|

High Tales of The Week

Bitcoin is a matter of nationwide safety — Deputy CIA director

The US Central Intelligence Company is more and more incorporating Bitcoin as a software in its operations, and dealing with the cryptocurrency is a matter of nationwide safety, Michael Ellis, the company’s deputy director, informed podcast host Anthony Pompliano.

In an look available on the market analyst and investor’s The Pomp Podcast present, Ellis informed Pompliano that the intelligence company works with regulation enforcement to trace BTC, and it’s a level of knowledge assortment in counter-intelligence operations. Ellis added:

“Bitcoin is right here to remain — cryptocurrency is right here to remain. As you understand, increasingly more establishments are adopting it, and I believe that may be a nice pattern. One which this administration has clearly been leaning ahead into.”

Kraken tells the way it noticed North Korean hacker in job interview

US crypto alternate Kraken has detailed a North Korean hacker’s try and infiltrate the group by making use of for a job interview.

“What began as a routine hiring course of for an engineering position rapidly was an intelligence-gathering operation,” the corporate wrote in a Could 1 weblog submit.

Kraken stated the applicant’s purple flags appeared early on within the course of after they joined an interview below a reputation completely different from what they utilized with and “sometimes switched between voices,” apparently being guided via the interview.

Fairly than instantly rejecting the applicant, Kraken determined to advance them via its hiring course of to assemble details about the ways used.

EU to ban nameless crypto accounts and privateness cash by 2027

The European Union is about to impose sweeping Anti-Cash Laundering (AML) guidelines that may ban privacy-preserving tokens and nameless cryptocurrency accounts from 2027.

Below the brand new Anti-Cash Laundering Regulation (AMLR), credit score establishments, monetary establishments and crypto asset service suppliers (CASPs) shall be prohibited from sustaining nameless accounts or dealing with privacy-preserving cryptocurrencies, resembling Monero and Zcash.

“Article 79 of the AMLR establishes strict prohibitions on nameless accounts […]. Credit score establishments, monetary establishments, and crypto-asset service suppliers are prohibited from sustaining nameless accounts,” based on the AML Handbook, printed by the European Crypto Initiative.

Ether extra ‘like a memecoin,’ says buying and selling agency as ETH drops 45% YTD

As Ether’s value has struggled within the first quarter of 2025, a US-based funding adviser agency, Two Prime, has dropped help for ETH and adopted a Bitcoin-only technique.

After lending $1.5 billion in loans each in Bitcoin and Ether over the previous 15 months, Two Prime determined to ditch ETH to focus solely on BTC asset administration and lending, the agency introduced on Could 1.

“ETH’s statistical buying and selling conduct, worth proposition, and neighborhood tradition have failed past a degree that’s price participating,” Two Prime said.

Learn additionally

Options

‘Ethical accountability’: Can blockchain actually enhance belief in AI?

Options

Most DePIN tasks barely even use blockchain: True or false?

The agency’s shift to a Bitcoin-only strategy comes as ETH has misplaced 45% of its worth year-to-date, with some optimists speculating that ETH is probably near the underside and reversing its damaging pattern quickly.

Motion Labs suspends co-founder following MOVE market turmoil

Motion Labs confirmed the suspension of its co-founder, Rushi Manche, following controversies over a market maker deal that he brokered.

Motion introduced the suspension of Manche in a Could 2 X submit, explaining that the “choice was made in mild of ongoing occasions.” The choice follows Coinbase’s latest choice to droop the Motion Community (MOVE) buying and selling, citing the token’s failure to satisfy its itemizing requirements.

The suspension got here after a just lately introduced third-party evaluation requested by the Motion Community Basis into an settlement orchestrated by Manche with Rentech — the latter helped dealer an settlement with market maker Web3Port. Personal intelligence agency Groom Lake is conducting the investigation.

