|

Ethereum builders shall be holding their breath for the 12 minutes it takes to work out if Ethereum’s Pectra onerous fork has finalized correctly after it’s deployed tomorrow.

Throughout each Ethereum onerous fork, there’s roughly a 12-minute interval — the time it takes for 2 epochs — the place over 100 tireless Ethereum builders vigilantly monitor the state of the community for indicators of issues, questioning, Did we do sufficient?

Each time Ethereum goes via a significant onerous fork — which is like changing parts of an airplane in mid-flight — there’s a niggling probability that one thing may go horribly flawed.

However for a decade now, devs have made certain that has by no means occurred — regardless of some notable issues following the Shanghai fork in 2023 and the Altair fork in 2021.

“We’ve had 10 years and not using a liveness failure. This is among the most vital elements of the protocol,” Mallesh Pai, a senior director of analysis at Ethereum software program and infrastructure agency Consensys, tells Journal.

“It’s gone with out lacking a beat, and thru some unimaginable modifications, just like the Merge, which was a big feat of engineering to actually change the underlying consensus and nonetheless not skip a beat.”

“You construct that belief over 10 years. In case you mess it up as soon as, you’re again to zero like everyone else.”

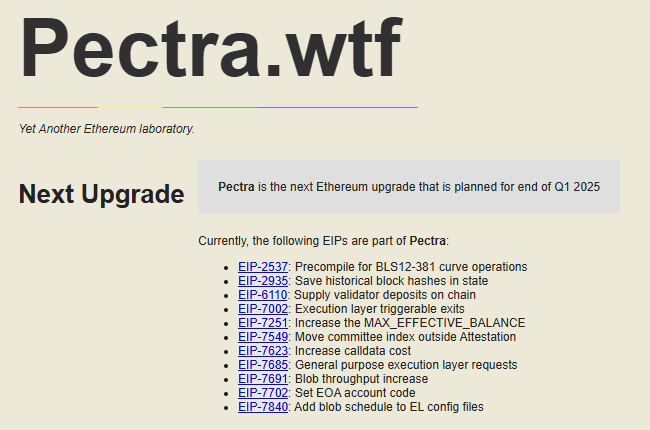

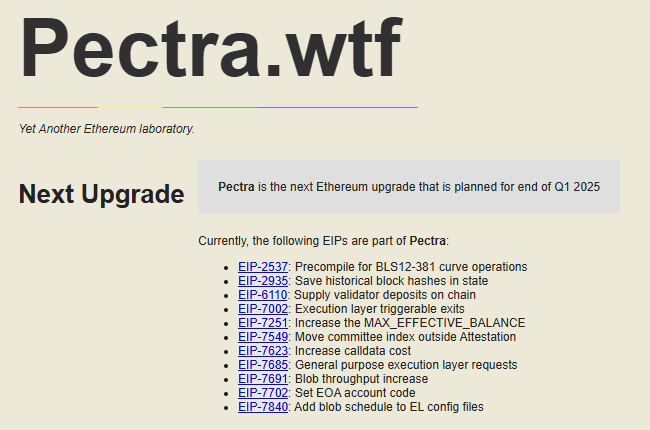

Ethereum’s upcoming main onerous fork — the Pectra improve set for Could 7 at 10:05 am UTC — has had an unusually troubled path to mainnet. For the most important onerous fork within the blockchain’s historical past, it’s taken a 12 months and a half to get so far and didn’t finalize correctly on the primary two testnets. And for the primary time in Ethereum’s historical past, it required a 3rd testnet to be arrange in direct response to the problems.

So, what precisely occurs in these 12 minutes?

Ethereum devs “holding their breath” as Pectra deploys

One epoch is roughly 6.4 minutes, the time period it takes for a random committee of Ethereum validators to suggest and vote on the validity of recent blocks. It’s the time taken for as much as 32 blocks to be added to the chain. The primary two to 3 epochs are the hazard zone the place any points from a brand new improve are more likely to rear their ugly heads.

