Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

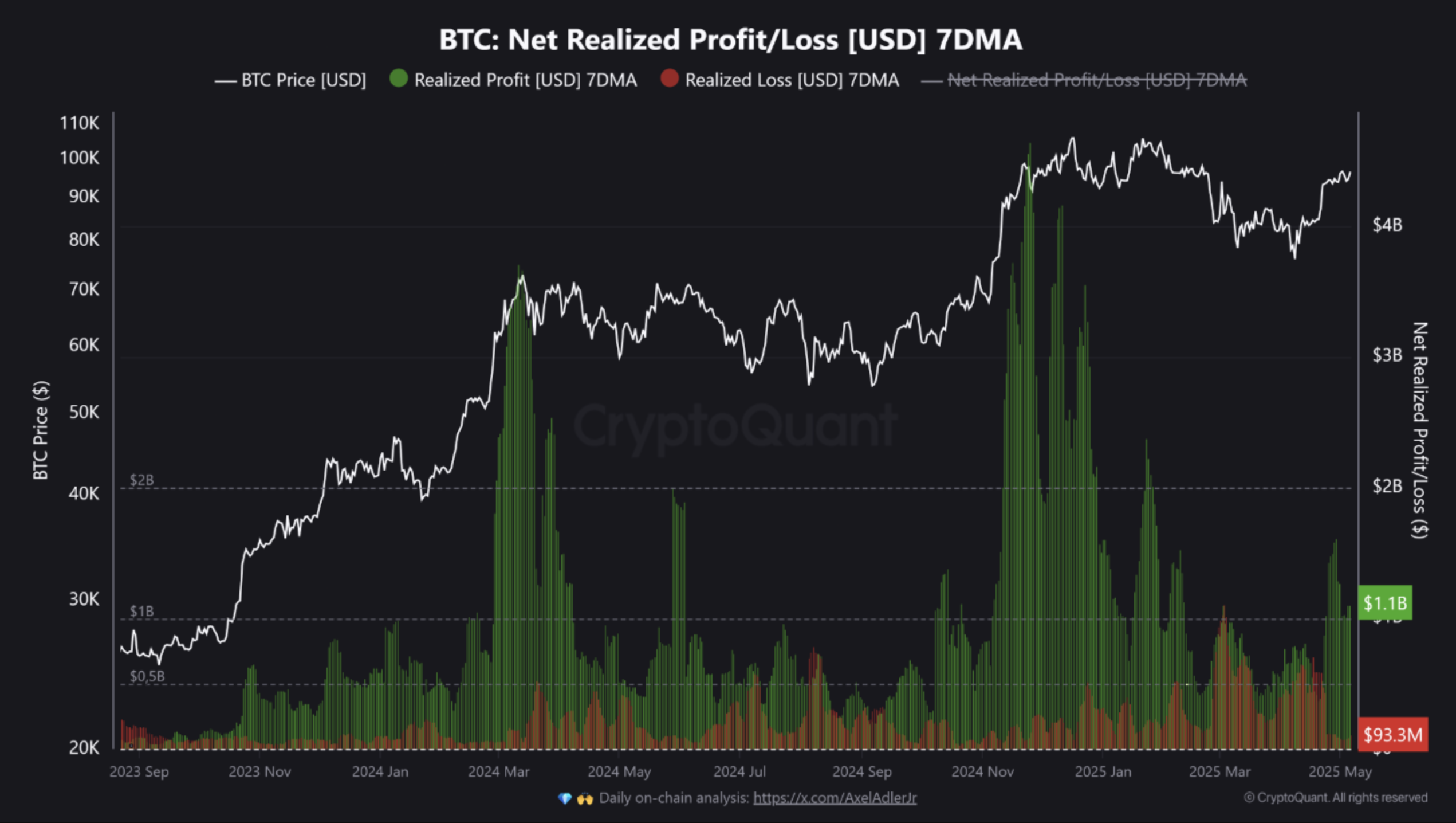

Based on a current CryptoQuant Quicktake put up, Bitcoin (BTC) buyers are aggressively taking income following the most recent surge within the digital asset’s value. This uptick in profit-taking mirrors investor conduct sometimes seen in the course of the late phases of a bull market.

Bitcoin Revenue-Taking Rises – A Trigger For Fear?

Bitcoin’s 7-day shifting common (MA) web realized revenue/loss has principally remained constructive since early 2024. The metric surged as excessive as $1 billion a day because the flagship cryptocurrency pushed in the direction of new all-time highs (ATH) final 12 months.

Though BTC skilled a pointy downturn between March and April 2025, profit-taking remained strong as Bitcoin recovered most of its losses. The asset is presently buying and selling within the mid-$90,000 vary.

Associated Studying

CryptoQuant contributor Kripto Mevsimi famous that such sturdy realized income – whilst costs rise – sometimes sign a late-stage bull market. Drawing comparisons to the 2021 market cycle, Mevsimi identified that related patterns preceded a neighborhood high.

Nonetheless, the launch of spot Bitcoin exchange-traded funds (ETFs) in January 2024 has altered the market construction to an excellent extent. That mentioned, investor psychology has remained the identical in that profit-taking patterns nonetheless align with historic patterns, although now with larger velocity and quantity.

Mevsimi shared a number of potential eventualities which will play out out there. First, If realized income stay excessive, the chance of a pointy correction will increase. This will push BTC again towards $90,000.

Quite the opposite, if profit-taking declines, it may point out the beginning of a market cycle transition. Both method, short-term volatility is anticipated to rise. The put up provides:

The sign isn’t calling a full macro high, but it surely’s flashing a neighborhood warning zone. As at all times: zoom out, and comply with conduct — not simply value.

BTC May See A Short-term Pullback

In the meantime, seasoned crypto analyst Ali Martinez warned that BTC could retest the $97,700 resistance forward of right now’s Federal Open Market Committee (FOMC) assembly, which may set off one other short-term pullback.

Moreover, Bitcoin’s provide shortage narrative is being questioned. Whereas trade reserves proceed to dwindle, current on-chain knowledge suggests a provide squeeze is unlikely within the close to time period.

Associated Studying

In related information, Bitcoin’s demand momentum is but to recuperate from adverse territory. Current knowledge reveals that market contributors are nonetheless favoring short-term hypothesis over holding BTC for the long-term.

That mentioned, momentum indicators just like the Bitcoin Stochastic RSI are exhibiting renewed power, bolstering the case for BTC to achieve a brand new ATH. At press time, BTC trades at $97,248, up 3.4% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and Tradingview.com