Cardano (ADA) reveals renewed energy, up greater than 10% within the final 24 hours. Its market cap is now at $26.5 billion. Buying and selling quantity has surged 50% over the identical interval, reaching over $900 million, signaling rising curiosity and exercise.

As ADA varieties an early-stage uptrend, technical indicators like ADX and EMA counsel rising momentum and the potential for a bullish breakout. Nonetheless, a six-day decline in whale wallets raises warning, highlighting a attainable divergence between worth motion and large-holder conduct.

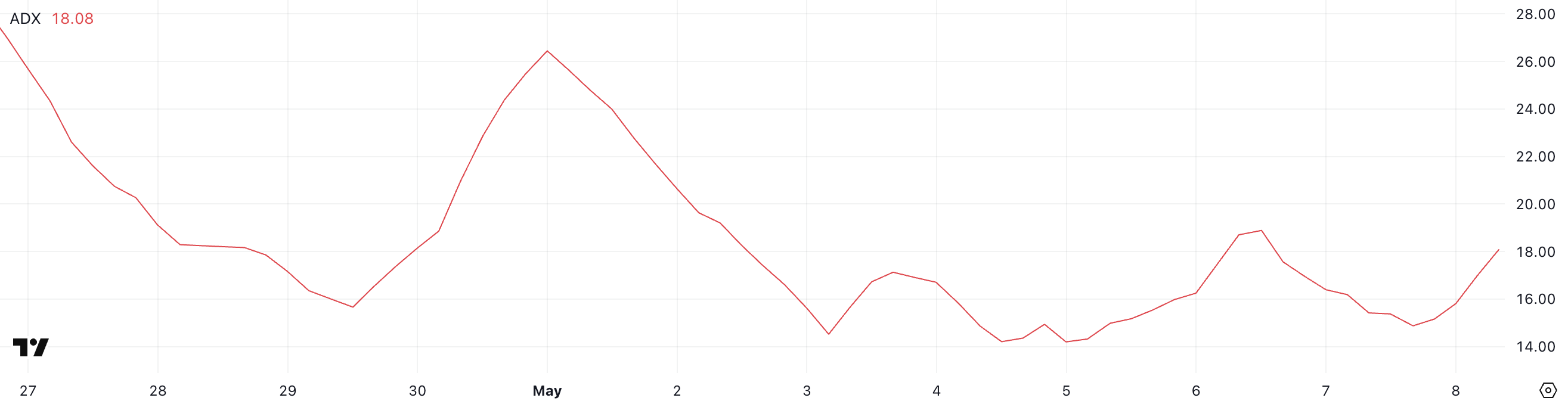

Cardano ADX Rises: Is a Stronger Transfer Coming?

Cardano’s ADX (Common Directional Index) has climbed to 18.08, up from 14.88 a day earlier, signaling rising development energy.

This shift comes as ADA begins forming an early-stage uptrend, with greater lows starting to look on the chart. Whereas the worth hasn’t damaged out decisively but, the rising ADX means that underlying momentum is constructing.

Merchants typically monitor these early ADX will increase as potential indicators of a bigger transfer forward, particularly when paired with bullish construction.

The ADX is a extensively used technical indicator that measures the energy, however not the course, of a development. Readings beneath 20 usually point out a weak or ranging market, whereas values between 20 and 25 sign {that a} development is forming.

A transfer above 25 confirms a powerful, energetic development. With ADA’s ADX now at 18.08 and steadily rising, the indicator is approaching the important threshold that might validate a strengthening uptrend.

If the ADX crosses above 20 and worth continues to climb, it may entice extra bullish momentum and improve the possibilities of a sustained rally.