“The minute they go as much as the fork […] they’re not harassed,” explains Nixo, a member of the Ethereum Basis’s protocol help group. “But it surely’s like, the one, two, 12 minutes after the fork the place they’re anticipating finalization, ensuring not one of the shoppers are forking off onto different chains or going off onto different forks.”

“So, I might say it’s, like, the quarter-hour after the fork occurs that there’s form of like [gasp] holding your breath.”

Throughout this era, builders are anxiously checking blocks are being proposed on time, explains Pai.

They’re checking voting charges — ensuring validators are capable of vote on blocks — and that the voting high quality is roughly of the identical high quality because it was pre-fork. Then they’re checking to see when a complete epoch finalizes.

“You let off one huge sigh after the primary finalization.” Inside a number of hours, “every thing’s working usually, after which everybody simply forgets; it’s just like the chain has at all times been working like that, simply persevering with fortunately,” provides Pai.

Pectra bugs may crop up nearly anytime

Nonetheless, Pai says it’s nonetheless attainable for one thing to go flawed beneath the floor.

“You’re by no means fully within the clear. This isn’t simply Ethereum. That is any of the blockchains. Like bizarre stuff occurs for a specific onerous fork. It may very well be an edge case that manifests a month later.”

In Could 2023 — a month after the Shanghai onerous fork — Ethereum builders went scrambling after the community quickly misplaced transaction finality for round 25 minutes, then once more for over an hour a day later earlier than the blockchain recovered by itself.

Finality is taken into account the purpose at which a transaction turns into irreversible and completely recorded on the blockchain.

“I do bear in mind being very scared that one thing bizarre was happening,” stated Pai. “It’s unintended conduct, and when there’s unintended conduct, you don’t know what else is unintended or what else may very well be going flawed.”

A autopsy later pointed to a flaw affecting two consensus shoppers, Prsym and Teku, which issued a repair not lengthy after — although it nonetheless took a toll on builders and others within the Ethereum ecosystem.

One other finality incident occurred through the Altair fork on the Ethereum Beacon Chain in 2021 when roughly 25% of blocks went lacking, which ended up being on account of one giant staking operator not having upgraded its infrastructure in time.

“That’s why we spend loads of time on due diligence and ensure that issues are appropriate and good,” Lucas Saldanha, lead protocol engineer at Consensys and Ethereum core developer, tells Journal.

“However I feel you may by no means be 100% certain with something in life, actually. It’s extra about simply embracing it and ensuring that you just’re doing the perfect you could.”

In Could, the stakes are simply as excessive once more, as Ethereum shall be going via its greatest improve since reworking to a proof-of-stake blockchain through the Merge in 2022.

It’s the largest fork when it comes to the variety of options and spec modifications, defined Saldanha.

A whopping 11 code modifications, or Ethereum Enchancment Proposals, shall be activated to make the community cheaper, extra environment friendly and customarily extra user-friendly. The final main improve, Dencun, in March 2024, included 9 EIPs.

Devs exhausted after Pectra’s buggy testnets

Nonetheless, the Pectra improve was tormented by points on the primary two testnets.

In February, the Holesky testnet took two weeks to realize finality on account of a consumer software program bug that occurred for a “very particular, nearly irritating” motive because of Holesky’s testnet setup, in response to Pai.

Then in March, Ethereum’s second testnet for Pectra, Sepolia, encountered a special concern that led to many execution layer shoppers not together with transactions in blocks. That was an issue particular to the configuration of the testnet and shouldn’t be capable of happen on mainnet.

Nixo tells Journal that builders are “drained” and are simply hoping to maneuver on to Ethereum’s subsequent improve, Fusaka, after engaged on Pectra for the final 12 months and a half.

“This has been a very lengthy fork for them. Individuals are exhausted.”

