- Stellar (XLM) Underneath Bearish Strain: After beginning the 12 months at $0.50, XLM has dropped to $0.25, down 8.86% prior to now week, with bearish patterns forming on a number of timeframes.

- Technical Evaluation – Key Assist Ranges: XLM is buying and selling inside a descending channel, with help at $0.22 and resistance at $0.28. A break beneath $0.22 might set off a decline to $0.20, whereas a transfer above $0.28 might open the door for a rally towards $0.30.

- Indicators Sign Weak Momentum: The CMF has fallen beneath zero, indicating rising promoting strain, and the MACD is in detrimental territory, reinforcing the bearish outlook except a bullish crossover emerges.

Stellar (XLM) had a strong run within the final quarter of 2024, however 2025 hasn’t been as sort. Beginning the 12 months at $0.50, the coin has since slipped to round $0.25, marking an 8.86% drop over the previous week. And with XLM’s construction wanting shaky throughout a number of timeframes, the possibilities of a rebound aren’t precisely wanting sturdy.

XLM Bulls on the Defensive

On the every day chart, XLM is buying and selling inside a descending channel — not an incredible signal for the bulls. This sample, fashioned by two downward-sloping trendlines containing decrease highs and decrease lows, is usually bearish.

Proper now, the higher trendline is appearing as resistance, whereas the decrease one is holding as help. However there’s extra to it. The Chaikin Cash Move (CMF) indicator has dipped beneath the zero line, signaling that promoting strain is ramping up whereas demand is falling flat.

And it’s not simply the CMF. The Parabolic SAR dots have flipped to sit down above the value. Normally, when these dots are beneath the value, they point out help and potential for a rally. However above? That’s resistance — an indication that the bears are holding the road.

If this setup continues, XLM may be heading towards a break beneath the $0.22 help zone.

XLM Worth Evaluation – Potential Breakdown

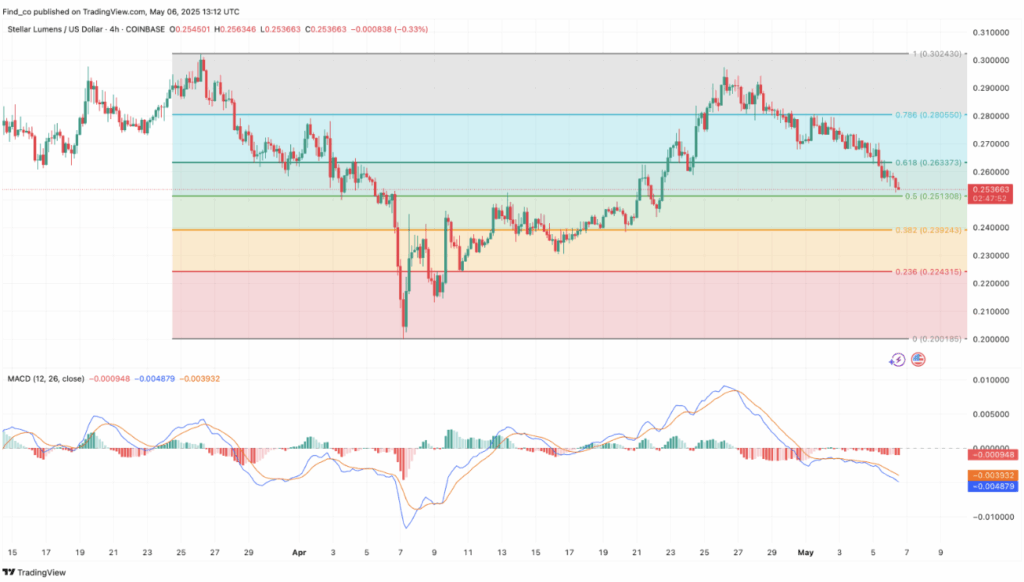

Zooming into the 4-hour chart, the bearish alerts hold piling up. The Shifting Common Convergence Divergence (MACD) indicator is in detrimental territory, with the 12 EMA beneath the 26 EMA. This setup usually factors to bearish momentum.

If bulls don’t step in quickly, the following transfer could possibly be a slip beneath the $0.22 help — a stage that traces up with the 0.236 Fibonacci stage. Ought to that break down, the following cease could possibly be $0.20.

However it’s not all doom and gloom. If a optimistic MACD crossover seems and the value manages to interrupt above the $0.28 resistance, we might see XLM claw its manner again to $0.30. In a best-case situation, if the broader market will get bullish, the coin may even try and retest its yearly excessive.

Key Ranges to Watch:

- Assist: $0.22, $0.20

- Resistance: $0.28, $0.30

- Breakout Affirmation: A detailed above $0.28 with quantity might set the stage for a run to $0.30 and past, however dropping $0.22 might open the door for additional draw back towards $0.20.