline from its March 2025 peak of $2,500.

Regardless of this, market sentiment exhibits some constructive indicators. Ethereum funding merchandise additionally noticed US$183m inflows final week following an 8-week run of outflows. The Ethereum spot ETF had a complete internet influx of US$6.4932 million yesterday. This displays sustained long-term curiosity from establishments, even amid short-term promoting stress from whales.

Moreover, a whale’s massive 10,000 ETH quick place suggests expectations of a near-term value decline, probably amplifying downward stress if market sentiment turns adverse.

In the meantime, retail buyers seem like affected by this uncertainty, with ETH buying and selling quantity on exchanges dropping 10% over the previous 24 hours.

Dangers and Alternatives

The opposing actions of whales place buyers at a crossroads of dangers and alternatives. On the danger facet, the promoting stress from whales, notably the numerous quick place, may decrease ETH’s value within the quick time period, particularly given the overbought market situations.

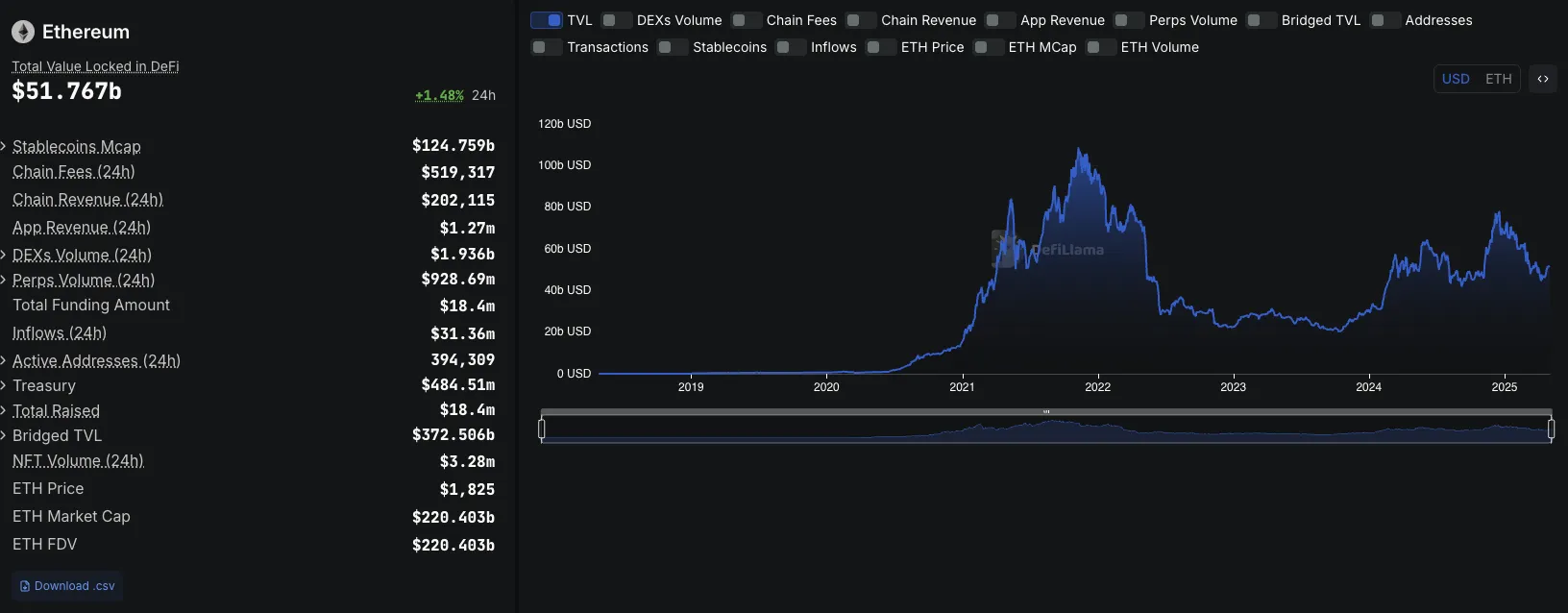

Nevertheless, alternatives additionally abound. Whales’ accumulation of 1000’s of ETH displays long-term confidence in Ethereum’s potential, notably because the community continues to steer in DeFi, with a complete worth locked (TVL) of $52 billion in Could 2025, in accordance with DefiLlama.