She says that is another excuse why Ethereum builders have been pushing for extra frequent upgrades to the protocol.

Ethereum devs need quicker onerous fork cadence after Pectra

In February, throughout an “All Core Devs” assembly, Ethereum devs and ecosystem leaders agreed to shorten the period of time between every improve. Crypto enterprise agency Paradigm has additionally known as for Ethereum builders to ship quicker than one change per 12 months.

Nixo says a part of this need comes from builders merely wanting to have the ability to “reset” extra usually once they begin work on a brand new fork.

“Earlier than all of this testnet stuff occurred, there was a story that, like, we needed accelerationism; we needed fork cadences to go quicker,” stated Nixo.

“However a part of that that wasn’t actually talked about was that builders are simply bored with engaged on the identical factor for thus lengthy. Like, as you go on, for those who don’t freeze the spec, increasingly issues get added.”

“And actually, they’re simply bored with engaged on one thing for a 12 months, a 12 months and a half.”

Learn additionally

Options

Is Ethereum left and Bitcoin proper?

Options

US enforcement businesses are turning up the warmth on crypto-related crime

Saldanha explains that with a quicker launch cadence, builders shall be making smaller modifications every time, which may make it rather less dangerous every time there’s an improve.

“It’s like a reset once you begin engaged on a brand new fork,” added Nixo.

Logically, although, quicker forks may be riskier. Each Saldanha and Pai say there additionally must be a stability between pace and warning.

Saldanda says there are limits to how briskly Ethereum can ship, given its decentralized nature and the challenges round working with builders from everywhere in the world.

Learn additionally

Options

Off The Grid’s ‘greatest replace but,’ Rumble Kong League overview: Web3 Gamer

Options

Can Crypto be Sweden’s Savior?

“In actuality, in the case of Ethereum and the best way that we do issues, there are loads of different elements that don’t actually enable us to have an excellent fast improvement cycle,” he stated.

Pai notes that Ethereum has 5 consensus shoppers and 5 govt shoppers, which means that a person can run any one in every of 25 completely different combos.

“So, which means whereas, in precept, every thing is written to spec, there are many edge instances. So, you actually have to be very certain that each one 25 combos, in precept, may work, proper? That there isn’t some bizarre communication error that comes up for some bizarre case that causes hassle for some set of individuals.”

“If it was only one monolithic individual pushing out on a monolithic consumer, they may do one thing quicker and constantly combine.”

On the upside, that makes it a lot much less possible they’ll all fail without delay, which is the rationale for having so many consumers.

Pai says he has seen speak of two forks a 12 months however stresses that one can’t go too quick and skip vital steps on this course of.

The Ethereum mainnet alone holds some $123 billion in stablecoins and holds a 57% market share of real-world tokenized property.

“We undoubtedly worth that belief and usually are not going to, you understand, muck it up,” says Pai.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Felix Ng

Felix Ng first started writing in regards to the blockchain business via the lens of a playing business journalist and editor in 2015. He has since moved into masking the blockchain area full-time. He’s most eager about revolutionary blockchain expertise geared toward fixing real-world challenges.

Learn additionally

Hodler’s Digest

Prison at Bitcoin 2024, BTC Strategic Reserve Invoice, and extra: Hodler’s Digest, July 28 – Aug. 3

Editorial Workers

10 min

August 3, 2024

Sen. Lummis introduces Bitcoin Strategic Reserve Invoice, Bitfinex hacker reveals up at Bitcoin 2024, and Trump Bitcoin sneakers: Hodler’s Digest.

Learn extra

Hodler’s Digest

BTC white paper hidden on macOS, Binance loses AUS license and DOGE information: Hodler’s Digest, April 2-8

Editorial Workers

7 min

April 8, 2023

Binance Australia Derivatives’ license revoked, the Bitcoin white paper is hidden on trendy macOS and Dogecoin costs spike after Twitter’s icon change.

Learn extra