President Trump is once more urging decrease rates of interest after bullish US employment knowledge. Some analysts are hopeful that new price cuts will generate constructive momentum for Bitcoin.

Nevertheless, there are not any indicators that Powell will change his thoughts. If something, it’s even much less doubtless. Tariffs may trigger unprecedented chaos, and the financial system doesn’t want price cuts to outlive proper now.

Can Trump Compel Cuts to US Curiosity Charges?

Earlier as we speak, the US Bureau of Labor Statistics launched its newest jobs report, which appears fairly bullish within the face of recession fears.

Whole nonfarm payroll employment elevated by 177,000, far outperforming expectations, whereas unemployment remained regular and wages went up. This prompted President Trump to ask as soon as once more for cuts to the rate of interest:

President Trump has repeatedly requested Federal Reserve Chair Jerome Powell to chop rates of interest. The crypto business has additionally closely advocated for such a transfer, which might encourage funding in risk-on belongings.

Nevertheless, each Powell and different Fed higher-ups have been very clear that tariffs are too unpredictable to permit additional price cuts.

Powell’s place has been very constant. Tariffs may severely injury the financial system, and the Federal Reserve must hold its powder dry to stave off future collapse. If it reduce charges after bullish information, the Fed would have one much less potential device within the occasion of an actual disaster.

Trump even threatened to fireside Powell over the speed reduce subject, however relented after the markets panicked. He can’t legally fireplace Powell; ousting such a outstanding regulator would undoubtedly trigger chaos.

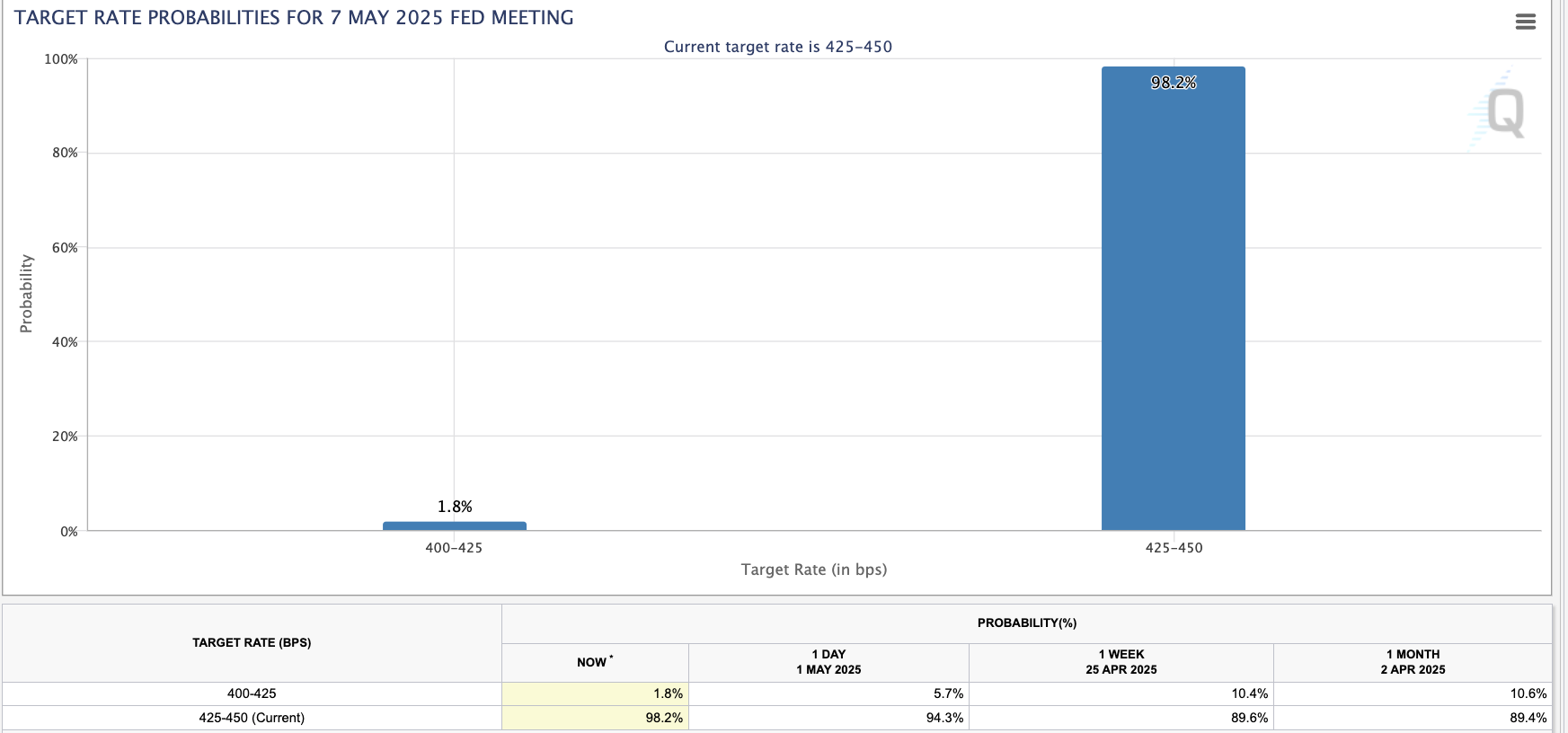

After the roles report got here out, the market anticipated fewer price cuts, and the CME reported that an adjustment in Might is nearly inconceivable.

To place it bluntly, there’s a very low likelihood that Trump will get his desired price cuts quickly. Justin Wolfers, an economist on the College of Michigan, defined why the bullish report really makes price cuts much less doubtless:

“I’m nearly sure that the Fed stays on maintain at its subsequent assembly. The actual financial system (to date) is robust sufficient to not warrant a price reduce. And the large questions are all simply over the horizon. Powell has been clear: He doesn’t need to guess what’s over that horizon, he desires to attend & see. The report is totally legit. White Home interpretations are a special subject,” he mentioned.

President Trump desires these price cuts, however can’t power the difficulty with out inflicting larger issues. As a result of the tariffs are so chaotic and unpredictable, false rumors have moved the crypto market on a number of current events.

Merchants ought to stay cautious round hypothesis that appears too good to be true.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.