- AVAX Consolidation and Potential Reversal: Avalanche (AVAX) is stabilizing after a chronic correction, with key assist round $18.30–$19.00 and resistance at $24.16. A bullish divergence within the RSI hints at a doable bounce, however failure to carry assist may result in a retest of the $14.37 low.

- 1-Hour Chart Breakdown: AVAX accomplished a five-wave impulse transfer, peaking above $24, adopted by a textbook A-B-C correction. If the $18.30 assist holds, a rebound may goal $24.16 and probably lengthen to $30.22 and $35.12 (Fibonacci ranges).

- Key Ranges to Watch: Assist zones at $18.30, $16.50, and $14.37 stay essential, whereas resistance at $22.80, $24.16, and $30.22 will decide the subsequent breakout course. A confirmed increased low with robust quantity above $24 may sign a bullish continuation.

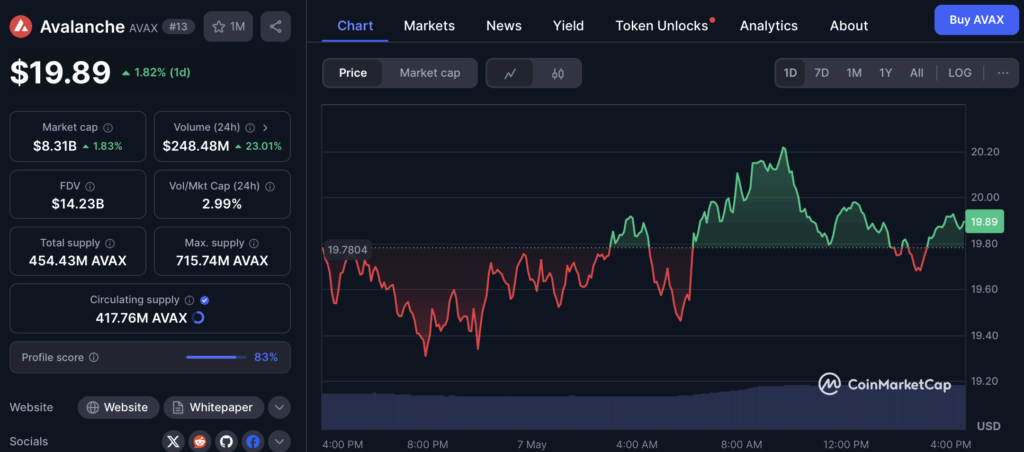

Avalanche (AVAX) has been in consolidation mode after a prolonged correction that dragged its value right down to an important multi-month assist zone. From a broader perspective, AVAX simply accomplished a fancy W-X-Y-X-Z sample, and now the value motion is hinting at a doable bottoming section.

Technical Overview – Multi-Timeframe Evaluation

Zooming out, AVAX has been trapped in a downtrend since peaking close to $55 again in December 2024. That descent unfolded as a multi-wave corrective sample, lastly bottoming out at $14.37 on April seventh. Following that, the value staged a five-wave restoration however has since pulled again, discovering assist within the $19–$20 zone — a degree that’s been a pivotal space all through 2023 and 2024.

The important thing zone between $18.50 and $24 has been repeatedly examined and continues to carry significance. Lately, value was rejected under the 0.236 Fibonacci retracement at $24.16, failing to keep up the breakout. Nevertheless, there’s nonetheless some hope — value is consolidating above the prior swing low of $18.28, aligning with the bottom of the present assist construction.

RSI Reveals Divergence, However Will It Maintain?

On the 4-hour chart, the Relative Power Index (RSI) is flashing a bullish divergence, a setup that always precedes a bounce. But it surely’s not a carried out deal but. AVAX must reclaim the $22–$24 vary to verify bullish momentum. Quantity remains to be comparatively gentle, so any breakout try will want robust shopping for curiosity to push via resistance.

If assist round $18.30 offers method, although, issues may get dicey. The following goal can be the March low at $14.37 — a degree that, if breached, may invalidate the bullish restoration setup.

Zooming In – 1-Hour Chart Breakdown

Trying nearer on the 1-hour timeframe, AVAX accomplished a transparent five-wave impulse transfer from the April low, peaking simply above $24 in late April. Since then, it’s been unwinding in a traditional A-B-C correction.

- Wave A knocked the value right down to $20.40.

- Wave B managed a weak bounce to $22.80.

- Wave C is at present unfolding, with value motion eyeing the $18.30 assist zone.

This space is crucial — it’s not only a horizontal assist degree but additionally a psychological spherical quantity and a requirement cluster that beforehand triggered impulsive strikes. RSI is climbing off oversold territory, forming a bullish divergence with value, suggesting that the promoting stress is likely to be easing.

Subsequent Potential Strikes

If AVAX holds the $18.30–$19.00 vary and reclaims the earlier wave B excessive at $22.80, a brand new impulse wave may kick off. Preliminary targets can be the 0.236 Fib at $24.16, with additional extensions towards $30.22 (0.382 Fib) and $35.12 (0.5 Fib).

Nevertheless, a breakdown under $18.30 would open the door for a slide towards $16.50 and probably the $14.37 low.

Key Ranges to Watch

- Assist: $18.30, $16.50, $14.37

- Resistance: $22.80, $24.16 (0.236 Fib), $30.22 (0.382 Fib), $35.12 (0.5 Fib)

- Affirmation: The next low, coupled with robust quantity above $24, may sign a bullish set off for a possible run towards $30 and past.