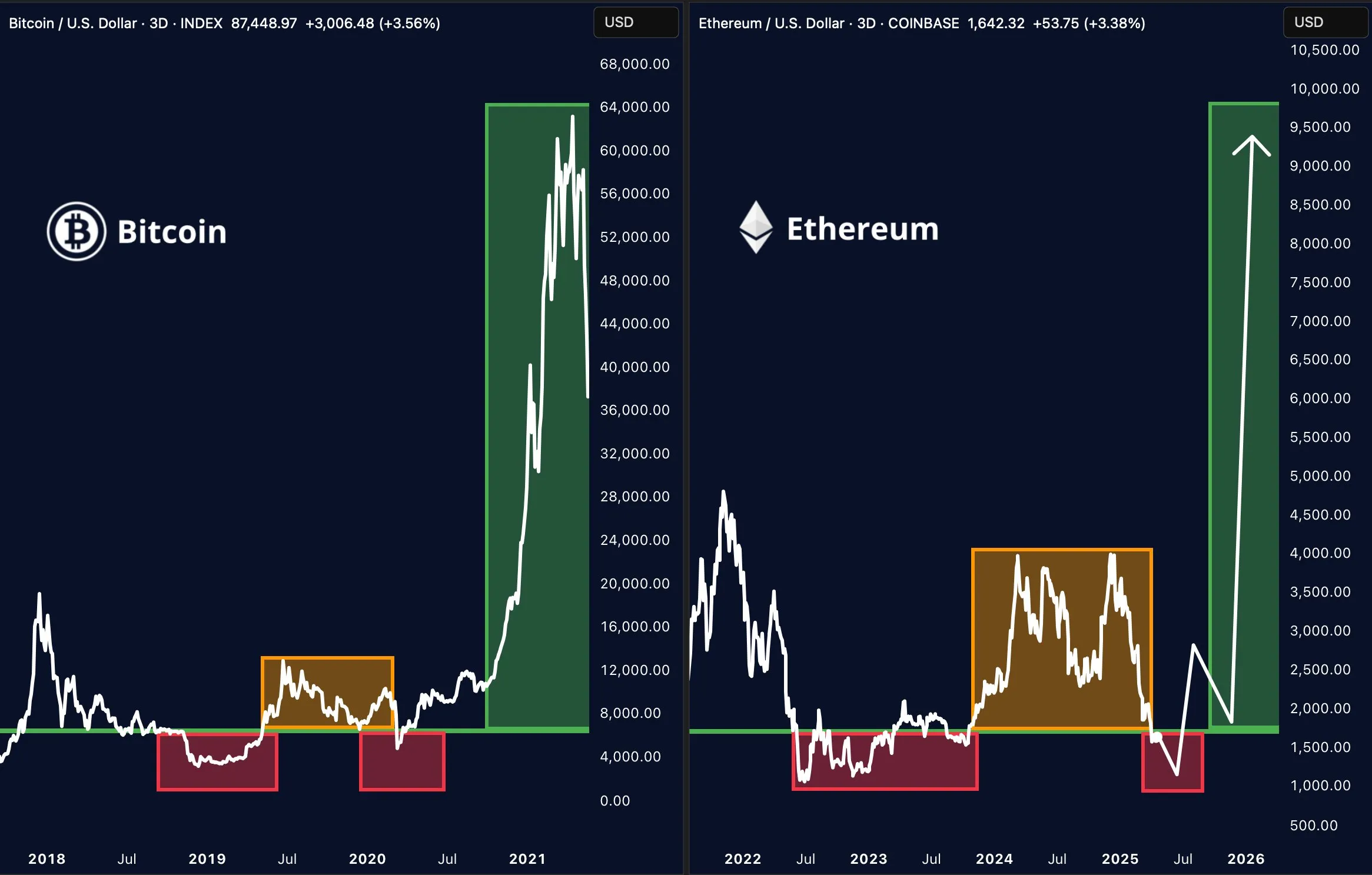

Analyst Merlijn has proven that Ethereum’s present value construction is much like that of Bitcoin in 2020. Accordingly, he believes that Ethereum will witness a robust growth if historical past repeats itself.

Ethereum dangers shedding builders to Solana, which is gaining momentum on account of higher startup help and a streamlined person expertise.

But, technical upgrades like Ethereum 2.0 and the expansion of Layer 2 options similar to Arbitrum and Optimism additionally help ETH’s long-term improvement.

Traders may view the present lower cost ranges as a possibility to build up, however they need to carefully monitor whale actions and technical indicators to mitigate correction dangers.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.