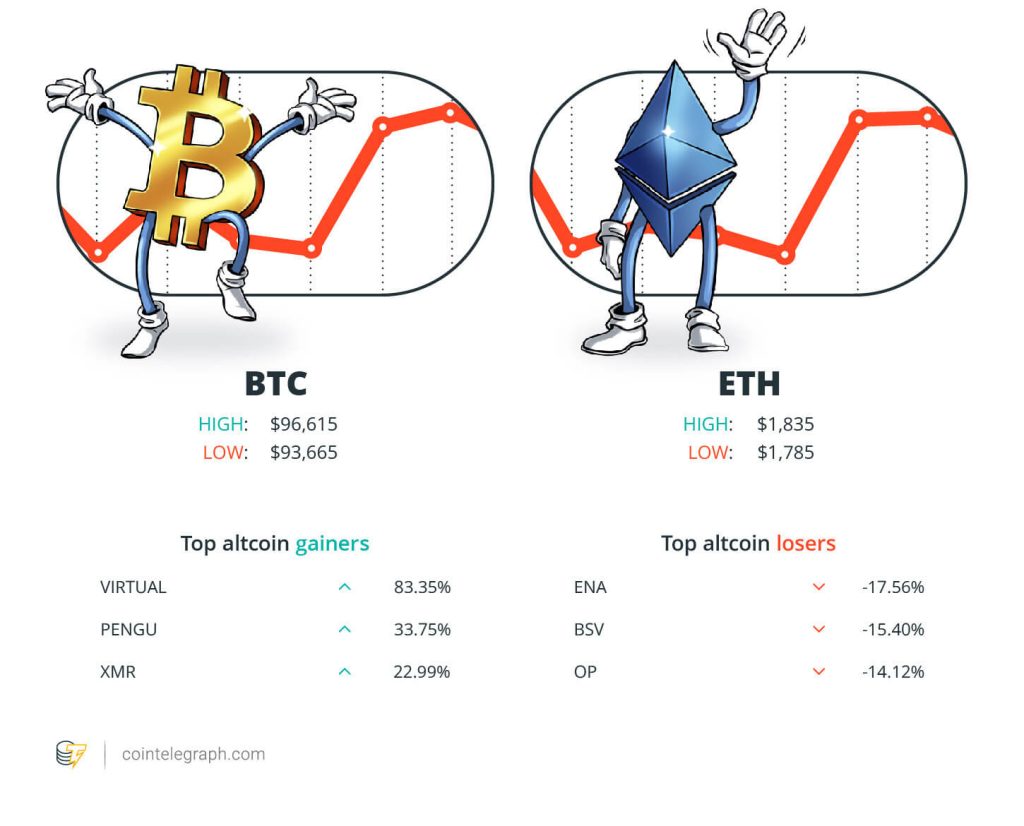

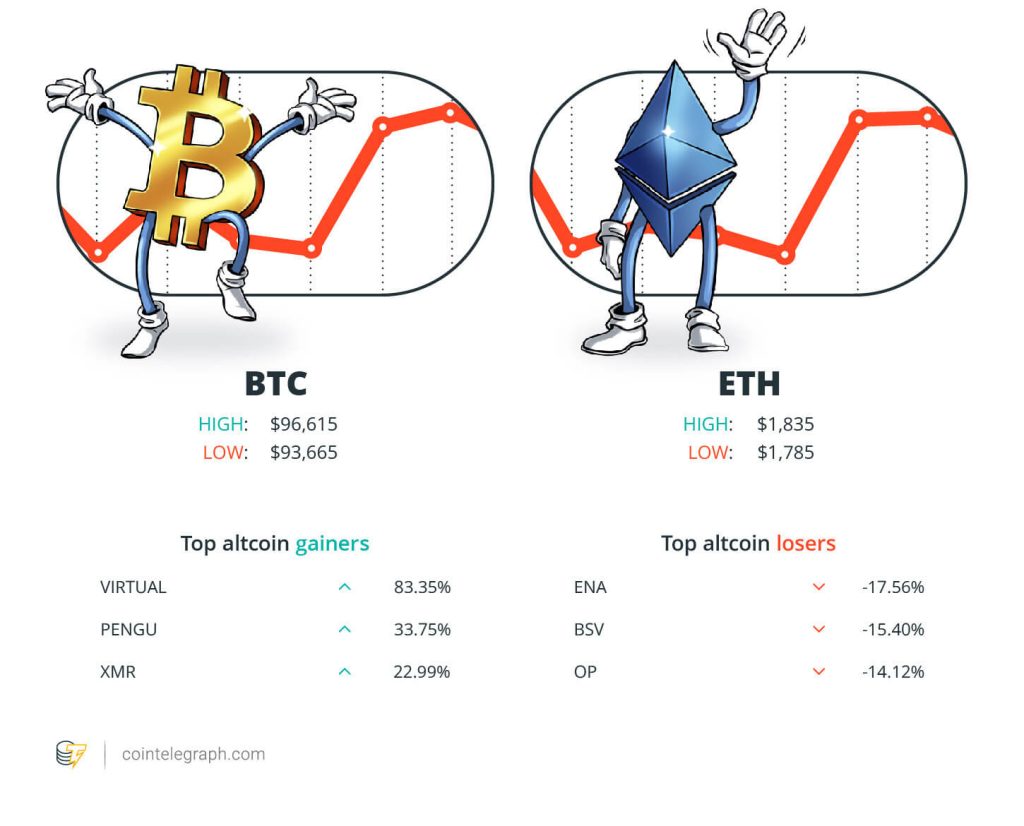

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $96,615, Ether (ETH) at $1,835 and XRP at $2.20. The overall market cap is at $3.01 trillion, based on CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Virtuals Protocol (VIRTUAL) at 83.35%, Pudgy Penguins (PENGU) at 33.75% and Monero (XMR) at 22.99%.

The highest three altcoin losers of the week are Ethena (ENA) at 17.56%, Bitcoin SV (BSV) at 15.40% and Optimism (OP) at 14.12%. For more information on crypto costs, ensure to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“Our in-house prediction is $1 million by 2029. In order that Bitcoin will match gold’s market cap and complete addressable market by 2029.”

