Welcome to the US Crypto Information Morning Briefing—your important rundown of crucial developments in crypto for the day forward.

Seize a espresso to view the market from the eyes of economic specialists throughout TradFi and crypto. Given the extra established monetary channels, there’s rising overlap, with Bitcoin (BTC) inadvertently benefiting from TradFi woes.

Crypto Information of the Day: Max Keiser Says Bitcoin and Saylor Are the Future

Warren Buffett made the final word case for Bitcoin because the American investor considers stepping down as CEO of Berkshire Hathaway.

Pending board approval, Buffett might step apart on the finish of the 12 months, giving manner for Greg Abel, vice chair of non-insurance operations, to change into Berkshire’s new chief.

This revelation got here at Berkshire Hathaway’s annual shareholder assembly on Might 3, 2025, the place Buffett additionally supplied a stark warning in regards to the long-term worth of the US greenback.

He famous that each system ultimately debases its foreign money. In keeping with Warren Buffett, authorities choices make paper cash lose worth over time.

“Ultimately, when you get individuals to regulate the foreign money, you may subject paper cash, and you’ll,” Buffett advised shareholders in Omaha.

With out naming alternate options equivalent to Bitcoin, the 93-year-old investor cautioned towards holding belongings denominated in a foreign money he mentioned was systematically devalued by authorities coverage.

“The pure course of presidency is to make the foreign money price much less over time… Some locations devalue at breathtaking charges… it’s not evil, it’s simply their job,” he added.

The investing icon mentioned that if his late companion, Charlie Munger, had to decide on a second space moreover shares, he would have gone into overseas trade.

These remarks instructed an openness to non-traditional belongings. Bitcoin advocate and broadcaster Max Keiser responded to the remarks in an interview with BeInCrypto.

Max Keiser interprets Buffett’s feedback as a tacit validation of the thesis behind Bitcoin.

“Govt chairman and co-founder of MicroStrategy Michael Saylor is the Warren Buffett of the twenty first century. He noticed what Buffett described and constructed his technique round it,” Keiser began.

Keiser has lengthy criticized fiat foreign money programs and centralized banking. The Bitcoin pioneer contrasted Saylor’s Bitcoin-focused funding strategy with what he described as Buffett’s reliance on conventional finance (TradFi).

“Warren Buffett constructed his empire on cash printing. Most of his holdings over time have been in banks, insurance coverage firms, and monetary providers,” Keiser claimed.

In his view, Buffett benefited from having political leverage in Washington, notably throughout the 2008 monetary disaster. Throughout this time, Keiser says, his [Buffett] investments in Wall Avenue establishments aligned with government-led rescue efforts.

Buffett’s Position Throughout The 2008 Monetary Disaster Is Nicely Documented

Through the market downturn, Berkshire Hathaway invested closely in firms like Goldman Sachs and Financial institution of America (BofA), which earned him reward as a stabilizing power.

Michael Saylor, in the meantime, has taken a dramatically completely different strategy. Underneath his management, MicroStrategy (now Technique) started buying Bitcoin in 2020 as a part of its company treasury technique. The agency cited considerations in regards to the long-term debasement of fiat currencies.

As of early 2025, the corporate holds greater than 200,000 BTC, price tens of billions of {dollars} at present market costs. A latest US Crypto Information publication revealed considered one of Technique’s newest Bitcoin purchases.

Buffett has lengthy been crucial of Bitcoin, famously calling it “rat poison squared” in 2018. Nonetheless, some within the digital asset area have interpreted his latest feedback about foreign money debasement as aligning with core arguments made by Bitcoin proponents.

Primarily based on his remarks, the American investor and philanthropist is worried in regards to the US fiscal coverage.

His feedback allude that whereas he could not like Bitcoin, he clearly understands why it exists. Sentiment on X (Twitter) exhibits that neighborhood members took discover.

Responses counsel that if Warren Buffett understands cash and its flaws manifested in fiat kind, why does he not endorse Bitcoin as the answer?

“Warren Buffet talks in regards to the virtues of Bitcoin with out mentioning Bitcoin,” one person on X quipped.

In the meantime, others hope Buffett’s potential alternative as CEO will see the following Berkshire Hathaway chief to guide the corporate in a special path, doubtlessly adopting Bitcoin.

A spokesperson for Berkshire Hathaway didn’t instantly reply to a request for touch upon Keiser’s remarks.

Elsewhere, and consistent with Buffett’s assertion about overseas trade, QCP Capital analysts cite a exceptional 8% rally within the Taiwanese Greenback (TWD) on Monday.

They cite this because the TWD’s sharpest transfer in many years, alongside good points in different APAC currencies with robust present account surpluses. In keeping with the analysts, hypothesis over a possible US-Taiwan commerce deal drove this rally, as did insurer-hedging flows, pushing TWD’s 1Y NDF unfold to its widest since 2008.

Whereas Taiwan’s commerce surplus helps the TWD, capital outflows have traditionally balanced it. This shift mirrors previous overseas trade dislocations just like the 2023 JPY carry unwind.

For crypto, the transfer alerts potential macro volatility forward, with gold up 3% and BTC going through a binary path tied to international capital flows and commerce diplomacy.

“In a market the place correlations are fraying, FX could as soon as once more be the canary within the macro coalmine,” wrote QCP analysts.

