- Whale Exercise Indicators Hassle: A serious investor shorted HYPE with 5x leverage after depositing $6.51M USDC, elevating bearish strain throughout the market.

- Market Sentiment Weakening: Lengthy liquidations far outpaced shorts, funding charges are flat, and retail curiosity has dropped—indicators that merchants are cautious and momentum is fading.

- Key Resistance Blocks Progress: HYPE is caught under the $22 resistance. If bulls can’t reclaim that stage, a drop towards the $18 help zone appears seemingly.

Effectively, issues simply acquired a bit shaky for HYPE.

An enormous-time whale not too long ago dropped a hefty 6.51 million USDC into Hyperliquid and opened up a 5x quick place—not precisely a bullish vote of confidence. Strikes like this have a tendency to rattle the market, and this one’s no completely different. That quick might simply gas extra draw back strain if the dominos begin to fall.

Regardless of the bearish vibes, HYPE continues to be holding at round $20.54 proper now, up about 1.7% within the final 24 hours. However don’t let the inexperienced idiot you—there’s turbulence underneath the floor.

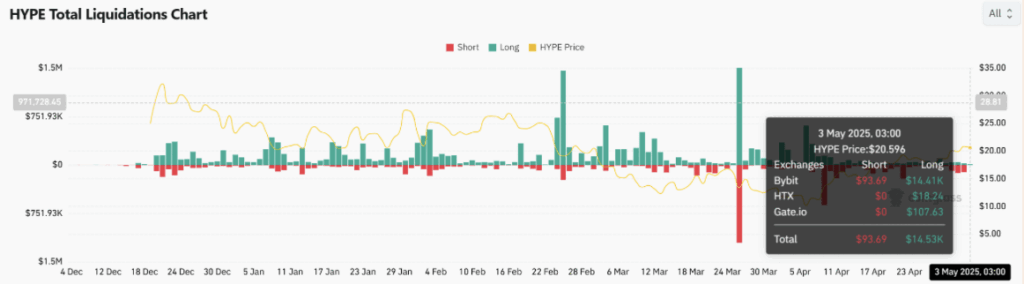

Lengthy Liquidations Pile Up

CoinGlass knowledge exhibits a reasonably nasty imbalance: round $14,000 price of lengthy positions have been liquidated, in comparison with simply $93 in shorts. Ouch.

Mainly, bulls are getting rinsed proper now. The market’s leaning bearish, and these liquidation numbers are simply including gas to that fireplace. If this retains up, we might see HYPE take one other dip—particularly if extra longs get flushed out.

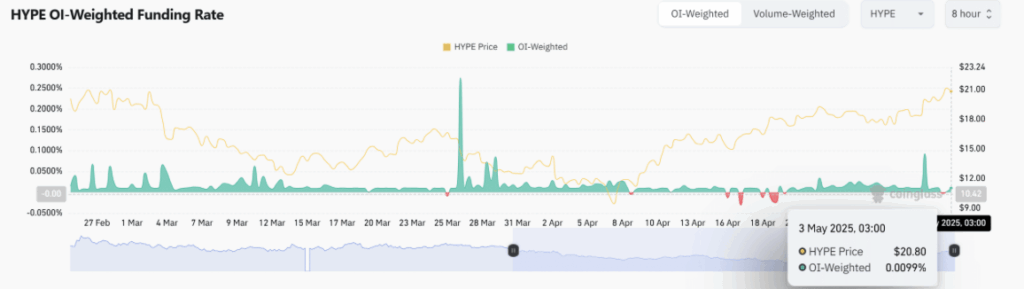

Merchants Taking part in It Secure

Funding charge? Nonetheless constructive, however barely—sitting at 0.00999% finally verify. It’s an indication that merchants are being actual cautious, not speeding to make large bets in both path.

This sort of hesitation often means one factor: chop. With no clear breakout or breakdown, HYPE would possibly simply keep caught in its present zone. No person’s actually pulling the set off but, and it exhibits.

That Pesky $22 Wall

HYPE’s been attempting (and failing) to interrupt above the $22 resistance zone. It’s type of like watching somebody attempt to push by way of a locked door. Each try simply fizzles out.

Proper now, the worth is hovering round $20.60, nevertheless it’s not making any actual progress. Except bulls handle to muscle previous that $22 mark, the trail decrease—possibly even to $18—appears extra seemingly.

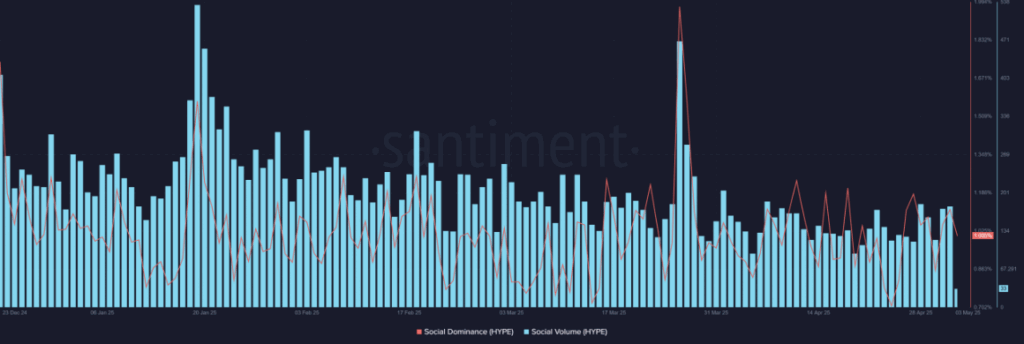

Retail Hype? Not So A lot

It’s not simply the worth motion—retail curiosity is cooling too.

Social Dominance has slipped to 1.00%, and Social Quantity is at a low 33. That’s not nice. When merchants cease speaking, it’s usually an indication the hype practice’s working out of steam.

With out recent curiosity from retail crowds, the push wanted to reclaim misplaced floor simply isn’t there. This weakening social chatter kinda reinforces the bearish tilt.

Last Take

Proper now, the vibe round HYPE is leaning bearish. An enormous whale shorting, a wave of lengthy liquidations, comfortable funding charges, and fading retail buzz—all of it provides up.

Except bulls present up in pressure or we see some type of breakout above $22, HYPE would possibly simply preserve drifting towards that $18 help stage. For now, it’s a ready recreation.