- DOGE exhibits indicators of a reversal after weeks of decline, with elevated shopping for strain and a small order imbalance favoring bulls, as patrons bought extra DOGE than sellers offloaded.

- On-chain metrics look bullish, with futures longs dominating at practically 70%, spot alternate outflows rising, and the Inventory-to-Circulate Ratio hitting a weekly excessive—suggesting accumulation and rising shortage.

- If bullish momentum holds, DOGE might reclaim $0.187 quickly, but when it fades, the value would possibly fall again towards $0.165. Market sentiment is cautiously shifting again to the bullish facet.

Dogecoin hasn’t had the smoothest experience recently. After touching $0.43 a couple of months again, it’s been sliding down inside a descending channel—and actually, it’s been robust for the DOGE devoted. The value has struggled to construct any strong upward momentum… till now, perhaps?

Proper now, DOGE is sitting at round $0.1726, which continues to be down about 4.24% over the previous week. That mentioned, it did pop up from $0.16 to just about $0.175 within the final 24 hours—so, yeah, not all doom and gloom.

Quantity Spikes, however Is {That a} Good Signal?

Curiously, buying and selling exercise has ramped up. Choices quantity shot up by 34%, and common buying and selling quantity jumped by over 23%. Extra eyes are again on DOGE—however right here’s the factor: it’s nonetheless down 0.87% in 24 hours. Why? Nicely, seems patrons had been fairly inactive not too long ago, which stored issues form of stagnant.

However! That could be altering.

Purchase Strain Sneaking Again In

Trying on the Purchase-Promote Quantity, issues are tilting bullish. Consumers grabbed 748.7 million DOGE within the final 24 hours, whereas sellers offloaded 730 million. That leaves a 14 million DOGE hole favoring the bulls—small, however it counts. A constructive order imbalance like this? Normally an indication that patrons are beginning to take the wheel once more.

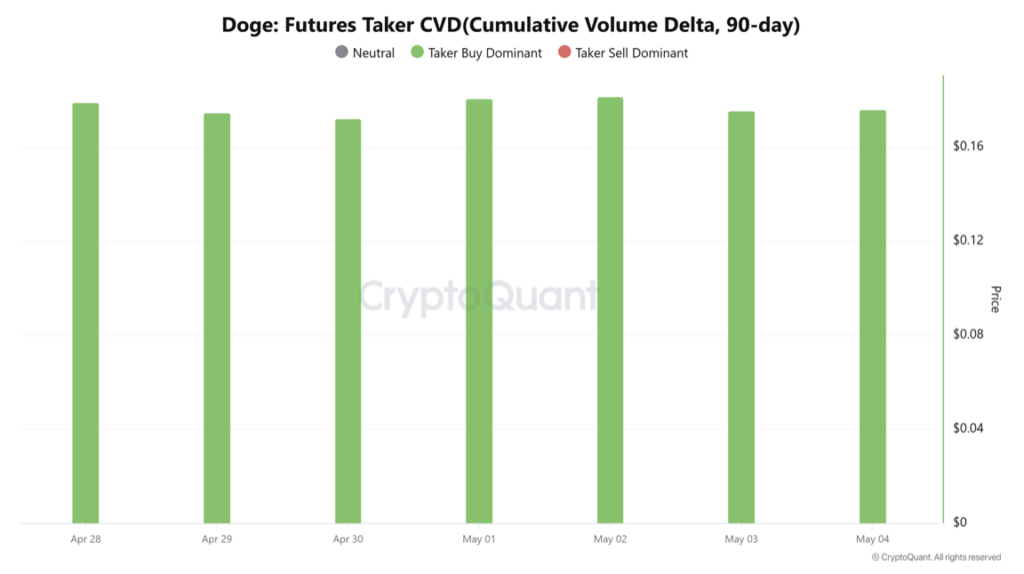

And if that wasn’t sufficient, each the Futures and Spot Taker CVD charts present purchaser dominance. That’s fancy discuss for “persons are shopping for DOGE throughout the board.”

Proper now, longs make up practically 70% of the market. Solely 30% are shorting. That’s a strong signal of rising optimism.

Outflows Sign Accumulation

Even higher—on the spot market facet, DOGE is exhibiting detrimental netflow. Extra cash are being pulled off exchanges than put again on, which normally means one factor: accumulation. Of us are taking their DOGE and sticking it in personal wallets, ready for the subsequent leg up.

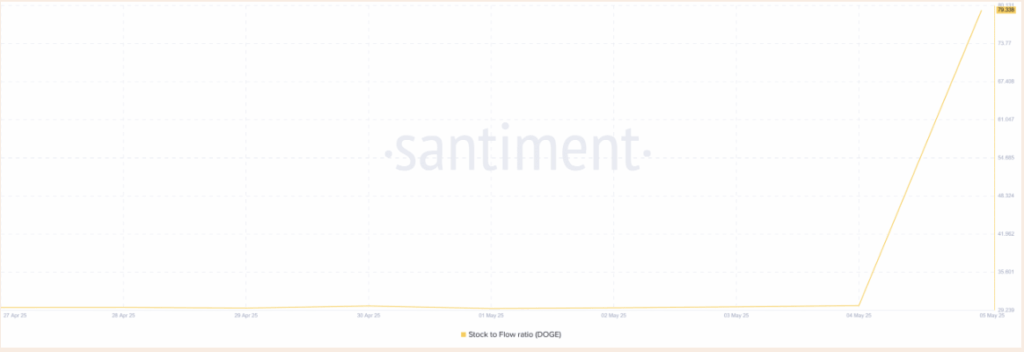

Plus, the Inventory-to-Circulate Ratio (form of a shortage indicator) hit 79 this week. That’s a excessive for the week and means that DOGE is getting… nicely, scarcer. And if demand retains up whereas provide tightens? Value normally follows.

So… What’s Subsequent?

Right here’s the underside line: if patrons keep lively, we might see DOGE climb towards $0.187 quickly and perhaps get away of this drawn-out vary. But when the bulls lose steam? A dip to $0.165 could be on the desk once more.

All eyes are on whether or not this little meme pup nonetheless has some chunk left within the tank.