Crypto change Bybit is broadening its scope past digital property because it prepares to launch new buying and selling choices, together with US equities, commodities, and indices.

The change, identified for its crypto leverage merchandise, goals to introduce these choices earlier than the top of the present quarter.

Trump-Period Professional-Crypto Insurance policies Gasoline Bybit’s Transfer Into Equities

On Could 3, Bybit CEO Ben Zhou confirmed the event throughout a Livestream occasion. He famous that customers will quickly be capable of commerce devices corresponding to gold, crude oil, and main US shares like Apple and MicroStrategy.

These additions considerably shift Bybit’s product technique and replicate the platform’s ambition to serve a wider set of retail and institutional traders.

The buying and selling options will combine with Bybit’s present infrastructure. This contains the MetaTrader 5 (MT5) platform, which already helps leveraged gold buying and selling. Customers can entry as much as 500x leverage on choose devices, a characteristic that appeals to high-risk merchants.

Notably, gold and oil buying and selling have been accessible on the platform in a restricted kind. So, including US shares poses a extra direct problem to platforms like Robinhood, which merge crypto with conventional finance.

In the meantime, Bybit’s transfer displays a bigger development within the monetary business the place the boundaries between crypto-native platforms and conventional brokerages have gotten much less outlined.

In latest months, a number of conventional buying and selling platforms have signaled curiosity in providing crypto merchandise. On the identical time, exchanges like Bybit are including conventional property to match investor demand.

The shift additionally follows rising coverage help for digital property underneath President Donald Trump’s present administration.

Trump has adopted a extra favorable stance towards crypto innovation. This has resulted in a coverage surroundings that’s driving companies like Bybit to diversify and stay aggressive.

In the meantime, this product growth transfer follows a significant safety breach in February. The platform was just lately focused in an exploit that resulted within the theft of 500,000 ETH, valued at roughly $1.5 billion.

Zhou acknowledged {that a} portion of the stolen funds—roughly 28%—have turn into untraceable as a result of attacker’s laundering efforts. Nonetheless, the change is working with the broader neighborhood to hint the remaining funds.

Regardless of this setback, Bybit seems to be regaining momentum.

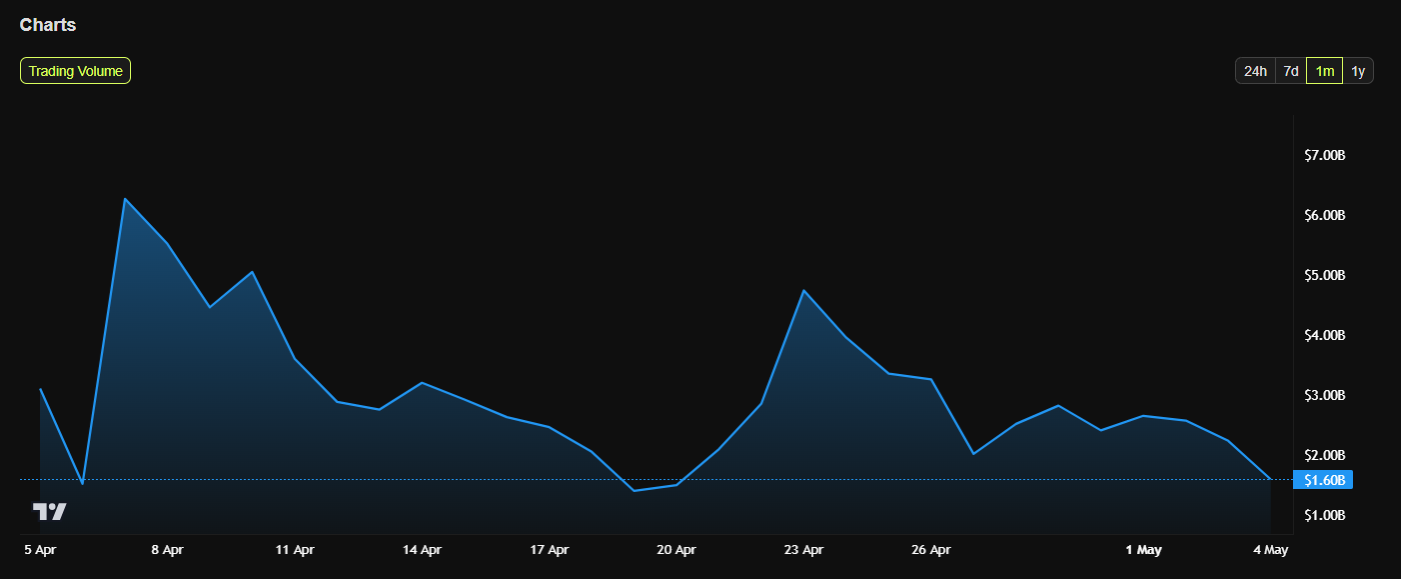

In accordance with knowledge from BeInCrypto, consumer exercise and buying and selling quantity are climbing again to ranges seen earlier than the exploit, suggesting that confidence within the platform is returning.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.