The Pectra improve introduces expanded blob house, sensible accounts, and validator enhancements that would considerably impression Ethereum Layer-2 ecosystems. Arbitrum (ARB), StarkNet (STRK), Mantle (MNT), Aevo (AEVO), and Gas (FUEL) are 5 key tokens to observe as they stand to profit from decrease information prices, elevated scalability, and enhanced performance.

Whereas all 5 tokens have just lately confronted value corrections, on-chain upgrades may act as a tailwind within the coming weeks. Every of those Layer-2s is positioned to achieve from Ethereum’s evolving infrastructure—if momentum returns, upside potential is on the desk.

Arbitrum (ARB)

With expanded blob house and extra environment friendly information availability coming from the Ethereum Pectra improve, Arbitrum can cut back its L1 settlement charges and scale extra effectively.

On the identical time, EIP-7702 introduces sensible account performance that permits gasless transactions, batching, and simplified onboarding, all of which improve the expertise for builders and finish customers constructing on Arbitrum.

Regardless of these long-term tailwinds, ARB is down over 6% prior to now seven days. If the correction continues, value could fall to $0.292 — a key assist degree — and doubtlessly dip additional to $0.27.

Nevertheless, if ARB regains momentum, the primary resistance to observe is $0.315.

A break above that degree may open the door for additional upside towards $0.345 and, in a stronger bullish situation, $0.363.

StarkNet (STRK)

The Pectra improve introduces enhancements in information availability and validator operations, which can profit StarkNet in a number of methods.

Enhanced blob house immediately helps cheaper and extra scalable calldata posting — a serious win for zk-rollups like StarkNet that rely closely on L1 for information availability.

Moreover, EIP-7002 permits extra versatile validator withdrawals, which helps future integrations of re-staking protocols and simplifies cross-chain liquidity actions.

STRK has fallen greater than 13.5% prior to now seven days, and its EMA traces point out a downtrend. If this pattern continues, the following key assist degree is round $0.116.

Nevertheless, if STRK manages to reverse momentum, the primary resistance to observe is $0.136. A break above that degree may result in additional upside, with STRK doubtlessly testing $0.15 and even $0.161 in a stronger bullish situation.

Mantle (MNT)

The Pectra improve brings enhancements that would not directly assist Mantle’s modular structure and staking design. With EIP-7251 elevating the validator staking restrict, large-scale staking operations develop into extra environment friendly — a possible profit for Mantle, which integrates restaked ETH into its ecosystem.

This variation simplifies validator administration and enhances the financial safety of protocols that depend on Ethereum as a base layer.

Moreover, the enlargement of blob house contributes to decrease L1 information prices, supporting cheaper and extra scalable interactions for Mantle’s modular rollups and Layer 2 purposes.

