XRP is more and more being considered as a serious contender within the cryptocurrency house, not merely for its market rank however for the in depth infrastructure backing it.

Over the previous decade, Ripple—the corporate behind XRP—has constructed a strong world funds system that now spans over 55 nations and companions with greater than 350 monetary establishments.

This achievement locations it far forward of many crypto initiatives that also depend on potential future utility somewhat than confirmed real-world use.

Not like speculative tokens that make guarantees, Ripple is actively executing on its imaginative and prescient, demonstrating a capability to scale, combine with conventional finance, and serve crucial monetary features throughout borders.

Sometimes called a “sleeping large,” XRP is seen as an undervalued asset with vital untapped potential. The metaphor highlights the assumption that a lot of its capabilities and worth stay hidden from most of the people and even the broader crypto neighborhood.

This notion stems from XRP’s sheer measurement, attain, and integration with world banking methods. Establishments equivalent to your complete Japanese banking community have proven curiosity in Ripple’s know-how, and the infrastructure it has developed is already in use—not merely theoretical or pending future launches.

Supply – Austin Hilton on YouTube

Ripple’s Authorized Readability and Monetary System Alignment May Be XRP’s Launchpad

One of the vital notable facets of Ripple’s journey is its resilience within the face of regulatory challenges. It’s the solely main cryptocurrency to emerge from a multi-year authorized battle with the U.S. Securities and Change Fee (SEC) with a partial authorized victory, creating extra regulatory readability round its standing.

The decision of this lawsuit, particularly with adjustments in regulatory management, is anticipated to unlock vital institutional curiosity and open the floodgates for wider adoption. Monetary entities which have been hesitant to announce partnerships because of regulatory uncertainty could now be extra keen to maneuver ahead.

The alignment of Ripple’s objectives with the normal monetary system is one other issue fueling optimism. Relatively than disrupting legacy banking establishments, Ripple goals to boost the velocity, cost-efficiency, and transparency of cross-border transactions.

Its actual competitors lies with outdated methods like SWIFT, not with banks themselves. This distinction makes Ripple’s proposition extra enticing to monetary entities that search modernization with out systemic disruption.

Furthermore, the potential introduction of an XRP belief by funding large BlackRock provides one other layer of anticipation and credibility to the asset. If such a improvement materializes, it will function a strong endorsement and sure appeal to institutional capital.

Ripple is positioning itself to faucet into the $150 trillion world cross-border funds market—a determine projected to double by the top of the last decade. With its present infrastructure, Ripple is well-equipped to assert a considerable share of this increasing market.

XRP’s basis shouldn’t be constructed on hype, however on a decade of execution, adoption, and strategic positioning. Its progress goes past market hypothesis, resting as a substitute on real-world utility, regulatory evolution, and growing alignment with institutional wants.

Because the market begins to acknowledge the complete scope of Ripple’s accomplishments and potential, XRP could certainly show to be probably the most underestimated property within the digital finance panorama.

XRP Worth Prediction

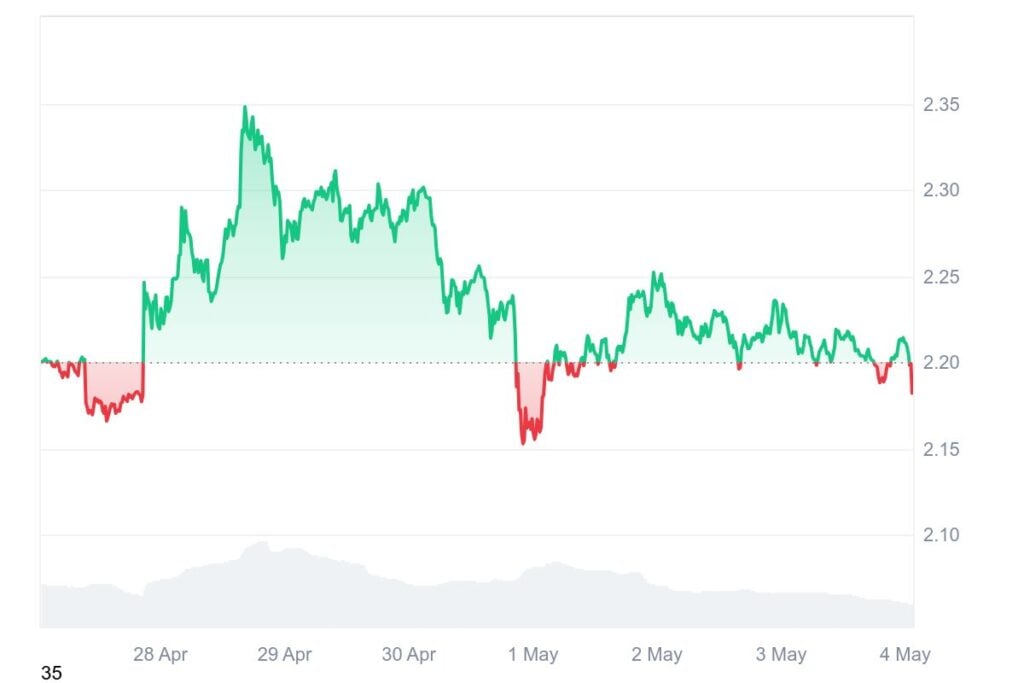

$XRP continues to show unusually steady worth conduct, hovering in a good buying and selling vary that has endured since late April.