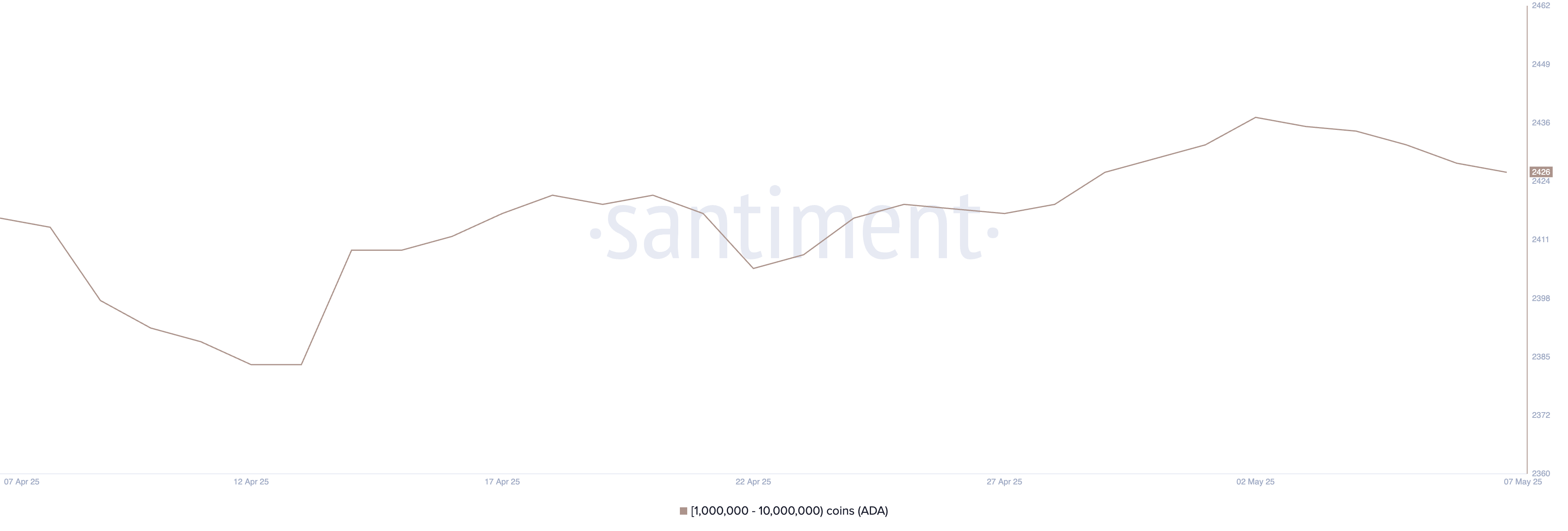

ADA Whale Wallets Drop for Sixth Day—Warning Forward?

Regardless of Cardano forming an early-stage uptrend, the variety of ADA whale wallets holding between 1 million and 10 million ADA has been quietly declining.

There are 2,426 such addresses, down from 2,438 simply six days in the past. This marks a six-day consecutive drop, following a latest peak that represented the very best whale depend since mid-March.

Whereas the worth reveals indicators of energy, the quiet exit or redistribution amongst massive holders may elevate warning for short-term momentum.

Monitoring whale wallets is essential as a result of massive holders can considerably affect worth course by accumulation or distribution behaviors. When these addresses develop in quantity, it typically indicators confidence within the asset and a possible for sustained rallies.

Conversely, a constant drop in whale exercise—particularly throughout a forming uptrend—could counsel profit-taking, lowered conviction, or capital rotation into different property.

At present ranges, the continued decline in ADA whales could also be an early warning signal that not all massive traders are backing this rally. If the development continues, it may restrict Cardano’s upside potential, or no less than decelerate the tempo of beneficial properties.

Merchants ought to watch intently whether or not this divergence between worth motion and whale conduct widens or begins to realign.