Chart of the Day

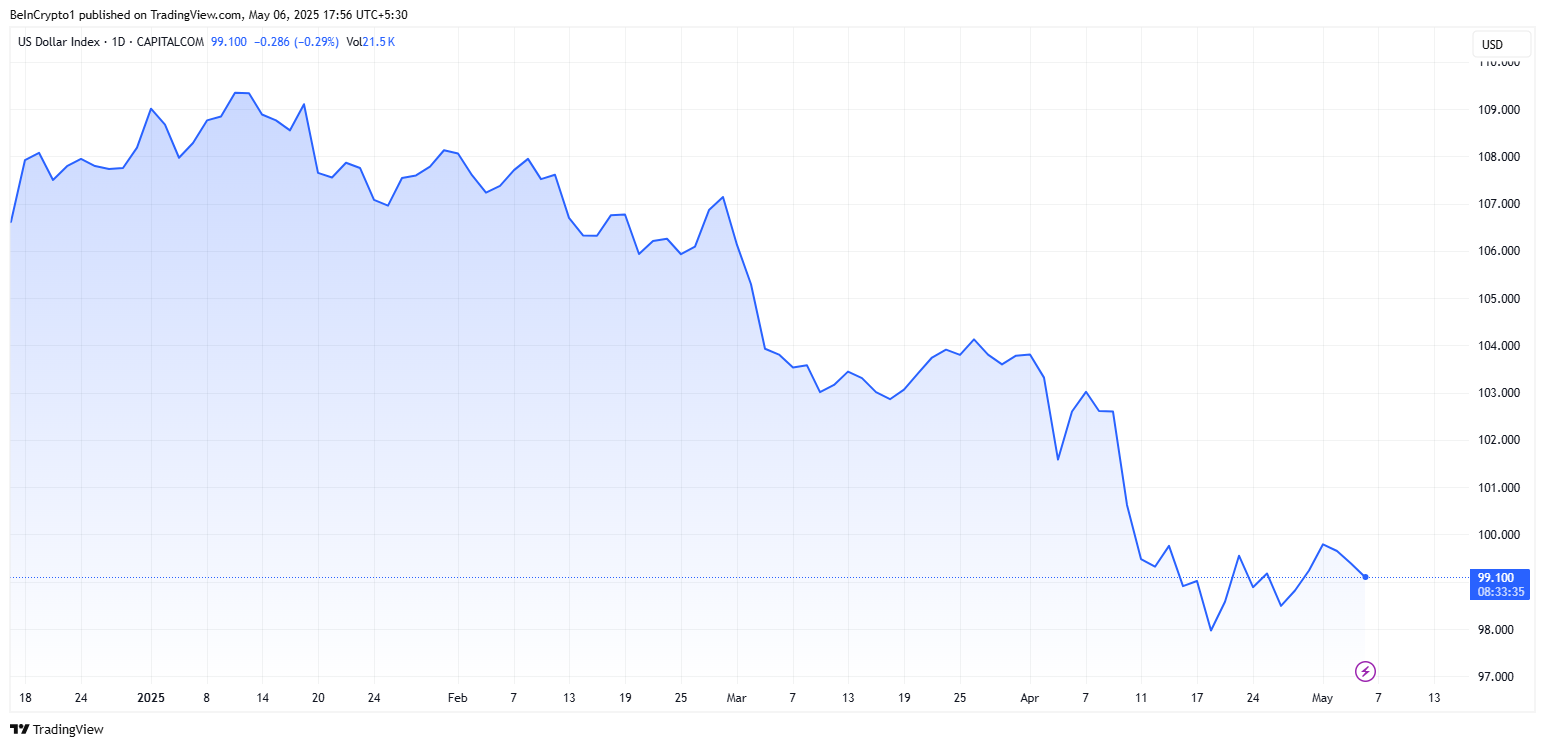

The chart exhibits the US Greenback Index (DXY) pattern from 2025, reflecting fluctuations within the worth of the US greenback towards a basket of main currencies. It signifies a downward motion from February to Might, with a latest slight restoration.

Byte-Sized Alpha

Right here’s a abstract of extra crypto information to comply with in the present day:

- Powell’s tone on the FOMC press convention might set off vital market actions, with analysts divided on the influence of his remarks.

- XRP’s common every day spot buying and selling quantity hit $3.2 billion in Q1 2025, peaking above $16 billion, pushed by robust institutional and retail demand.

- A brand new dialogue draft introduces a framework to scale back market focus and foster innovation. The invoice clarifies jurisdiction between the SEC and CFTC, emphasizing decentralized programs and offering regulatory readability for digital asset markets.

- Hypothesis grows over XRP worth suppression, citing Ripple’s giant token holdings and month-to-month gross sales.

- Cantor Fitzgerald’s administration of Tether’s reserves considerably decreased transparency considerations, and Tether has grown from crypto’s largest liquidity threat to a secure institutional funding.

- Bitcoin briefly outperformed shares in April 2025, signaling potential as a macro hedge, but it surely re-synced with equities by the tip of the month.

- Gemini has listed Ripple’s RLUSD stablecoin, enabling buying and selling, deposits, and withdrawals, marking a milestone in its adoption.

- Kenya’s Excessive Courtroom dominated Worldcoin violated privateness rights, ordering the deletion of biometric knowledge collected from customers.

- Pump.enjoyable tops Ethereum in 2025 charge income, incomes $296.1 million YTD and main weekly charts for 9 weeks.

Crypto Equities Pre-Market Overview

| Firm | On the Shut of Might 5 | Pre-Market Overview |

| Technique (MSTR) | $386.53 | $380.78 (-1.49%) |

| Coinbase World (COIN) | $199.40 | $196.50 (-1.45%) |

| Galaxy Digital Holdings (GLXY.TO) | $26.51 | $26.18 (-1.23%) |

| MARA Holdings (MARA) | $13.09 | $12.81 (-2.14%) |

| Riot Platforms (RIOT) | $7.90 | $7.79 (-1.39%) |

| Core Scientific (CORZ) | $8.75 | $8.51 (-2.74%) |

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.