André Dragosch, director and head of European analysis at Bitwise

“That is what I wish to see if Bitcoin can comply with via right this moment. A pleasant huge squeeze into the low 100Ks.”

AlphaBTC, crypto analyst

“I believe freedom of cash is vital, however to have freedom of cash, you need to have freedom of speech. Freedom of speech is type of the underside line. Should you don’t have that, nothing — no different freedom — works.”

Changpeng “CZ” Zhao, former CEO of Binance

“I made a decision to not apply to the MiCA license as a result of I want to guard the 400 million+ customers that we have now all over the world. They aren’t as fortunate as Europeans.”

Paolo Ardoino, CEO of Tether

“I’m telling you, if the banks don’t watch what’s coming, they’re going to be extinct in 10 years.”

Eric Trump, government vice chairman of the Trump Group

“Regardless of who will get in, we’re in a greater place than we had been a couple of 12 months in the past.”

Amy-Rose Goodey, CEO of the Digital Financial system Council of Australia

Prediction of the Week

Bitcoin to $1M by 2029 fueled by ETF and gov’t demand — Bitwise exec

Bitcoin’s increasing institutional adoption might present the “structural” inflows essential to surpass gold’s market capitalization and push its value past $1 million by 2029, based on Bitwise’s head of European analysis, André Dragosch.

“Our in-house prediction is $1 million by 2029. In order that Bitcoin will match gold’s market cap and complete addressable market by 2029,” he informed Cointelegraph in the course of the Chain Response day by day X areas present on April 30.

Gold is at present the world’s largest asset, valued at over $21.7 trillion. Compared, Bitcoin’s market capitalization sits at $1.9 trillion, making it the seventh-largest asset globally, based on CompaniesMarketCap knowledge.

FUD of the Week

US Treasury needs to chop off Huione over ties to crypto crime

The US Treasury Division is in search of to bar the Cambodia-based Huione Group from accessing the American banking system, accusing the corporate of serving to North Korea’s state-sponsored Lazarus Group launder cryptocurrency.

The Treasury’s Monetary Crimes Enforcement Community (FinCEN) proposed on Could 1 to ban US monetary establishments from opening or sustaining correspondent or payable-through accounts for or on behalf of the Huione Group.

Learn additionally

Options

Crypto Crimes Rated: From the Twitter Hackers to Not Your Keyser, Not Your Cash

Columns

It’s best to ‘go and construct’ your personal AI agent: Jesse Pollak, X Corridor of Flame

Huione Group has established itself because the “market of alternative for malicious cyber actors” just like the Lazarus Group, who’ve “stolen billions of {dollars} from on a regular basis Individuals,” US Treasury Secretary Scott Bessent stated in a Could 1 assertion.

Professional-crypto senator pushes again on Trump’s memecoin dinner — Report

Senator Cynthia Lummis and at the least one different Republican in Congress are reportedly important of US President Donald Trump for providing the highest holders of his memecoin a dinner and White Home tour.

In accordance with a Could 2 CNBC report, Lummis stated the concept the US president was providing unique entry to himself and the White Home for folks prepared to pay for it “offers [her] pause.” She wasn’t the one member of the Republican Occasion to be important of Trump’s memecoin perks, introduced on April 23, roughly three months after the then-president-elect launched the TRUMP token.

“I don’t assume it could be acceptable for me to cost folks to return into the Capitol and take a tour,” stated Republican Senator Lisa Murkowski, based on NBC Information.

UK regulator strikes to limit borrowing for crypto investments

The UK’s monetary regulator, the Monetary Conduct Authority (FCA), plans to cease retail buyers from borrowing cash to fund their crypto investments.

In accordance with a Could 2 Monetary Occasions report, the ban on borrowing to fund crypto purchases is among the upcoming crypto guidelines by the FCA. David Geale, FCA government director of funds and digital finance, informed the FT that “crypto is an space of potential progress for the UK, however it needs to be executed proper.” He added:

“To do this we have now to offer an acceptable degree of safety.”

High Journal Tales of The Week

Crypto wished to overthrow banks, now it’s changing into them in stablecoin struggle

Should you can’t beat them, be part of them. Crypto companies have gotten banks, or bank-like, to adjust to stablecoin legal guidelines within the US, EU and Hong Kong.

Japanese porn star’s coin purple flags, Alibaba-linked L2 runs at 100K TPS: Asia Categorical

JAV porn star Yua Mikami’s Solana memecoin targets Chinese language buyers, Alibaba subsidiary Ant Digital launches Ethereum layer 2 to hitch RWA race, and extra.

ZK-proofs are bringing good contracts to Bitcoin — BitcoinOS and Starknet

Nearly $2 trillion price of Bitcoin may very well be used natively in DeFi if Starknet and BitcoinOS efficiently add good contract performance by way of ZK-proofs.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.