- Ethereum’s burn charge has plummeted resulting from decrease person exercise on the mainnet, resulting in a 95% drop in day by day ETH burned and pushing ETH’s circulating provide greater—creating inflationary stress and making it more durable to remain above $2,000.

- Customers are migrating to cheaper, quicker alternate options like Optimism and Solana, contributing to Ethereum’s decline in transaction quantity, although consultants nonetheless argue that ETH’s sturdy fundamentals and decentralization give it a long-term edge.

- ETH’s worth is hovering round $1,834 with its RSI climbing to 57.68, suggesting rising bullish momentum; a breakout previous $2,027 is feasible if shopping for stress holds, however a dip to $1,733 might happen if it weakens.

Ethereum’s been feeling kinda sluggish these days. Consumer exercise on the mainnet? Yeah, it’s taken a dive. And that’s not just a few summary subject—it’s obtained actual influence. Fewer customers means fewer transactions, and fewer transactions imply much less ETH is getting burned. And when much less ETH will get burned… you guessed it: extra ETH floats round.

So now we’ve obtained inflationary stress creeping again in. ETH’s been struggling to remain above that $2K line—prefer it simply retains slipping off the ledge.

Extra ETH, Much less Burn, Extra Issues?

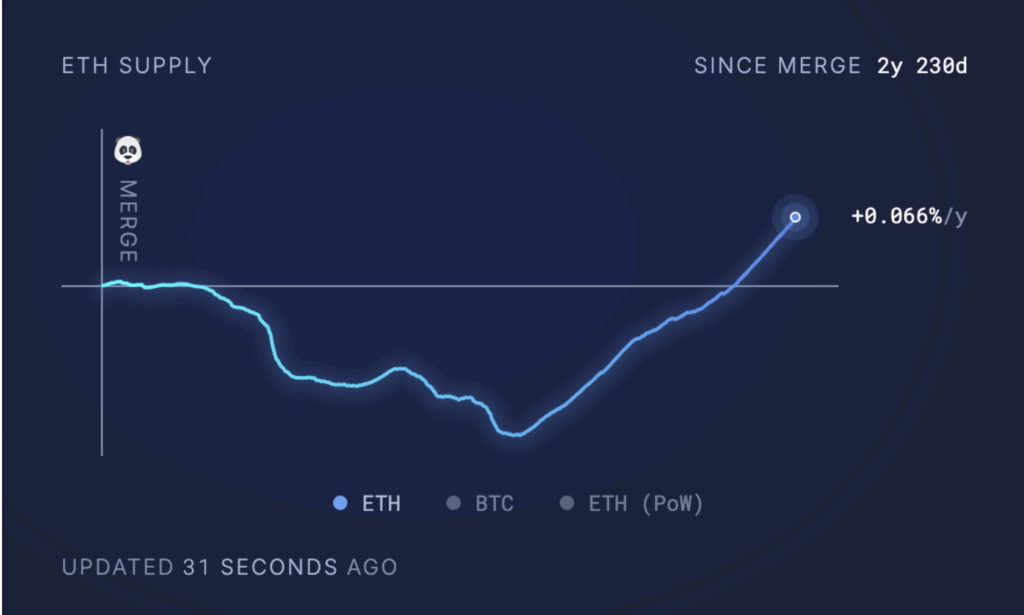

In response to Ultrasoundmoney, the previous month added round 72,927 ETH (roughly $134 million) to the entire provide. That places the present provide at over 120.7 million ETH—yep, greater than the place we had been pre-merge.