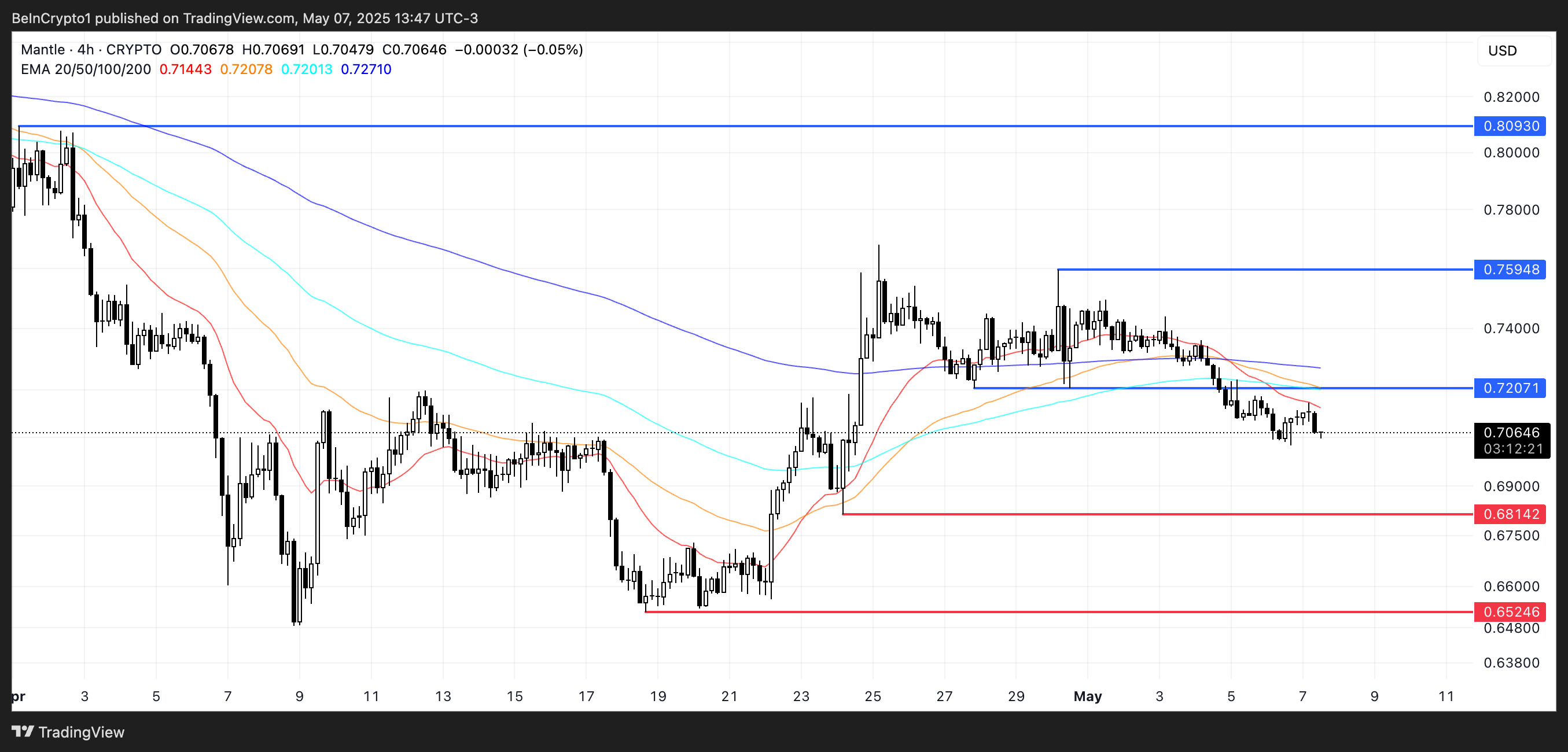

MNT fashioned a demise cross a couple of days in the past and is presently down 2.6% over the previous seven days, signaling ongoing bearish strain. Its subsequent key assist sits at $0.68, and if that degree fails to carry, value may decline additional towards $0.652.

On the upside, if MNT reverses course, the primary resistance to observe is $0.72.

A profitable break above that would set off a rally towards $0.759, and in a extra prolonged bullish transfer, MNT could take a look at $0.809.

Aevo (AEVO)

Aevo, a high-performance derivatives platform constructed on Layer 2 infrastructure, stands to profit from the Pectra improve by way of decrease information availability prices and improved scalability.

The enlargement of blob house launched by Pectra reduces calldata charges for L2s, which is essential for platforms like Aevo that depend on frequent state updates and excessive transaction throughput. This immediately interprets to cheaper and sooner settlement for perpetuals and choices.

Moreover, sensible account performance from EIP-7702 may allow options like gasless buying and selling or streamlined account restoration, enhancing the buying and selling expertise and decreasing friction for customers interacting with Aevo’s contracts.

AEVO is down almost 12% over the past seven days, with its value struggling to remain above the $0.10 mark.

If this downtrend continues, the following assist is at $0.096 — and a break beneath that would open the door to deeper declines towards $0.082 and even $0.0756.

On the flip aspect, if AEVO regains momentum and breaks above the $0.107 resistance, it may rally to check $0.115. A stronger bullish push may lengthen positive factors to the following goal at $0.121.

Gas Community (FUEL)

Gas Community, a modular execution layer centered on excessive throughput and developer flexibility, is well-positioned to profit from Ethereum’s Pectra improve.

The expanded blob house launched by Pectra considerably reduces the price of posting information to Ethereum, which is essential for Gas’s rollup structure. This enables Gas to scale transaction volumes extra effectively whereas sustaining decentralization.

Moreover, sensible account performance from EIP-7702 aligns with Gas’s purpose of bettering UX and developer tooling, enabling extra superior pockets interactions, gasless flows, and streamlined onboarding for customers deploying dApps on Gas’s stack.

FUEL’s EMA traces stay bullish, with short-term averages nonetheless holding above long-term ones, indicating underlying energy. Nevertheless, the token has struggled to interrupt by way of the $0.012 resistance in latest days.

If that degree is examined once more and cleared, FUEL may rally towards $0.0129 and $0.014, with a powerful uptrend doubtlessly pushing it again to $0.0163.

On the draw back, if momentum fades and FUEL breaks beneath the $0.010 assist, the following targets are $0.0084 and $0.0077.

Disclaimer

In step with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.