Key Takeaways

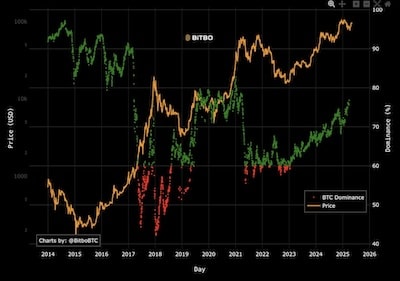

- Bitcoin dominance hits 64.98%, the best since January 2021.

- Institutional strikes, like Metaplanet’s $25M bond increase, are boosting Bitcoin’s share.

- Altcoins stay in decline, with Ethereum down 54% from its excessive.

Bitcoin now accounts for almost 65% of the entire digital asset market, its highest share since January 2021, as traders transfer away from altcoins and into what they view as a safer asset.

As of early Could, Bitcoin’s value is just below $97,000 with a market cap approaching $2 trillion, in comparison with $3 trillion for your complete digital asset market.

Institutional affect

This surge is fueled by rising institutional exercise.

Japanese agency Metaplanet raised $25 million by bond gross sales to amass extra Bitcoin, whereas Prime Two introduced it will abandon Ethereum in favor of a Bitcoin-only technique.

In the meantime, Technique has continued to build up Bitcoin and now controls over 2.5% of the entire provide.

Market analyst insights

David Morrison, Senior Market Analyst at Commerce Nation, mentioned:

It has excessive acceptance relative to its friends… and its provide is strictly restricted. Traders can now see an honest historical past of bounce-backs following massive pullbacks.

Financial components

April’s U.S. jobs report additionally performed a task.

With nonfarm payrolls rising 177,000—nicely above the anticipated 133,000—hopes for imminent fee cuts have dimmed, making traders cautious of speculative altcoins.

Altcoins like Ethereum, Solana, and Dogecoin are down 54%, 43%, and 61% from their highs, respectively.

Way forward for altcoins

The query stays whether or not an altcoin season is close to.

Some analysts level to the 65% dominance mark as a possible set off, whereas others argue extra macro and market indicators are wanted earlier than capital shifts.