Whereas this stability may appear boring to some merchants, it really indicators relative power in a unstable crypto market—particularly when evaluating XRP’s present place to the place it stood in late November or early December.

At current, $XRP is consolidating between a resistance zone of roughly $2.26 to $2.28 and a help vary of $2.15 to $2.18. This slim vary has restricted upside potential within the brief time period, with a possible breakout providing a 9% achieve, whereas the danger of a drop to $2.05 poses round a 7% loss.

Given these dynamics, extra enticing purchase alternatives lie both above the present resistance or at decrease help ranges. A confirmed breakout above $2.28 with robust quantity might open the door to a transfer towards $2.41, providing a greater risk-reward ratio with restricted draw back.

Alternatively, if Bitcoin initiates a broader market pullback, $XRP might discover compelling purchase zones close to $2.05 and even as little as $1.65, the place robust historic help stays.

Whereas short-term worth motion is prone to stay muted except triggered by main Bitcoin shifts or XRP-specific information, the general outlook leans bullish, with focus positioned on breakout shopping for alternatives somewhat than accumulation within the present vary.

With the Market Rebounding, Finest Pockets Turns into a Go-To for Secure, Sensible Crypto Storage

Because the crypto market exhibits indicators of restoration, Austin Hilton additionally discusses how having a dependable and safe pockets has by no means been extra necessary—and Finest Pockets (BEST) stands out as a prime contender in assembly that want.

It’s a feature-rich, multi-chain, non-custodial cryptocurrency pockets designed to present customers full management over their digital property. Not like conventional custodial companies, the place consumer funds are held by third events, Finest Pockets ensures that customers preserve possession by means of personal key administration.

This core precept of “not your keys, not your tokens” addresses issues raised by quite a few trade collapses in recent times, which noticed many buyers lose entry to their funds. By empowering customers with full autonomy, Finest Pockets units a better commonplace for security and transparency within the digital asset house.

Performance is the place Finest Pockets actually distinguishes itself. The app integrates an in-wallet crypto shopping for system, enabling customers to buy digital property with aggressive trade charges and low processing charges.

Its seamless design permits for the safe storage and administration of all kinds of crypto throughout over 60 totally different blockchains, together with Bitcoin, Ethereum, BNB Chain, and Solana.

Whether or not customers are managing tokens from established chains or exploring rising ones, Finest Pockets serves as a unified hub. Along with primary pockets companies, it presents built-in decentralized swapping. Customers can commerce any supported token inside the app, eliminating the necessity to go to exterior exchanges.

The pockets additionally helps portfolio monitoring, with the power to create a number of wallets tailor-made to totally different methods—equivalent to holding, staking, or collaborating in presales. Finest Pockets supplies early entry to accomplice token launches by means of a characteristic referred to as the “Upcoming Tokens.”

This instrument helps customers analysis, consider, and put money into early-stage initiatives by analyzing whitepapers, tokenomics, and different related information earlier than a pre-sale formally begins. Finest Pockets additionally consists of staking choices, permitting customers to earn rewards by locking their tokens.

Staking the native $BEST token presents extra perks, together with diminished transaction charges and potential debit card advantages. A crypto debit card characteristic inside the app permits customers to spend their holdings whereas incomes as much as 8% cashback on purchases.

This makes Finest Pockets a viable on a regular basis monetary instrument, not only a storage answer. The $BEST token is presently in its presale section, having raised near $12 million, with every token priced at $0.02495.

Safety is a prime precedence, with the platform incorporating superior fraud prevention mechanisms and restoration instruments. Customers can relaxation assured understanding their digital property are protected with cutting-edge know-how. To encourage consumer adoption, Finest Pockets is presently internet hosting an airdrop marketing campaign.

Individuals can earn $BEST tokens by finishing in-app duties, partaking on social media, or referring new customers. Nevertheless, time is restricted — the airdrop formally ends on Might fifteenth.

With its roadmap aiming to help 60+ blockchains, embrace restrict orders, and implement dollar-cost averaging instruments, Finest Pockets is positioning itself as an all-in-one answer for contemporary crypto buyers. Go to Finest Pockets token presale right here.

This text has been offered by one in every of our business companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our business companions could use affiliate packages to generate revenues by means of the hyperlinks on this text.