Solana (SOL) has elevated by 2% within the final 24 hours, driving the broader market’s optimism forward of the upcoming FOMC assembly. The Layer-1 (L1) coin at the moment trades at $147.83.

On-chain information exhibits a spike in demand for lengthy positions, indicating {that a} rising variety of merchants are positioning for a worth rally.

Solana Futures Present Energy Forward of FOMC

The slight uptick in buying and selling exercise throughout the crypto market over the previous 24 hours has pushed SOL’s worth up by 2%. This modest achieve displays rising investor optimism as markets gear up for at the moment’s FOMC assembly.

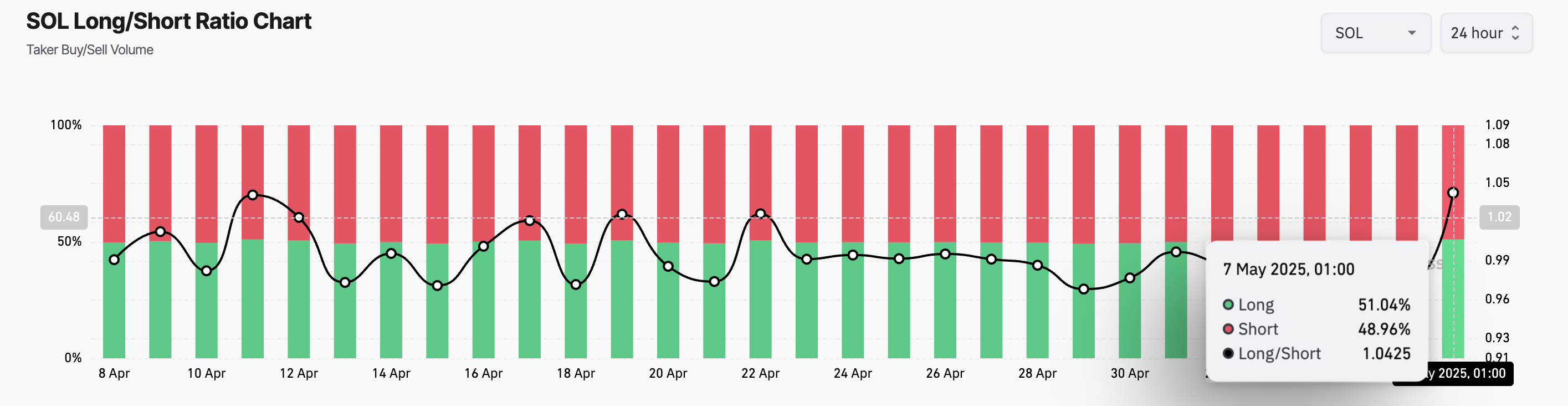

SOL’s futures merchants have expressed optimism by upping their demand for lengthy positions. In keeping with Coinglass, the coin’s lengthy/brief ratio is at a month-to-month excessive of 1.04, signaling a choice for lengthy positions amongst its futures market members.

The lengthy/brief ratio measures the proportion of bullish (lengthy) positions to bearish (brief) positions available in the market. When its worth is under one, extra merchants are betting on an asset’s worth dip than on its rally.

Conversely, as with SOL, a ratio above one means extra lengthy positions than brief ones. This implies bullish sentiment, with most SOL futures merchants anticipating its worth to rise.