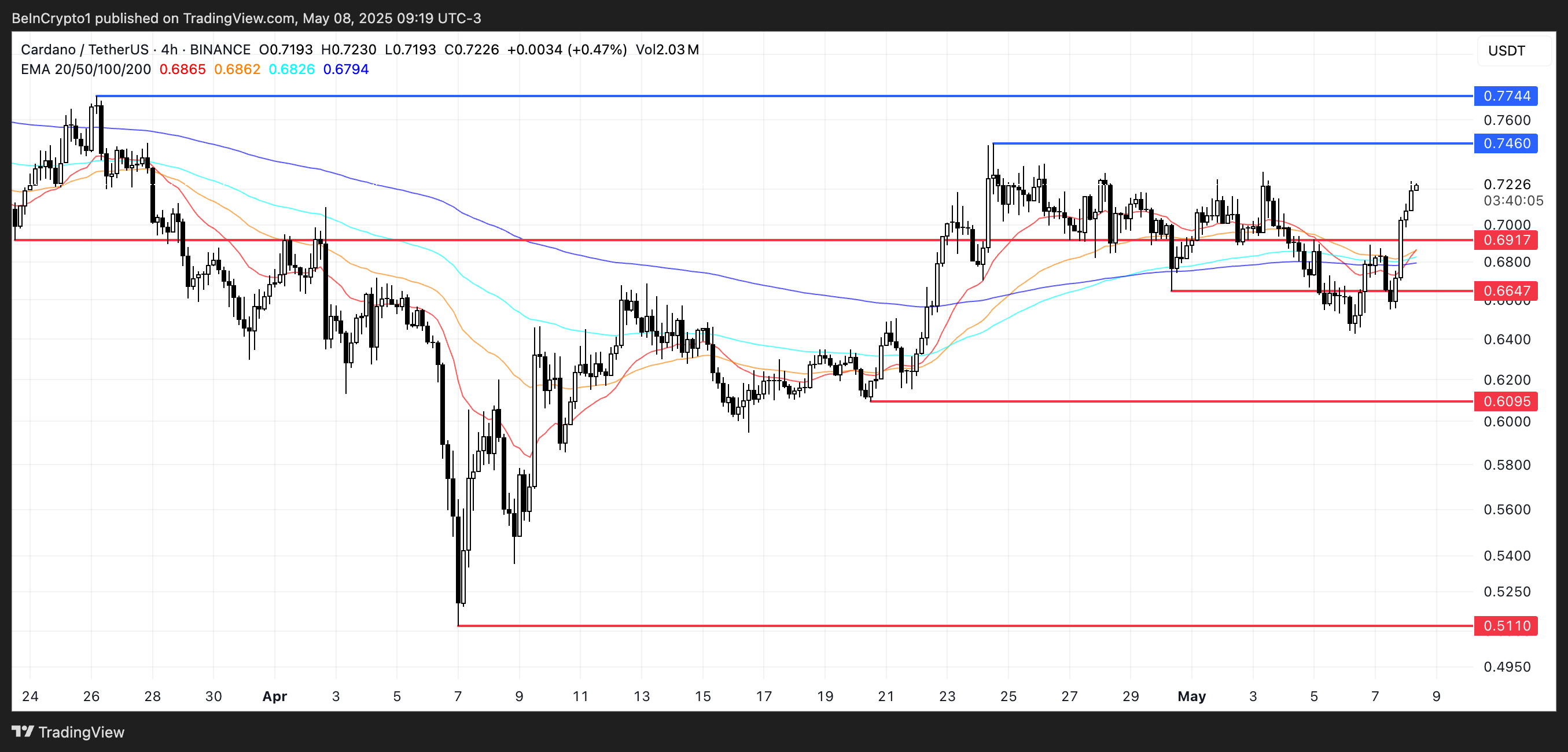

Cardano Eyes Golden Cross as Value Approaches Key Resistance

Cardano’s EMA traces are tightening, suggesting a golden cross may type quickly—a bullish sign that happens when the short-term EMA crosses above the long-term EMA.

If confirmed, and if Cardano worth breaks above the $0.73 stage, it may open the door to check the following resistances at $0.746 and $0.774.

A sustained breakout would put $0.80 in play, a stage not seen since March 8, doubtlessly reigniting broader bullish momentum for ADA within the quick time period.

Nonetheless, if the uptrend fails to achieve traction, ADA may slip again towards help at $0.69.

Dropping that stage would expose the token to additional draw back, with $0.66 and $0.60 as the following key help zones.

ADA may even fall as little as $0.511 in a powerful downtrend, its lowest stage in over two months.

Disclaimer

According to the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.