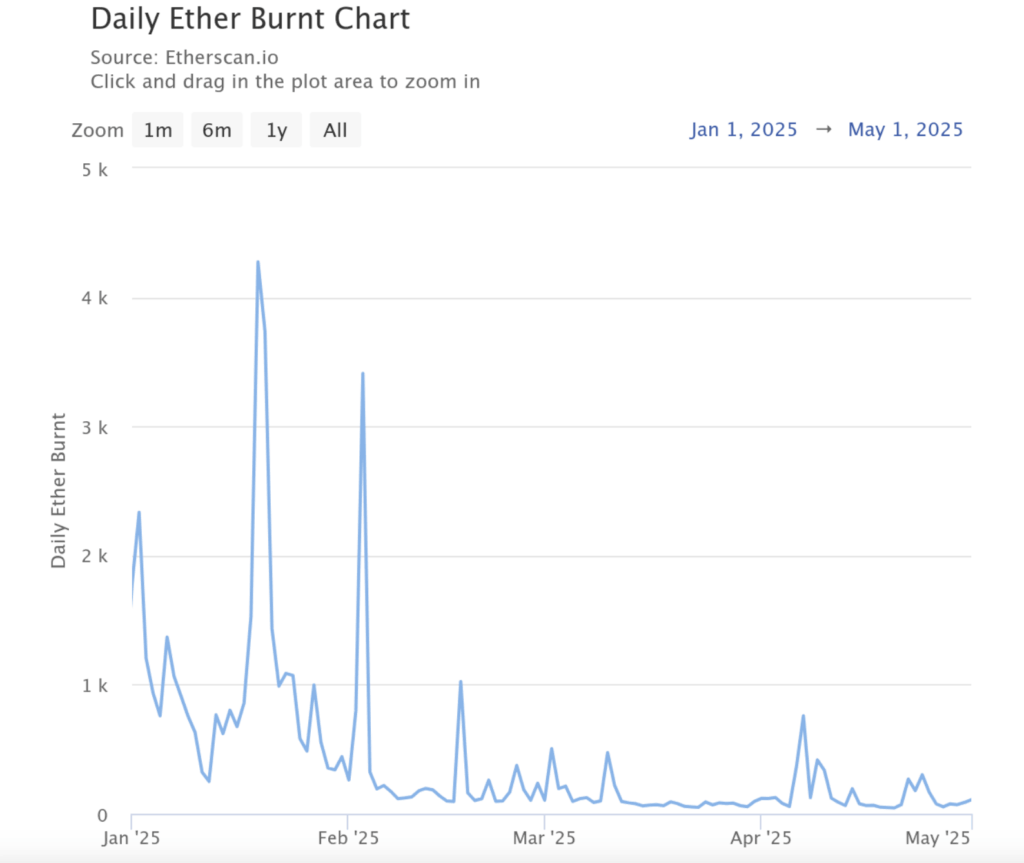

And right here’s the kicker: Etherscan exhibits day by day ETH burns have dropped 95% because the begin of the 12 months. On April 20, we hit all-time low with the bottom burn day but. Ouch.

Why’s Everybody Ditching Ethereum?

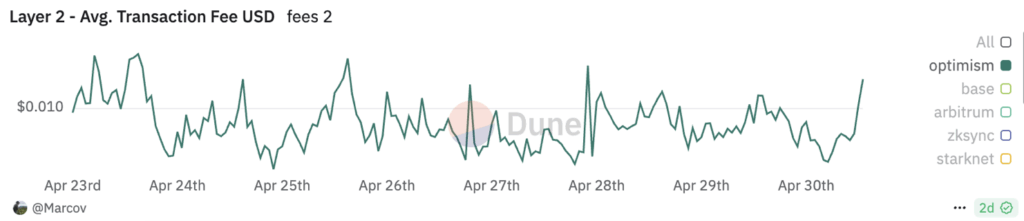

Actually, it’s not nearly Ethereum being “sluggish” or “costly” anymore—it’s about choices. Individuals are hopping over to Layer-2 networks like Optimism and Arbitrum. Why? Method cheaper charges and lightning-fast velocity.

Only for comparability: on April 30, Optimism had common charges round $0.024. Ethereum? A a lot steeper $0.18. Doesn’t take a genius to determine why people are switching.

Add within the rise of meme coin crazes over on Solana and different “ETH killers,” and Ethereum’s been left form of… out of the celebration.

Fundamentals Nonetheless Sturdy… Proper?

Regardless of all of the chatter, some consultants nonetheless imagine in ETH’s long-term muscle. Vincent Liu from Kronos Analysis says Ethereum continues to be crushing it once you take a look at whole worth locked—virtually $369 billion price. That’s no joke.

Positive, it ranks fifth in 24-hour charges behind different chains like Solana, Bitcoin, and BNB, however Liu thinks Ethereum nonetheless exhibits strong utilization and endurance.

Temujin Louie from Wanchain chimed in too, saying Ethereum’s construction—post-merge—continues to be an edge. Not like a bunch of Layer-1s which might be printing tokens like there’s no tomorrow, ETH can doubtlessly go deflationary. However… provided that there’s sufficient community exercise to justify the burn.

And yeah, even with Solana and different L1s stealing some thunder, Ethereum’s decentralization and historical past nonetheless make it a heavyweight within the room.

So, What’s Up With ETH’s Worth?

Properly, ETH’s been wobbling. It’s buying and selling round $1,834 proper now, down about 1% within the final 24 hours. However not all is doom and gloom—its RSI is climbing, sitting at 57.68. That’s a great signal that momentum’s quietly constructing.

If shopping for stress kicks in, we might see a push previous $2,027. But when bulls lose steam? It’d sink again to $1,733 territory.

Backside Line

Ethereum’s in a little bit of a bizarre spot. Fundamentals? Nonetheless strong. Burn charge? Not a lot. Consumer exercise? Yeah, that wants work. But when issues shift—if we get extra on-chain motion and demand picks up—ETH might rebound onerous. Till then, it’s all about watching that $2K stage like a hawk.