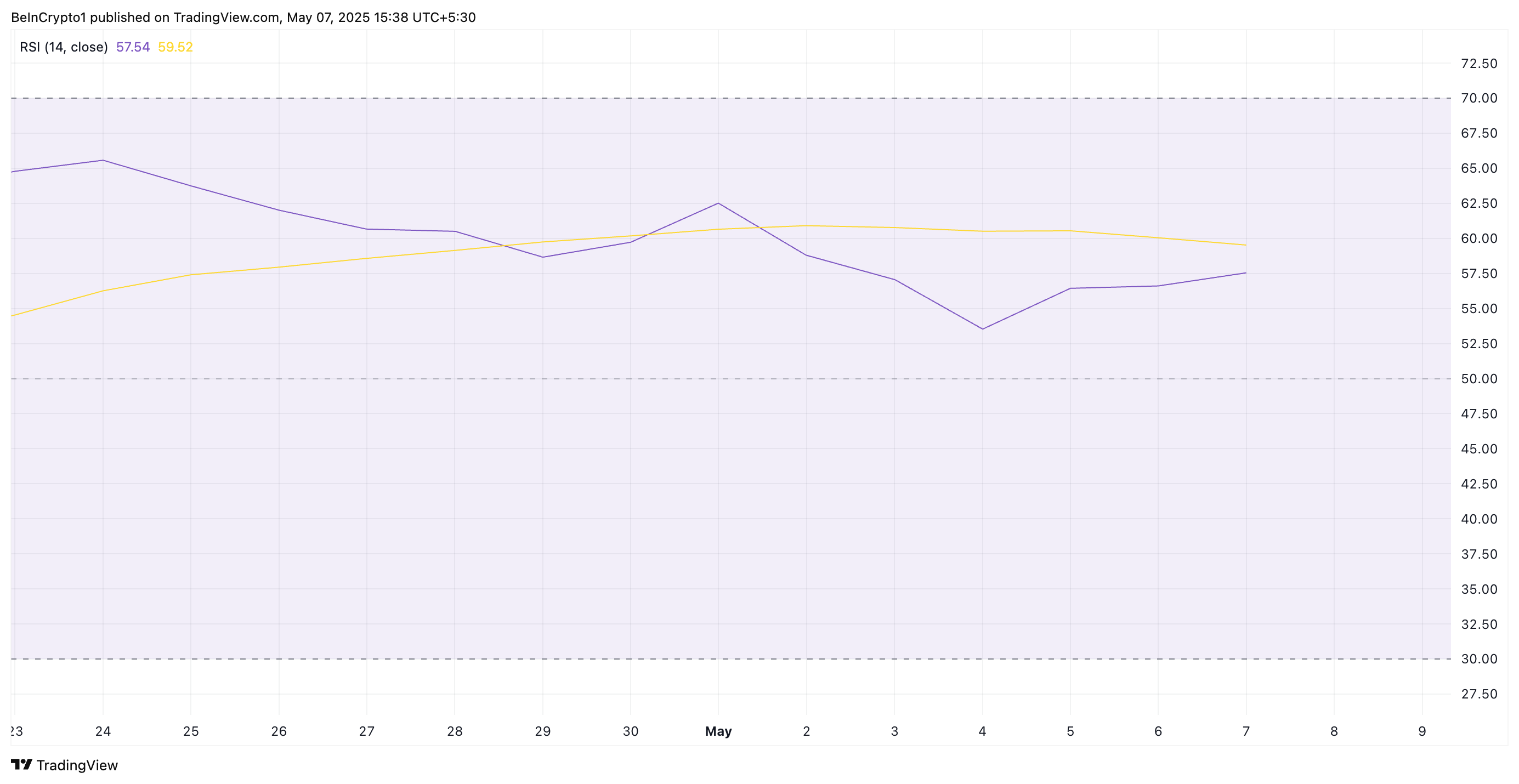

Additional, on the each day chart, SOL’s rising Relative Energy Index (RSI) confirms the spike in demand for the altcoin. At press time, this momentum indicator is at 57.54.

The RSI indicator measures an asset’s overbought and oversold market circumstances, starting from 0 to 100. Values above 70 usually sign an asset is overbought, whereas an RSI under 30 signifies oversold.

SOL’s present RSI studying alerts rising bullish momentum and leaves room for additional upward motion earlier than getting into overbought territory.

SOL Value Balances on Assist Line

As of this writing, SOL trades at $147.69, bouncing off the assist at $142.59. If demand soars and market circumstances stay favorable post-FOMC assembly, SOL may lengthen its rally and climb towards $171.88, a excessive it final reached on March 3.

Nevertheless, if the upcoming FOMC assembly sparks a resurgence in bearish stress, SOL may face renewed promoting momentum. In such a situation, the coin could break under the assist degree at $142.59, paving the way in which for a deeper decline towards $120.81.

Disclaimer

In step with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.