Briefly

- Technique introduced its 42-42 Capital Plan to amass $42 billion in fairness and glued revenue by 2027 regardless of posting a fifth consecutive quarterly loss.

- Cboe reported file earnings with 21% EPS development and highlighted its increasing crypto ecosystem together with new Bitcoin index choices and futures merchandise.

- Robinhood noticed 100% year-over-year development in crypto transaction income, however skilled a quarterly decline as it really works to diversify past crypto buying and selling.

Public Keys is a weekly roundup from Decrypt that tracks the important thing publicly traded crypto corporations.

This week: Technique goes full laser-eyes on its Bitcoin play, even because it posts a fifth straight quarterly loss; Cboe pats itself on the again for its “very nice” crypto ecosystem; and Robinhood sees crypto transactions take a dip whereas its premium Gold service continues gaining steam.

Bully for Technique

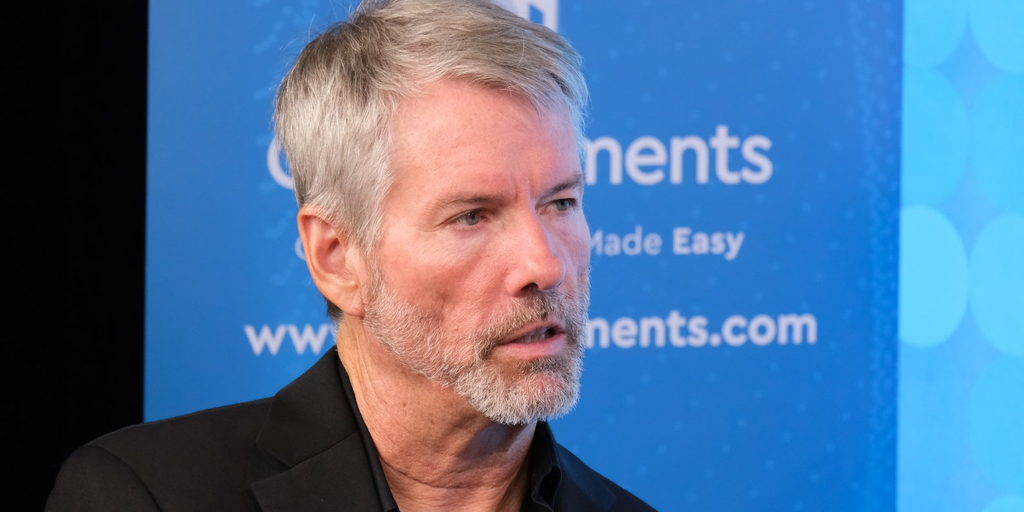

Bitcoin treasury and software program firm Technique, which trades on the Nasdaq beneath the MSTR ticker, unveiled its 42-42 Capital Plan throughout its Thursday earnings name.

The corporate famously pledged to boost $21 billion to amass extra Bitcoin. Now it desires to amass $42 billion in fairness and glued revenue by the top of 2027, in accordance with CEO Phong Le.

However even whereas the corporate actually doubled down on its bullish Bitcoin stance—and raised its 2025 Bitcoin yield projection from 15% to 25%—it posted a decline of $16.49 per frequent share.

That’s partially because of the firm pivoting from an on-premises to subscription mannequin with its software program clients. Yeah, bear in mind these? Technique has clients who pay for its knowledge analytics software program, regardless that it’s acquired nothing to do with Bitcoin.

“In Q1, complete software program revenues had been roughly $111 million, down 3.6% year-over-year,” Andrew Kang, chief monetary supply, mentioned throughout the name. “The decrease product license revenues, together with assist revenues in Q1, continues to be as anticipated, and our total income development continues to replicate the continued transition of our software program enterprise from on-prem to the cloud.”

The corporate has now reported 5 straight quarters of losses after having final seen a quarterly acquire of $89.1 million in This fall of 2023.

However analysts do not care. The inventory had climbed 3.35% to $394 as of shut Friday, after getting a lift from the likes of impartial veteran analyst Fred Krueger.

“Technique can have a stronger stability sheet than Apple inside 18 months,” he wrote on X earlier immediately.

Cboe’s “very nice ecosystem”

As Cboe, one of many largest international trade operators, notes record-high earnings per share and income on Friday, it additionally famous that it’s constructed a “very nice ecosystem round crypto there for patrons to have interaction in.”

First, the metrics. Tariffs have been hell for international markets, however they helped improve EPS by 21% to $2.37 and income by 16% to $565.2 million, the corporate mentioned Friday in its pre-market earnings report.

The catalyst was concern and uncertainty across the influence commerce wars might have on markets, in accordance with David Howsen, Cboe’s international president. He mentioned index choice quantity set a file in This fall 2024, across the time of the November U.S. election.

“That file has since been damaged a number of instances in April as commerce tensions escalated,” he mentioned throughout the incomes name.

In his subsequent breath, Howsen famous “encouraging development” within the firm’s new Bitcoin merchandise: “Most notably, our new Bitcoin index choices, tickers CBTX and MBTX.” These launched in December. And simply final week, Cboe launched CBO FTSE Bitcoin Index Futures (sure, it’s a mouthful), which trades beneath the XBTF ticker.

It’s a Bitcoin futures contract based mostly on the worth of BTC, and meant to permit traders one other strategy to hedge present Bitcoin exposures—together with holdings in spot Bitcoin, Bitcoin ETFs, or different derivatives.

Robinhood ebbs and flows

Buying and selling platform Robinhood, which trades on Nasdaq beneath the HOOD ticker, additionally reported Q1 earnings this week.

Like Cboe, HOOD put massive numbers on the board. The corporate noticed a 50% year-over-year improve in income. And crypto transaction income climbed 100%, to $252 million, when in comparison with the identical interval final 12 months.

However right here’s the catch: That crypto transaction income has fallen in comparison with final quarter, when it was $358 million.

CEO Vlad Tenev mentioned throughout the name that that’s to be anticipated, and that the corporate is working to diversify its enterprise so it might probably soak up the ebb and circulate of crypto buying and selling quantity with out a lot influence to its backside line.

“We’re diversifying the enterprise exterior of the crypto enterprise, which is able to make us much less reliant on crypto transaction volumes,” he mentioned on an earnings name Thursday. “But additionally inside crypto, there’s going to be diversification over time. So crypto itself will diversify and be much less reliant on transaction volumes sooner or later.”

He didn’t say how, precisely, crypto choices would change although.

As an alternative, all that glittered for Robinhood in Q1 was Gold.

“Once you have a look at the Gold bank card, we doubled the Gold cardholders to 200,000 simply previously few weeks and we love what we’re seeing,” Tenev mentioned throughout yesterday’s earnings name. And previously 12 months, Robinhood has practically doubled Gold subscribers to three.2 million, he added.

Robinhood Gold—no, not that sort—helped the corporate rake in $18 billion value of internet deposits in Q1. The Silicon Valley-based buying and selling platform gilded the providing for its premium subscribers throughout a presentation on March 27.

The brand new perks embrace “tailor, expert-managed portfolios” managed by former Wall Avenue merchants who used to serve institutional and high-net-worth traders, personal jet journey, and same-day supply of money direct to a buyer’s doorstep.

Different Keys

- Excessive stakes: Crypto corporations are actually pushing for the SEC to make clear that “crypto staking and related providers” don’t fall beneath the shadow of its rules. If there have been readability, then U.S. spot Ethereum ETFs would get a lift and not less than have the ability to pull stage with their counterparts in different components of the world.

- Welcome to Florida, Metaplanet: The Japanese Bitcoin treasury firm is on its strategy to the states. The corporate will function its new entity, Metaplanet Treasury Corp., with a aim to boost $250 million to additional gasoline its Bitcoin treasury technique.

- Riot’s blended outcomes: Bitcoin miner Riot Platforms shared Q1 earnings on Thursday, disclosing blended outcomes. The agency’s income beat expectations and was up 13% from the earlier quarter, but Riot swung to a $296.4 million loss, or $0.90 per share.

Edited by Andrew Hayward

Every day Debrief E-newsletter

Begin on daily basis with the highest information tales proper now, plus authentic options, a podcast, movies and extra.